Tesco 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71Tesco plc

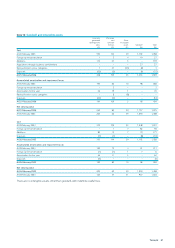

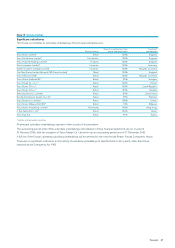

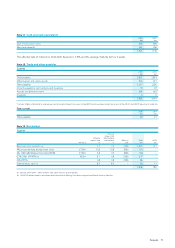

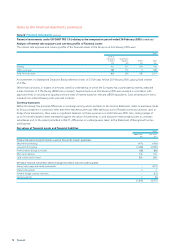

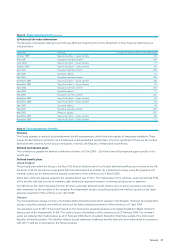

Note 17 Cash and cash equivalents

2006 2005

£m £m

Cash at bank and in hand 964 800

Short-term deposits 361 346

1,325 1,146

The effective rate of interest on short-term deposits is 3.9% and the average maturity term is 2 weeks.

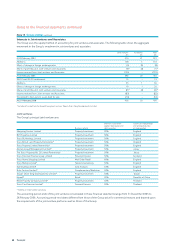

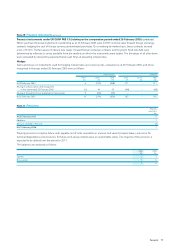

Note 18 Trade and other payables

Current

2006 2005

£m£m

Trade payables 2,832 2,819

Other taxation and social security 216 221

Other payables 1,257 1,236

Amounts payable to Joint ventures and Associates 79 29

Accruals and deferred income 693 663*

Dividends 66

5,083 4,974

*Includes £163m attributable to realised gains on terminated interest rate swaps. Under IFRS these have been reclassified as part of the IAS 32 and IAS 39 adjustments (note 33).

Non-current

2006 2005

£m £m

Other payables 29 21

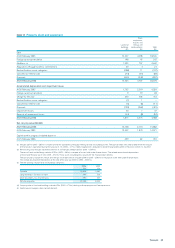

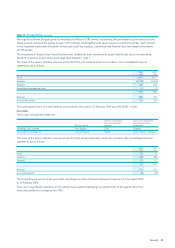

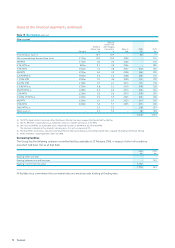

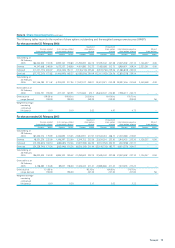

Note19 Borrowings

Current

Effective

interest rate

Effective after hedging

interest rate transactions Maturity 2006 2005

Par value % % year £m £m

Bank loans and overdrafts (a) 4.5 4.5 2006 1,013 471

4% unsecured deep discount loan stock £125m 10.2 10.8 2006 122 –

6% 150m GBP Medium Term Note (MTN) £150m 6.0 4.9 2006 158 –

0.7% 50bn JPY MTN (b) ¥50bn 0.7 4.8 2006 247 –

Other MTNs 4.8 4.8 2006 86 –

Finance leases (note 31) 8.3 8.3 – 20 11

1,646 482

(a) Includes £9m (2005 – £9m) of loans from Joint ventures and Associates.

(b) The MTNs denominated in currencies other than Pounds Sterling have been swapped into Pounds Sterling liabilities.