Tesco 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73Tesco plc

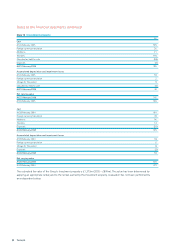

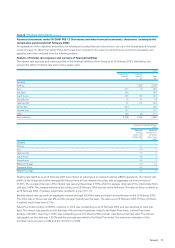

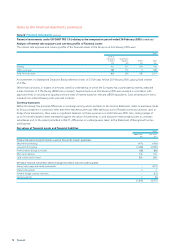

Note 20 Financial instruments

An explanation of the objectives and policies for holding and issuing financial instruments is set out in the Operating and financial

review on page 16.

The following tables provide details of financial instruments in accordance with the relevant IFRSs (including IAS 32 and IAS 39,

which the Group adopted as at 27 February 2005). Comparative figures for the year ended 26 February 2005 (before the adoption

of IAS 32 and IAS 39) are also provided in the tables that follow those for the current year.

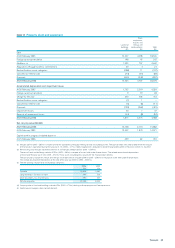

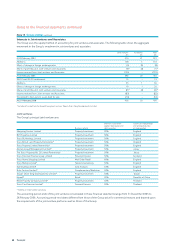

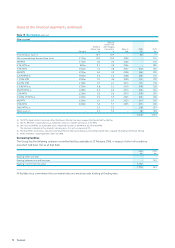

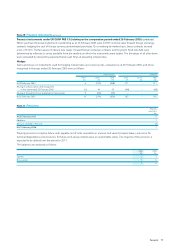

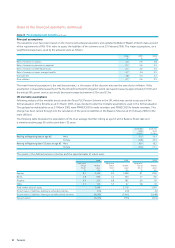

Carrying values of derivative financial instruments and other liabilities in the Balance Sheet:

2006

Assets Liabilities

£m £m

Current

Interest rate swaps and similar instruments 11 (69)

Forward foreign currency contracts 59 (170)

70 (239)

Non-current

Interest rate swaps and similar instruments – (46)

Forward foreign currency contracts – (2)

Put option on Samsung Tesco Co. Limited minority interest – (246)

– (294)

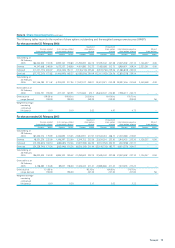

Fair values

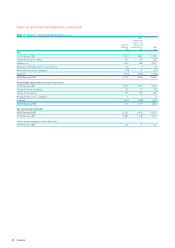

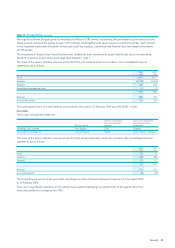

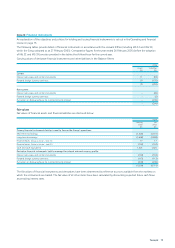

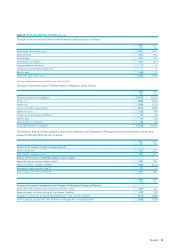

Fair values of financial assets and financial liabilities are disclosed below:

2006

Carrying Fair

value value

£m £m

Primary financial instruments held or issued to finance the Group’s operations:

Short-term borrowings (1,626) (1,641)

Long-term borrowings (3,658) (3,848)

Finance leases (Group as lessor – note 31) 17 17

Financeleases (Group as lessee – note 31) (104) (104)

Cash and cash equivalents 1,325 1,325

Derivative financial instruments held to manage the interest rate and currency profile:

Interest rate swaps and similar instruments (104) (104)

Forward foreign currency contracts (113) (113)

Put option on Samsung Tesco Co. Limited minority interest (246) (246)

(4,509) (4,714)

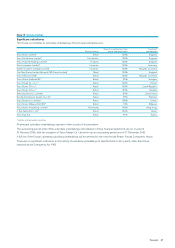

The fair values of financial instruments and derivatives have been determined by reference to prices available from the markets on

which the instruments are traded. The fair value of all other items have been calculated by discounting expected future cash flows

at prevailing interest rates.