Tesco 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

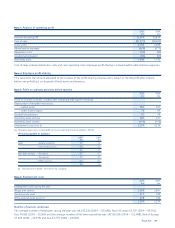

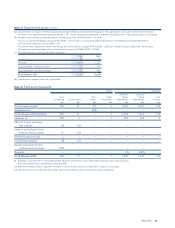

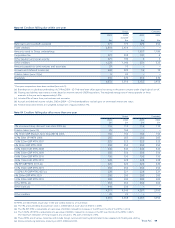

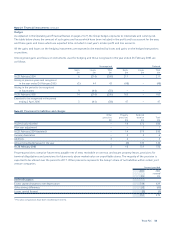

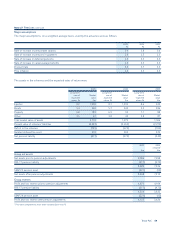

Note 21 Financial instruments continued

Fixed rate financial liabilities

2005 2004

Weighted Weighted Weighted Weighted

average average time average average time

interest rate for which interest rate for which

26 Feb 2005 rate is fixed 28 Feb 2004 rate is fixed

% Years % Years

Currency

Sterling 5.7 7 5.3 6

Euro 5.4 1 5.4 1

Japanese Yen 1.3 5 1.0 5

Czech Krona 3.9 3 4.0 4

Slovak Krona 4.3 3 – –

Malaysian Ringgit 7.9 12 – –

Taiwanese Dollar 4.5 – 4.5 2

Weighted average 5.5 6 5.3 6

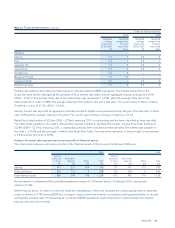

Floating rate liabilities bear interest at rates based on relevant national LIBOR equivalents. The interest rate profile of the

Group has been further managed by the purchase of Euro interest rate collars with an aggregate notional principal of £145m

(2004 – £135m). The average strike rate of the interest rate caps purchased is 6.76%, while the average strike rate of the

interest rate floors sold is 2.98%. The average maturity of the collars is two and a half years. The current value of these contracts,

if realised, is a loss of £1.7m (2004 – £2.6m).

Sterling interest rate caps with an aggregate notional principal of £600m were purchased during the year. The strike rate on these

caps is 6% and the average maturity is five years. The current value of these contracts, if realised, is £3.5m.

Retail Price Index funding of £226m (2004 – £220m), maturing 2016, is outstanding and has been classified as fixed rate debt.

The interest rate payable on this debt is 4% and the principal is linked to the Retail Price Index. Limited Price Index funding, of

£228m (2004 – £221m), maturing 2025, is outstanding and has been classified as fixed rate debt. The interest rate payable on

this debt is 3.322% and the principal is linked to the Retail Price Index. The maximum indexation of the principal in any one year

is 5.0% and the minimum is 0.0%.

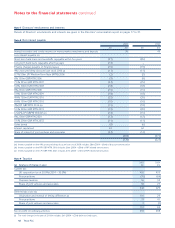

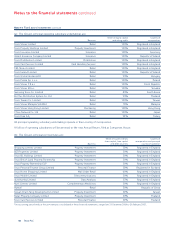

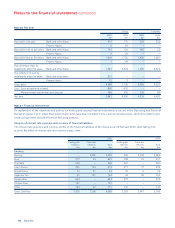

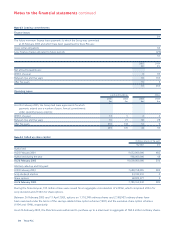

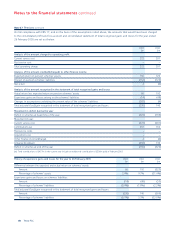

Analysis of interest rate exposure and currency profile of financial assets

The interest rate exposure and currency profile of the financial assets of the Group at 26 February 2005 were:

2005 2004

Cash at Cash at

bank and Short-term bank and Short-term

in hand deposits Other Total in hand deposits Other Total

£m £m £m £m £m £m £m £m

Sterling 411 231 104 746 517 161 112 790

Other currencies 389 115 4 508 153 269 4 426

Total financial assets 800 346 108 1,254 670 430 116 1,216

An investment in collateralised Deutsche Bank preference shares of £150m was held at 26 February 2005, paying fixed

interest of 4.3%.

Other financial assets, in respect of amounts owed by undertakings in which the company has a participating interest, attracted

a rate of interest of 5.7% (being LIBOR plus a margin). Surplus funds are invested in accordance with approved limits on security

and liquidity and bear rates of interest based on relevant LIBOR equivalents. Cash at bank and in hand includes non-interest

bearing cash and cash in transit.

Tesco PLC 51