Tesco 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC 23

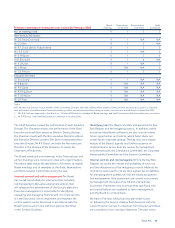

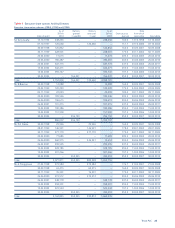

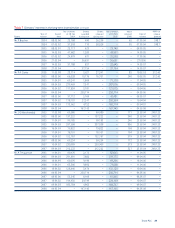

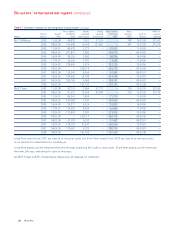

Table 2 Pension details of the Directors

Increase/ Transfer Transfer Transfer

Age at Increase/ (decrease) Transfer value value value

26 February Total (decrease) in accrued value of total of total of total Increase

2005/ accrued in accrued pension of previous accrued accrued accrued in transfer

Years of pension at pension during the column at pension at pension at pension at value less

company 26 February during the year (net of 26 February 28 Feb 2004 28 Feb 2004 26 February Directors’

service 2005(a) year inflation) 2005 (old basis (b)) (new basis (b)) 2005 contributions

£000 £000 £000 £000 £000 £000 £000 £000

Sir Terry Leahy (c) 49/26 479 46 33 409 3,801 4,204 5,117 913

Mr R S Ager (d) 59/19 274 (13) (14) n/a 4,844 5,191 5,898 707

Mr R Brasher (e) 43/18 135 23 19 146 775 806 1,025 219

Mr P A Clarke 44/30 228 28 22 180 1,447 1,517 1,874 357

Mr J Gildersleeve (d) 60/40 405 1 – n/a 7,273 7,717 8,537 820

Mr A T Higginson (f) 47/7 140 28 24 227 908 974 1,318 344

Mr T J R Mason 47/23 250 27 20 191 1,802 1,921 2,341 420

Mr D T Potts 47/32 253 31 24 227 1,833 1,965 2,425 460

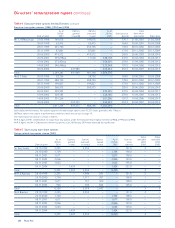

(a) The accrued pension is that which would be paid annually on retirement at 60, based on service to 26 February 2005.

(b) The method used for calculating transfer values was revised during the year to bring it in line with latest actuarial professional guidance. Changes in

financial conditions and improving mortality rates have meant that the previous basis for calculating transfer values, used since 1997, is not considered

to produce suitable values. Transfer values at 28 February 2004 have been restated using the new method for comparative purposes.

(c) Sir Terry Leahy is entitled to retire at any age from 57 to 60 inclusive, with an immediate pension of two-thirds of base salary.

Part of his pension may be provided on an unfunded basis within a separate unapproved arrangement.

(d) As disclosed in Table 1, Mr R S Ager and Mr J Gildersleeve both retired in March 2004. The total accrued pension shown is the pension immediately

after retirement. Transfer values do not apply in retirement and the transfer values at 26 February 2005 have been calculated on a basis consistent

with transfer values for non-retired directors.

(e) Mr R Brasher was appointed during the year. The increase in accrued pension shown is based on the increase since appointment.

Similarly, the transfer value as at 28 February 2004 is based on the value of his pension as at the date of appointment to the Board.

(f) Part of Mr A T Higginson’s benefits, in respect of pensionable earnings in excess of the earnings limit imposed by the Finance Act 1989,

are provided on an unfunded basis within a separate unapproved arrangement.

All transfer values have been calculated in accordance with Actuarial Guidance Note GN11.