Tesco 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC 45

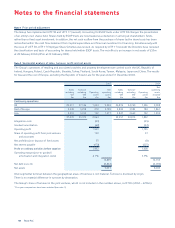

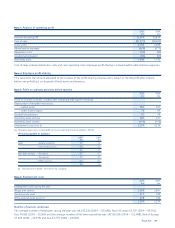

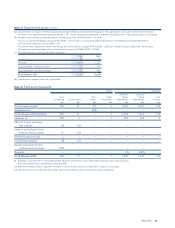

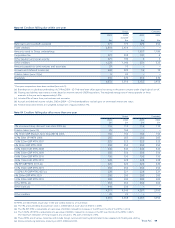

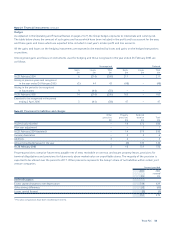

Note 13 Tangible fixed assets continued

(a) Includes £63m in respect of interest capitalised, principally relating to land and building assets. The capitalisation rate used to determine the amount

of finance costs capitalised during the period was 5.7%. Interest capitalised is deducted in determining taxable profit in the period in which it is incurred.

(b) Net book value includes capitalised interest at 26 February 2005 of £597m (2004 – £540m).

The cost of Land and buildings includes £16m (2004 – nil) in respect of assets held under finance leases. The related accumulated depreciation

at the end of the year was £0.1m (2004 – nil).

The cost of Plant, equipment, fixtures and fittings and motor vehicles includes £397m (2004 – £842m) in respect of assets held under finance leases.

The related accumulated depreciation at the end of the year was £358m (2004 – £572m).

(c) The net book value of land and buildings comprises:

2005 2004

£m £m

Freehold 12,070 11,023

Long leasehold – 50 years or more 552 501

Short leasehold – less than 50 years 553 485

At 26 February 2005 13,175 12,009

(d) Capital work in progress does not include land.

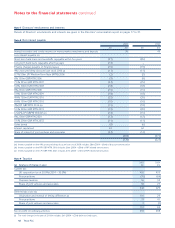

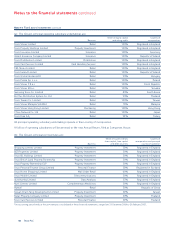

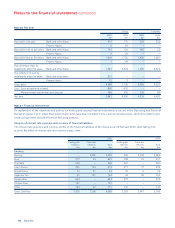

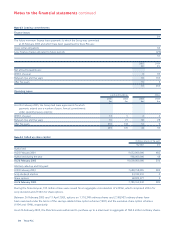

Note 14 Fixed asset investments

Group Company

Shares in Loans to

Joint Own Other Group Group Joint

ventures(b) Associates(c) shares investments undertakings undertakings ventures

£m £m £m £m £m £m £m

As previously reported 309 21 28 6 5,524 3,553 143

Restatement (i) – – (28) – – – –

At 28 February 2004 (restated) 309 21 – 6 5,524 3,553 143

Additions (ii) 148 5 – 1 382 258 2

Effect of foreign exchange

rate changes (5) (3) –––––

Share of profit/(loss) of joint

ventures and associates 72 (3) –––––

Transfer to provisions (iii) 3––––––

Goodwill amortisation (4) (1) –––––

Income received from joint

ventures and associates (135) ––––––

Disposals ––––(9)(287) –

At 26 February 2005 388 19 – 7 5,897 3,524 145

(i) Restated in line with UITF 17 (revised) and UITF 38 (note 1). The Own shares held by the employee share ownership trust

are now included within shareholders’ funds (note 25).

(ii) Additions includes £140m of goodwill in respect of Joint ventures and £1m of goodwill in respect of Associates.

(iii) Transfer to provisions represents the Group’s share of net liabilities within certain joint venture companies.