TD Bank 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7TD BANK GROUP ANNUAL REPORT 2011 CHAIRMAN OF THE BOARD’S MESSAGE

* As of December 1, 2011.

** Designated Audit Committee Financial Expert.

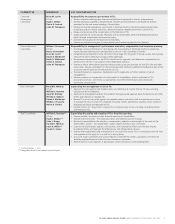

COMMITTEE

Corporate

Governance

Committee

Human Resources

Committee

Risk Committee

Audit Committee

MEMBERS*

Brian M. Levitt

(Chair)

Hugh J. Bolton

Pierre H. Lessard

John M. Thompson

Wilbur J. Prezzano

(Chair)

Henry H. Ketcham

Brian M. Levitt

Karen E. Maidment

Nadir H. Mohamed

Helen K. Sinclair

John M. Thompson

Harold H. MacKay

(Chair)

William E. Bennett

Amy W. Brinkley

Wendy K. Dobson

Karen E. Maidment

Wilbur J. Prezzano

Helen K. Sinclair

William E. Bennett**

(Chair)

Hugh J. Bolton**

John L. Bragg

Harold H. MacKay

Irene R. Miller**

Carole S. Taylor

KEY RESPONSIBILITIES

Responsibility for corporate governance of TD:

• Set the criteria for selecting new directors and the Board’s approach to director independence;

• Identify individuals qualified to become Board members and recommend to the Board the director

nominees for the next annual meeting of shareholders;

• Develop and, where appropriate, recommend to the Board a set of corporate governance principles,

including a code of conduct and ethics, aimed at fostering a healthy governance culture at TD;

• Review and recommend the compensation of the directors of TD;

• Satisfy itself that TD communicates effectively with its shareholders, other interested parties and the

public through a responsive communication policy;

• Facilitate the evaluation of the Board and Committees;

• Oversee an orientation program for new directors and continuing education for directors.

Responsibility for management’s performance evaluation, compensation and succession planning:

• Discharge, and assist the Board in discharging, the responsibility of the Board relating to leadership,

human resource planning and compensation as set out in this committee’s charter;

• Set performance objectives for the CEO which encourage TD’s long-term financial success and regularly

measure the CEO’s performance against these objectives;

• Recommend compensation for the CEO to the Board for approval, and determine compensation for

certain senior officers in consultation with independent advisors;

• Oversee a robust talent planning process that provides succession planning for the CEO role and other

senior roles. Review candidates for CEO and recommend the best candidate to the Board as part of the

succession planning process for the position of CEO;

• Oversee the selection, evaluation, development and compensation of other members of senior

management;

• Produce a report on compensation for the benefit of shareholders, which is published in TD’s

annual proxy circular, and review, as appropriate, any other related major public disclosures

concerning compensation.

Supervising the management of risk of TD:

• Approve TD’s risk appetite and related metrics and identify and monitor the key TD risks including

evaluating their management;

• Approve risk management policies that establish the appropriate approval levels for decisions and other

checks and balances to manage risk;

• Review TD’s actual risk profile against risk appetite metrics and satisfy itself that policies are in place

to manage the risks to which TD is exposed, including market, operational, liquidity, credit, insurance,

regulatory and legal and reputational risk;

• Provide a forum for “big-picture” analysis of an enterprise view of risk, including considering trends

and emerging risks.

Supervising the quality and integrity of TD’s financial reporting:

• Oversee reliable, accurate and clear financial reporting to shareholders;

• Oversee internal controls – the necessary checks and balances must be in place;

• Be directly responsible for the selection, compensation, retention and oversight of the work of the

shareholders’ auditor – the shareholders’ auditor reports directly to this committee;

• Listen to the shareholders’ auditor, chief auditor, chief compliance officer and chief anti-money

laundering officer, and evaluate the effectiveness and independence of each;

• Oversee the establishment and maintenance of processes that ensure TD is in compliance with the laws

and regulations that apply to it, as well as its own policies;

• Act as the Audit Committee and Conduct Review Committee for certain subsidiaries of TD that are

federally regulated financial institutions and insurance companies;

• Receive reports on and approve, if appropriate, certain transactions with related parties.