TD Bank 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

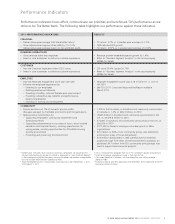

TD BANK GROUP ANNUAL REPORT 2011 MANAGEMENT’S DISCUSSION AND ANALYSIS10

(millions of Canadian dollars) 2011 2010 2009

Operating results – adjusted

Net interest income $ 12,831 $ 11,543 $ 11,326

Non-interest income1 8,587 8,020 7,294

Total revenue 21,418 19,563 18,620

Provision for credit losses2 1,465 1,685 2,225

Non-interest expenses3 12,395 11,464 11,016

Income before provision for income taxes, non-controlling interests in subsidiaries,

and equity in net income of associated company 7,558 6,414 5,379

Provision for income taxes4 1,508 1,387 923

Non-controlling interests in subsidiaries, net of income taxes 104 106 111

Equity in net income of an associated company, net of income taxes5 305 307 371

Net income – adjusted 6,251 5,228 4,716

Preferred dividends 180 194 167

Net income available to common shareholders – adjusted 6,071 5,034 4,549

Adjustments for items of note, net of income taxes

Amortization of intangibles6 (426) (467) (492)

Increase (decrease) in fair value of derivatives hedging the reclassified

available-for-sale debt securities portfolio7 134 5 (450)

Integration and restructuring charges relating to U.S. Personal and Commercial Banking acquisitions8 (69) (69) (276)

Increase (decrease) in fair value of credit default swaps hedging the corporate loan book,

net of provision for credit losses9 13 (4) (126)

Recovery of (provision for) income taxes due to changes in statutory income tax rates10 – 11 –

Release (provision) for insurance claims11 – 17 –

General allowance release (increase) in Canadian Personal and Commercial Banking and Wholesale Banking12 – 44 (178)

Settlement of TD Banknorth shareholder litigation13 – – (39)

FDIC special assessment charge14 – – (35)

Agreement with Canada Revenue Agency15 – (121) –

Integration charges relating to the Chrysler Financial acquisition16 (14) – –

Total adjustments for items of note (362) (584) (1,596)

Net income available to common shareholders – reported $ 5,709 $ 4,450 $ 2,953

NON-GAAP FINANCIAL MEASURES − RECONCILIATION OF ADJUSTED TO REPORTED NET INCOME

TABLE 2

1 Adjusted non-interest income excludes the following items of note: 2011 –

$19 million pre-tax gain due to change in fair value of CDS hedging the corporate

loan book , as explained in footnote 9; $157 million gain due to change in fair value

of derivatives hedging the reclassified available-for-sale debt securities portfolio, as

explained in footnote 7; 2010 – $9 million pre-tax loss due to change in fair value

of credit default swaps (CDS) hedging the corporate loan book; $14 million pre-tax

gain due to change in fair value of derivatives hedging the reclassified available-for-

sale debt securities portfolio; $25 million recovery of insurance claims, as explained

in footnote 11; 2009 – $196 million pre-tax loss due to change in fair value of CDS

hedging the corporate loan book; $564 million pre-tax loss due to change in fair

value of derivatives hedging the reclassified available-for-sale debt securities portfolio.

2 Adjusted provisions for credit losses exclude the following items of note: 2010 –

$59 million release in general allowance for credit losses in Canadian Personal and

Commercial Banking and Wholesale Banking, as explained in footnote 12; 2009 –

$255 million increase in general allowance for credit losses in Canadian Personal

and Commercial Banking and Wholesale Banking.

3 Adjusted non-interest expenses exclude the following items of note: 2011 –

$613 million amortization of intangibles, as explained in footnote 6; $113 million

in integration and restructuring charges relating to U.S. Personal and Commercial

Banking acquisitions, as explained in footnote 8; $21 million of integration charges

related to the Chrysler Financial acquisition, as explained in footnote 16; 2010 –

$592 million amortization of intangibles; $108 million in integration and restruc-

turing charges relating to U.S. Personal and Commercial Banking acquisitions;

2009 – $653 million amortization of intangibles; $429 million integration and

restructuring charges relating to the Commerce acquisition; settlement of TD

Banknorth shareholder litigation of $58 million, as explained in footnote 13;

$55 million Federal Deposit Insurance Corporation (FDIC) special assessment

charge, as explained in footnote 14.

4 For reconciliation between reported and adjusted provision for income taxes,

see the ‘Non-GAAP Financial Measures – Reconciliation of Reported to Adjusted

Provision for Income Taxes’ table in the “Taxes” section.

5 Adjusted equity in net income of associated company excludes the following items

of note: 2011 –$59 million amortization of intangibles , as explained in footnote 6;

2010 – $72 million amortization of intangibles; 2009 – $68 million amortization

of intangibles.

6 Amortization of intangibles primarily relates to the Canada Trust acquisition in

2000, the TD Banknorth acquisition in 2005 and its privatization in 2007, the

Commerce acquisition in 2008, the acquisitions by TD Banknorth of Hudson United

Bancorp (Hudson) in 2006 and Interchange Financial Services (Interchange) in

2007, and the amortization of intangibles included in equity in net income of

TD Ameritrade. Effective 2011, amortization of software is recorded in amortiza-

tion of intangibles; however, amortization of software is not included for purposes

of items of note, which only includes amortization of intangibles acquired as

a result of business combinations.

7 During 2008, as a result of deterioration in markets and severe dislocation in the

credit market, the Bank changed its trading strategy with respect to certain trading

debt securities. Since the Bank no longer intended to actively trade in these debt

securities, the Bank reclassified these debt securities from trading to the available-

for-sale category effective August 1, 2008. As part of the Bank’s trading strategy,

these debt securities are economically hedged, primarily with CDS and interest rate

swap contracts. This includes foreign exchange translation exposure related to the

debt securities portfolio and the derivatives hedging it. These derivatives are not

eligible for reclassification and are recorded on a fair value basis with changes in

fair value recorded in the period’s earnings. Management believes that this asym-

metry in the accounting treatment between derivatives and the reclassified debt

securities results in volatility in earnings from period to period that is not indicative

of the economics of the underlying business performance in Wholesale Banking.

Commencing in the second quarter of 2011, the Bank may from time to time

replace securities within the portfolio to best utilize the initial, matched fixed term

funding. As a result, the derivatives are accounted for on an accrual basis in

Wholesale Banking and the gains and losses related to the derivatives in excess

of the accrued amounts are reported in the Corporate segment. Adjusted results

of the Bank exclude the gains and losses of the derivatives in excess of the

accrued amount.

8 As a result of U.S. Personal and Commercial Banking acquisitions and related inte-

gration and restructuring initiatives undertaken, the Bank may incur integration

and restructuring charges. Restructuring charges consisted of employee severance

costs, the costs of amending certain executive employment and award agreements,

contract termination fees and the write-down of long-lived assets due to impair-

ment. Integration charges consisted of costs related to information technology,

employee retention, external professional consulting charges, marketing (including

customer communication and rebranding), and integration-related travel costs.

Beginning in Q2 2010, U.S Personal and Commercial Banking elected not to

include any further Commerce related integration and restructuring charges in this

item of note as the efforts in these areas has wound down and in light of the fact

that the integration and restructuring was substantially complete. Similarily, begin-

ning in Q2 2012, U.S. Personal and Commercial Banking is not expected to include

any further FDIC-assisted and South Financial related integration and restructuring

charges. For the twelve months ended October 31, 2011, the integration charges

were driven by the FDIC-assisted and South Financial acquisitions. There were no

restructuring charges recorded.

9 The Bank purchases CDS to hedge the credit risk in Wholesale Banking’s corporate

lending portfolio. These CDS do not qualify for hedge accounting treatment and

are measured at fair value with changes in fair value recognized in current period’s

earnings. The related loans are accounted for at amortized cost. Management

believes that this asymmetry in the accounting treatment between CDS and loans

would result in periodic profit and loss volatility which is not indicative of the

economics of the corporate loan portfolio or the underlying business performance

in Wholesale Banking. As a result, the CDS are accounted for on an accrual basis in

Wholesale Banking and the gains and losses on the CDS, in excess of the accrued

cost, are reported in the Corporate segment. Adjusted earnings exclude the gains

and losses on the CDS in excess of the accrued cost. When a credit event occurs in

the corporate loan book that has an associated CDS hedge, the PCL related to the

portion that was hedged via the CDS is netted against this item of note.