TD Bank 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK GROUP ANNUAL REPORT 2011 MANAGEMENT’S DISCUSSION AND ANALYSIS 15

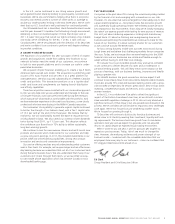

(millions of Canadian dollars) 2011 vs. 2010 2010 vs. 2009

Favourable (unfavourable) Favourable (unfavourable)

due to change in due to change in

Average Average Net Average Average Net

volume rate change volume rate change

Total earning assets $ 1,595 $ (523) $ 1,072 $ 1,663 $ (3,163) $ (1,500)

Total interest-bearing liabilities (517) 733 216 (921) 2,638 1,717

Net interest income $ 1,078 $ 210 $ 1,288 $ 742 $ (525) $ 217

ANALYSIS OF CHANGE IN NET INTEREST INCOME

TABLE 8

growth in insurance revenue. Wealth Management non-interest income

increased primarily due to higher fee-based revenue from higher client

assets. U.S. Personal and Commercial Banking non-interest income

increased due to higher fee-based revenue and the impact of acquisi-

tions, partially offset by lower overdraft fees due to Regulation E and

the translation effect of a stronger Canadian dollar. Wholesale Banking

non-interest income decreased mainly due to lower trading-related

revenue, partially offset by higher security gains.

NON-INTEREST INCOME

Non-interest income for the year was $8,763 million, an increase of

$741 million, or 9%, on a reported basis, and $8,587 million on an

adjusted basis, an increase of $567 million, or 7%, compared with

last year. The increase in adjusted non-interest income was driven

by increases in all retail segments, partially offset by a decline in

Wholesale Banking. Canadian Personal and Commercial Banking non-

interest income increased due to strong fee income growth and strong

(millions of Canadian dollars) 2011 vs. 2010

2011 2010 2009 % change

Investment and securities services

TD Waterhouse fees and commissions $ 459 $ 421 $ 465 9.0%

Full-service brokerage and other securities services 631 590 451 6.9

Underwriting and advisory 378 368 387 2.7

Investment management fees 215 189 191 13.8

Mutual funds management 941 856 718 9.9

Total investment and securities services 2,624 2,424 2,212 8.3

Credit fees 687 634 622 8.4

Net securities gains (losses) 393 75 (437) 424.0

Trading income (loss) 43 484 685 (91.1)

Service charges 1,602 1,651 1,507 (3.0)

Loan securitizations 450 489 468 (8.0)

Card services 961 820 733 17.2

Insurance, net of claims 1,173 1,028 913 14.1

Trust fees 154 153 141 0.7

Other income (loss) 676 264 (310) 156.1

Total $ 8,763 $ 8,022 $ 6,534 9.2%

NON-INTEREST INCOME

TABLE 9

(millions of Canadian dollars) 2011 2010 2009

Net interest income $ 842 $ 827 $ 1,210

Trading income (loss) 43 484 685

Loans designated as trading under the fair value option1 4 21 47

Total trading-related income (loss) $ 889 $ 1,332 $ 1,942

By product

Interest rate and credit portfolios $ 403 $ 896 $ 1,292

Foreign exchange portfolios 432 418 573

Equity and other portfolios 50 (3) 30

Loans designated as trading under the fair value option1 4 21 47

Total trading-related income (loss) $ 889 $ 1,332 $ 1,942

TRADING-RELATED INCOME

TABLE 10

credit markets and fewer trading opportunities. Foreign exchange

and equity and other portfolios benefited from wider spreads, and

increased client activity from elevated levels of volatility in the markets.

The mix of trading-related income between net interest income and

trading income is largely dependent upon the level of interest rates,

which drives the funding costs of the Bank’s trading portfolios.

Generally, as interest rates rise, net interest income declines and trad-

ing income reported in non-interest income increases. Management

believes that the total trading-related income is the appropriate

measure of trading performance.

TRADING-RELATED INCOME

Trading-related income is the total of net interest income on trading

positions, trading income which includes income from trading loans,

and income from loans designated as trading under the fair value

option that are managed within a trading portfolio. Trading-related

income decreased by $443 million, or 33% from 2010. The decrease

was primarily in interest rate and credit portfolios, partially offset

by increases in foreign exchange and equity and other portfolios

compared to the prior year. The trading environment for interest rate

and credit trading was challenging in 2011 due to volatility in the

1 Excludes amounts related to securities designated as trading under the fair value

option that are not managed within a trading portfolio, but which have been

combined with derivatives to form economic hedging relationships.