Sunoco 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

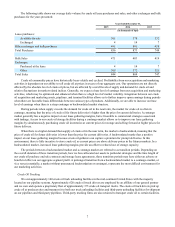

Crude Oil Acquisition and Marketing

These activities include the acquisition and marketing of crude oil, primarily in the mid-continent United States. The

operations are conducted using our assets, which include approximately 375 crude oil transport trucks and approximately 140

crude oil truck unloading facilities, as well as third-party truck, rail and marine assets. Specifically, our crude oil acquisition

and marketing activities include:

• purchasing crude oil at both the wellhead from producers, and in bulk from aggregators at major pipeline

interconnections and trading locations;

• storing inventory during contango market conditions (when the price of crude oil for future delivery is higher than

current prices);

• buying and selling crude oil of different grades, at different locations in order to maximize value;

• transporting crude oil using our pipelines, terminals and trucks or, when necessary or cost effective, pipelines,

terminals or trucks owned and operated by third parties; and

• marketing crude oil to major integrated oil companies, independent refiners and resellers through various types of sale

and exchange transactions.

The crude oil acquisition and marketing activities generate substantial revenue and cost of products sold as a result of the

significant volume of crude oil bought and sold. While the absolute price levels of crude oil significantly impact revenue and

cost of products sold, such price levels normally do not bear a relationship to gross profit. As a result, period-to-period

variations in revenue and cost of products sold are not generally meaningful in analyzing the variation in gross profit for the

crude oil acquisition and marketing activities. The operating results are dependent on our ability to sell crude oil at a price in

excess of our aggregate cost. Our operations are affected by overall levels of supply and demand for crude oil and relative

fluctuations in market-related indices. Generally, we expect a base level of earnings from our crude oil acquisition and

marketing activities that may be optimized and enhanced when there is a high level of market volatility, favorable basis

differentials, and/or a steep contango or backwardated structure. Although we implement risk management processes to provide

general stability in our margins, these margins are not fixed and will vary from period to period.

We mitigate most of our pricing risk on purchase contracts by selling crude oil for an equal term on a similar pricing

basis. We also mitigate most of our volume risk by entering into sales agreements, generally at the same time that purchase

agreements are executed, at similar volumes. As a result, volumes sold are generally equal to volumes purchased. We do not

acquire and hold futures contracts or other derivative products for the purpose of speculating on crude oil price changes, as

these activities could expose us to significant losses.

Crude Oil Purchases and Exchanges

In a typical producer's operation, crude oil flows from the wellhead to a separator where the petroleum gases are removed.

After separation, the producer treats the crude oil to remove water, sediment, and other contaminants and then moves it to an

on-site storage tank. When the tank is full, the producer contacts our field personnel to purchase and transport the crude oil to

market. The crude oil in the producer's tanks is then either delivered directly or transported via truck to our pipeline or to a

third-party pipeline. The trucking services are performed either by our truck fleet or a third-party trucking operation.

Crude oil purchasers who buy from producers compete on the basis of price and the ability to provide highly responsive

services. Our management believes that our ability to offer competitive pricing and high-quality field and administrative

services to producers is a key factor in our ability to maintain our volume of lease purchased crude oil and to obtain new

volume.

We also enter into exchange agreements to enhance margins throughout the acquisition and marketing process. When

opportunities arise to increase our margin or to acquire a grade of crude oil that more nearly matches our delivery requirements

or the preferences of our refinery customers, we exchange our physical crude oil with third parties. Generally, we enter into

exchanges to acquire crude oil of a desired quality in exchange for a common grade crude oil or to acquire crude oil at locations

that are closer to our end markets, thereby reducing transportation costs.

Generally, we enter into contracts with producers at market prices for a term of one year or less, with a majority of the

transactions on a 30-day renewable basis. For the year ended December 31, 2015, we purchased 365 thousands of barrels per

day, from approximately 4 thousand producers, who operate approximately 62 thousand active leases. We also undertook

491 thousand barrels per day of exchanges and bulk purchases during the same period.