Sunbeam 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Sunbeam annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

own stock is one of the best investments we can

make. At the same time, we remain opportunistic

yet disciplined in our approach to acquisitions, and

employ a thoughtful balance between patience and

swiftness to act.

The theme of this year’s annual report is

“Uncommon Value.” As we analyze the building

blocks that have made up Jarden’s success, we

believe Jarden’s DNA and the culture that has

evolved sets us apart in the consumer products

sector. Our business model is truly unique for a

company with annualized revenue of approximately

$8 billion and a compound annual revenue growth

rate since 2001 of over 30%.

Jarden has proven resilient in down cycles, as seen

by our performance in 2008 and 2009, and has

delivered signicant growth in healthier economic

conditions. This sustained growth regardless of

the economy can be attributed to the consistent

leadership from our Ofce of the Chairman, the

consistent application of our operating principles

and the consistent implementation of our capital

allocation priorities. We have always been business

builders with three internal mantras. The rst is that

our best assets go home every night; the second is

to treat the Company’s cash as if it were your own;

and third is that we have no asset in Jarden that

couldn’t be better. This philosophy, coupled with

Jarden’s DNA, has led to consistent consolidated

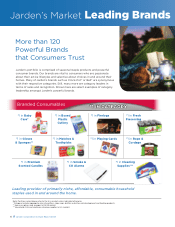

performance across our portfolio of over 120

distinct brands. We believe that despite the many

differences in the end markets we serve, and the

independent operating cultures of our different

businesses, they all benet operationally and

strategically from being part of Jarden.

We have created a culture of developing talent

from within and will further these efforts in the

years ahead. We try to avoid the arrogance that

can come with scale and continue to maintain our

“think lean, act large” entrepreneurial culture. In

2013, brand equity investment reached a new record

of approximately 6% of sales, or over $415 million.

It is this consistent focus on driving new product

innovation that we believe sets the foundation for

Jarden to continue its leadership positions in the vast

majority of its target markets for years to come.

Organic growth in 2013 was 4.4%, or nearly $300

million. This healthy performance was augmented

by the addition of a number of new brands to the

portfolio, the best known being the Hardy y-

shing and Yankee Candle brands. Yankee Candle

was our largest acquisition to date and we are

delighted to welcome their signicant organization

to the Jarden family. This is a very “Jardenesque”

company that further diversies our product

categories and distribution channels and clearly ts

our acquisition criteria, which have remained largely

unchanged since Jarden’s 2001 inception, namely:

1) Category-leading positions in niche

consumer markets with defensible

moats around the business

2) Recurring revenue with margin

expansion opportunities

3) Strong cash ow characteristics

4) Talented management teams

5) Attractive transaction valuations,

accretive from day one pre-synergies

As we look to 2014 and beyond, we believe

that our updated long-term objectives provide

a realistic and positive outlook for the next ve

years. Many aspects of our goals are evergreen and

consistent by design; a factor in delivering reliable

performance each year. Other goals however

require updating given Jarden’s operational and

nancial progress. Our new ve-year operating

plan is designed to meet these goals, not necessarily

every quarter but rather over an extended period

of time.

These goals include:

• Delivering Long-Term Average Organic Sales

Growth of 3%-5%

• Continuing to Leverage SG&A

• Expanding Segment Earnings Margins +150bps

from the Current 12.7% Level

• Generating Average, Annual Adjusted Earnings

Growth of at Least 10%

• Producing at Least $4 Billion of Cash Flow

from Operations over the Next Five Years

WE TRY TO AVOID THE

ARROGANCE THAT CAN

COME WITH SCALE and

continue to maintain our

“think lean, act large”

entrepreneurial culture.

Jarden Corporation Annual Report 2013 3