Sunbeam 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Sunbeam annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BNDED CONSUMABLES

is a leading provider of primarily niche,

market leading branded consumer products

used in and around the home.

Our leading brands include Ball®, Bee®,

Bernardin®, Bicycle®, Billy Boy®, Crawford®,

Diamond®, Dicon®, Fiona®, First Alert®,

First Essentials®, Forster®, Hoyle®, Java-Log®,

Kerr®, Lehigh®, Leslie-Locke®, Lillo®, Loew

Cornell®, Mapa®, NUK®, Pine Mountain®,

Quickie®, Spontex®, Tigex® and Tundra®.

markets, extending the debt maturity

profile of the Company. As disciplined

stewards of capital, our objective

is to strike an appropriate balance

between increased internal investment

in new product development, debt

repayment, additional acquisitions, share

repurchases and dividend increases. As

the management team are significant

shareholders, our interests regarding the

optimal deployment of capital to help

drive the long-term prosperity of Jarden

are aligned with those of all shareholders.

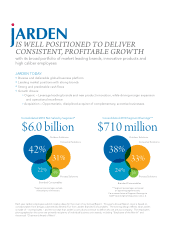

What did all of this mean for Jarden in

2010? We produced record sales of $6

billion and record segment earnings of

$710 million, both a 17% increase over

2009. We maintained our leverage ratio

at less than 3x, as defined by our bank

credit facility, and produced $289 million

of cash flow from operations, finishing

the year with nearly $700 million of

cash on hand. Financially 2010 was a

successful year for Jarden and, most

importantly, we believe it positions us

well to continue our top- and bottom-

line growth in 2011.

Ian Ashken, my friend, colleague and

partner, and I founded the concept of

Jarden when we joined the company

a decade ago. We have always seen

business as a team sport and believe

our most important assets go home

every night. We are profoundly grateful

for the efforts, tenacity and dedication

of the Jarden workforce.

As Jarden has matured, we have

continued to bring on outstanding

talent to help execute our growth plan.

As announced earlier this year, I have

decided to assume the position of

Executive Chairman following our 2011

Annual Meeting and James E. Lillie,

Jarden’s current President and Chief

Operating Officer, who joined us eight

years ago, will become Chief Executive

Officer. I will continue to set Jarden’s

strategic and philosophical direction,

and Jim will continue to focus on the

successful day-to-day management of

the business. The change should be

seamless to the businesses, and I will

continue to work with Ian and Jim within

the “Office of the Chairman”, which was

created in 2005, to effectively lead the

overall company.

While it is satisfying to look back at

the successes of the past ten years, my

real interest is in looking forward to how

Jarden can continue to win in the future.

Undoubtedly, future success will need

to be based on our current operating

plan: to invest in market-leading brands

in niche categories; to leverage our low-

cost, highly efficient operating platform;

and to make disciplined, strategic

acquisitions. We will continue to

balance our drive for growth within the

businesses with our desire to expand

gross margins. We will also need to

be flexible to stay ahead of new macro

trends as they emerge. However, I

believe Jarden’s current market position

and financial foundation provide us a

strong platform from which to grow for

the foreseeable future. It is then down

to hard work and executing on our plan

to determine whether we succeed. I

think I speak for all Jarden’s employees

in saying how much we look forward to

making the most of the opportunities

that lie ahead and striving to create

significant future value for our owners,

the shareholders.

Respectfully yours,

Martin E. Franklin

Chairman and Chief Executive Officer

4

“As disciplined stewards of

capital, our objective is to

strike an appropriate balance

between increased internal

investment in new product

development, debt repayment,

additional acquisitions, share

repurchases and dividend

increases.”

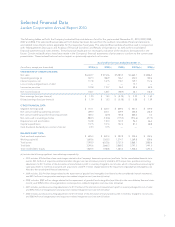

5-Year Financial Highlights

($ in millions)

Net Sales

CAGR = 12%

$5,153

$5,383

$4,660

$3,846

2006 2007 2008 2009 2010

$6,023

Segment Earnings*

CAGR = 14%

$419

$502

$609 $606

$710

* Non-GAAP – For a reconciliation of Segment

Earnings to GAAP Operating Earnings please

see p. 6.

2006 2007 2008 2009 2010

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

0

$700

$600

$500

$400

$300

$200

$100

0