Sunbeam 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 Sunbeam annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis

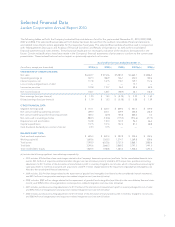

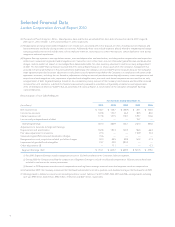

Jarden Corporation Annual Report 2010

Cash Flows from Operating Activities

Net cash provided by operating activities was $289 million and $641 million for 2010 and 2009, respectively. The change is primarily

due to a higher year over year inventory build as the Company returns to growing its sales, which results in higher inventory levels;

the impact of the $27.4 million purchase accounting adjustment for the elimination of manufacturer’s profit in inventory that requires

the fair value of the inventory acquired to be valued at the sales price of the finished inventory, less costs to complete and a

reasonable profit allowance for selling effort; and an increase in pension contributions of approximately $34 million, which includes

approximately $14 million related to the settlement of a domestic pension plan, partially offset by improved operating results and

the impact of the Acquisition. The Company’s inventory at December 31, 2009 was maintained at lower levels, as a result of the

anticipated demand decline due to the global recessionary environment.

Cash Flows from Financing Activities

Net cash provided by (used in) financing activities for 2010 and 2009 was $480 million and ($32.5) million, respectively. The change

is primarily due the proceeds from the issuance of long-term debt in excess of payments on long-term debt ($525 million) during

2010 and the impact of the incremental net change in short-term debt on a year-over-year basis ($210 million), partially offset by

the proceeds from issuance of common stock, net of transaction fees, during 2009 ($203 million) and the year-over-year increase

in the repurchase of the Company’s common stock and shares tendered for taxes ($38.7 million) and the year-over-year increase of

dividends paid ($22.1 million).

Cash Flows from Investing Activities

Net cash used in investing activities was $883 million and $131 million for 2010 and 2009, respectively. Cash used for the acquisition

of businesses, net of cash acquired and earnout payments for 2010 increased approximately $742 million over the same period

due to acquisitions. For 2010, capital expenditures were $138 million versus $107 million in 2009. The Company has historically

maintained capital expenditures at less than 2% of net sales. Subsequent to the Acquisition, the annualized capital expenditure run-

rate is expected to be approximately 2.5% of net sales.

Dividends

In September 2009, the Company announced that the Board had decided to initiate a quarterly cash dividend. In December

2010, the Board declared a quarterly cash dividend of $0.0825 per share of the Company’s common stock, or $7.3 million, paid on

January 31, 2011 to stockholders of record as of the close of business on January 3, 2011. Cash dividends paid to stockholders in

2010 and 2009 were $28.7 million and $6.6 million, respectively. For 2010, the Company’s total annual dividend of $0.33 per share of

common stock represents a 10% increase over the 2009 annualized run rate. The actual declaration of any future cash dividends, and

the establishment of record and payment dates, will be subject to final determination by the Board each quarter after its review of

the Company’s financial performance.

CAPITAL RESOURCES

At December 31, 2010 and 2009, the Company had cash and cash equivalents of $695 million and $827 million, respectively. At

December 31, 2010, there was no amount outstanding under the revolving credit portion of the Facility. At December 31, 2010, net

availability under the Facility was approximately $102 million, after deducting approximately $48 million of outstanding standby and

commercial letters of credit. The Company is required to pay commitment fees on the unused balance of the revolving portion of

the Facility. At December 31, 2010, the annual commitment fee on unused balances was 0.375%.

In November 2010, the Company completed a registered public offering for $300 million aggregate principal amount of 6 1/8%

senior notes due 2022 and received approximately $294 million in net proceeds. The net proceeds will be used for general

corporate purposes. Beginning in November 2015, the Company may redeem all or part of these 6 1/8% senior notes due 2022 at

specified redemption prices ranging from approximately 100% to 103% of the principal amount, plus accrued and unpaid interest to

the date of redemption. These notes are subject to similar restrictive and financial covenants as the Company’s existing senior notes

and senior subordinated notes.

On January 20, 2010, the Company completed a registered public offering for $492 million aggregate principal amount of 7 1/2%

senior subordinated notes due 2020 and received approximately $476 million in net proceeds. The offering consisted of two

tranches: a U.S. dollar tranche with aggregate principal amount of $275 million and a Euro dollar tranche with aggregate principal

amount of C

=150 or approximately $217 million. The Company used the net proceeds to repay $250 million of the Facility term loans,

with the balance to be used for general corporate purposes. Beginning in January 2015, the Company may redeem all or part of

these 7 1/2% senior subordinated notes due 2020 at specified redemption prices ranging from approximately 100% to 104% of the

principal amount, plus accrued and unpaid interest to the date of redemption. These notes are subject to similar restrictive and

financial covenants as the Company’s existing senior notes and senior subordinated notes.

14