Sunbeam 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Sunbeam annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Shareholders: In last year’s letter to shareholders,

I stated my belief that the best was yet to come for Jarden. We entered 2004

with a strong platform for growth and horizons full of opportunity and I’m

very pleased to say that, as optimistic and confident as we felt at that time,

we surpassed our expectations for progress during 2004.

First and foremost, we once again generated record financial results in 2004. Organic sales growth at Jarden,

adjusting for the impact of acquisitions, was approximately 5%, at the high end of our target range. EBITDA margins,

excluding non-cash restricted stock charges, were approximately 18%, consistent with our long-term strategy of main-

taining an EBITDA margin in excess of 15%. With over $70 million of cash flow from operations, we continued the strong

cash generation that has become a Jarden trademark and one of our primary financial objectives. We firmly believe that

strong cash flow not only demonstrates the strength of our business, but also provides the capacity for future investment,

including increased marketing programs and acquisitions.

This continued peer-leading performance was the result not only of our ability to effectively execute accretive

acquisitions, but also the delivery of strong operating results in the face of a tough trading climate. Our rapid pace of

growth was recognized by FORTUNE magazine in their September 2004 issue, ranking Jarden as the 19th fastest growing

company in America.

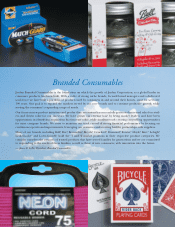

During 2004, we completed the acquisition of The United States Playing Card Company and signed a definitive

agreement to acquire American Household, Inc. USPC expanded our distribution and added diversity to our Branded

Consumables division. USPC is the world’s largest manufacturer and distributor of playing cards. During 2004, USPC

extended its traditional playing card offering to include poker chips and poker sets, capitalizing on the surge in

popularity of the game of poker. In fact, our poker chip sets were recognized as one of the hottest items for the 2004

holiday season by a number of our major retail customers.

Our agreement to acquire AHI was announced in September 2004 and closed in January 2005. This was a watershed

event for Jarden, tripling our revenue base as well as providing significant international distribution and a new portfolio

of market-leading global brands. AHI met most of our traditional acquisition criteria, including market leadership, brand

strength, complementary distribution channels and, of course, attractive valuation. The only significant aspect that

deviated from our historical acquisition criteria was in adjusted EBITDA margins, where AHI had a run rate of

approximately 7% EBITDA margins in 2004. However, we view this as a significant opportunity for Jarden in two regards.

First, all of the businesses within the “new” Jarden should benefit from the synergies arising from the combination with AHI.

We once again generated record

financial results in 2004.

2