Sunbeam 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Sunbeam annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

innovations that improve life

Jarden Corporation 2004 Annual Report

Table of contents

-

Page 1

innovations that improve life Jarden Corporation 2004 Annual Report -

Page 2

...Solutions 08 Outdoor Solutions 10 Other 11 Selected Financial Data 14 Management's Discussion and Analysis 36 Financial Statements Winner of Jarden's 2004 Annual Report Cover Design Concept Contest: Shannon Simpson, Jarden Plastic Solutions. and Ball ® are registered trademarks of Ball Corporation... -

Page 3

..., playing cards, coffee makers, blenders, toasters, smoke alarms, scales, camping tents and lanterns, coolers and sleeping bags. Headquartered in Rye, N.Y., Jarden has over 9,000 employees worldwide. Corporate Strategy Our objective is to build a world-class consumer products company that enjoys... -

Page 4

... growing company in America. During 2004, we completed the acquisition of The United States Playing Card Company and signed a definitive agreement to acquire American Household, Inc. USPC expanded our distribution and added diversity to our Branded Consumables division. USPC is the world's largest... -

Page 5

... of our earnings per share over the same time horizon. Operating highlights during the year were led by a record number of new product introductions. These included our World Poker Tour™ poker kits, a new line of premium plastic cutlery under the Signature brand, a line of FoodSaver® accessories... -

Page 6

...by our core brands and to continue profitable growth, while serving the consumer's expanding range of needs. Our focus on new product initiatives and product line extensions has successfully generated increased sales for retailers and driven value for our investors. We have grown our revenue base by... -

Page 7

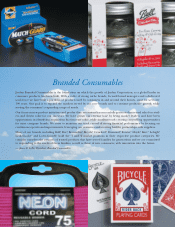

... creative, new products at retail in 2004. • Products and Brands We develop, manufacture, market and distribute a broad array of branded products, many of which are consumable in nature, including home canning jars, jar closures and related accessories, kitchen matches and related flame products... -

Page 8

..., Jarden Consumer Solutions intends to continue to accelerate return on investment and shareholder value. The legacy and strength of our brands provide a market ® advantage today that will become even more important as we expand and develop new opportunities. Sunbeam Mr. Coffee, Oster, Health... -

Page 9

... of consumer products. We have market-leading positions in a number of product categories, including toasters, irons, blenders, drip coffee makers, stand mixers, warming blankets, home vacuum packaging machines, smoke alarms, carbon monoxide alarms, hotel room amenities and professional animal care... -

Page 10

... when the business was run by the Coleman family. In addition to putting new product development on the fast track, we intend to service our customers better and to drive margin improvement throughout the business. I believe Coleman is poised for significant growth due to the power of the brand, the... -

Page 11

... largest trademark/brand licensor in the world and the 36th leading licensor overall. Truly a global company, Outdoor Solutions provides other Jarden portfolio companies channel and geographic expansion opportunities, primarily in Europe and Japan. New executive management team and organization... -

Page 12

.... This business services certain of the internal needs of our three primary segments, as well as a number of third-party customers. Jarden Zinc Products is the largest North American producer of niche products fabricated from solid zinc strip. Jarden Zinc Products is the sole source supplier of... -

Page 13

... 31, 2004, 2003, 2002, 2001 and 2000. The selected financial data set forth below has been derived from our audited consolidated financial statements and related notes thereto where applicable for the respective fiscal years. The selected financial data should be read in conjunction with "Management... -

Page 14

... stock charge, net of related tax benefit. Given that the Company's diluted weighted average shares for the year were 23.5 million, the non-cash restricted stock charge, net of related tax benefits also reduced the Company's diluted earnings per share by $0.56. (d) The results of Diamond Brands... -

Page 15

..., cash flows from operations included $38.6 million of income tax refunds resulting primarily from the 2001 loss on divestiture of assets. (m) Working capital is defined as current assets (including cash and cash equivalents) less current liabilities. Reconciliation of non-GAAP Measure For the year... -

Page 16

... ("AHI Acquisition") we also provide global consumer products through the Campingaz®, Coleman®, First Alert®, Health o meter®, Mr. Coffee®, Oster® and Sunbeam® brands (see "Recent Developments"). See Item 1. Business and Note 5. Business Segment Information in Item 8. Financial Statements and... -

Page 17

... from year to year, and the primary factors that accounted for those changes, as well as how certain accounting principles, policies and estimates affect our financial statements. Acquisition Activities We have grown through strategic acquisitions of complementary businesses and expanding sales of... -

Page 18

... as part of Deferred Consideration for Acquisitions on our Consolidated Balance Sheet. Loew-Cornell is included in the branded consumables segment from March 18, 2004. 2003 Activity On September 2, 2003, we acquired all of the issued and outstanding stock of Lehigh Consumer Products Corporation and... -

Page 19

... manufacturing business acquired in the Diamond Acquisition in February 2003. Excluding intercompany sales, net sales for the plastic consumables segment were higher due to increased sales to certain existing OEM customers and new international sales. In 2004, our other segment reported net sales of... -

Page 20

... prices which were not passed through to our branded consumables segment with respect to plastic cutlery products and higher validation costs incurred for new business development projects, partially offset by the sales effects discussed above. Operating earnings of our other segment increased by... -

Page 21

... increase in organic operating earnings due to a favorable home canning sales mix resulting from increased sales of premium products. Also, the operating earnings of the consumer solutions segment increased by $10.9 million, principally due to (i) the acquisition of this business in April 2002; (ii... -

Page 22

Management's Discussion and Analysis of Financial Condition and Results of Operations (cont'd) Diamond Brands and Lehigh product lines. This effect is partially offset by the benefit of including the higher gross margins of the acquired consumer solutions business for the full year in 2003 but only ... -

Page 23

... both tax and accounting purposes. Gains and losses related to the effective portion of the interest rate swap will be reported as a component of other comprehensive income and will be reclassified into earnings in the same period that the hedged transaction affects earnings. As of December 31, 2004... -

Page 24

... common stock to three of our executive officers. The restrictions on these shares were to lapse ratably over a three-year period commencing January 1, 2005, and would lapse immediately in the event of a change in control. Following the signing of the AHI transaction, during October 2004, our Board... -

Page 25

... recorded a non-cash restricted stock charge of approximately $21.8 million related to the lapsing of restrictions over all the restricted stock issuances to three of our executive officers, discussed immediately below and in "2002 Activity" also below. We received a tax deduction for this non-cash... -

Page 26

...in control; or (ii) the earlier of our common stock achieving a closing price of $28 (up from $23.33) or us achieving annualized revenues of $800 million. However, if such restrictions were to lapse during a period when these officers were subject to additional contractual limitations on the sale of... -

Page 27

... the Bank of America prime rate and (b) the federal funds rate plus .50%, plus, in each case, an applicable margin ranging from 2.00% to 2.75% for Eurodollar Rate loans and from .75% to 1.5% for Base Rate loans. The Old Credit Agreement contained restrictions on the conduct of our business similar... -

Page 28

... Activities - 2004 Activity" above) and the recording of a contingent earn-out for our Tilia Acquisition (see "Acquisition Activities - 2002 Activity" above); partially offset by the addition of the working capital of our 2004 acquired businesses; and higher inventory balances (see "Cash Flows... -

Page 29

...into account the AHI Acquisition and its related financing in January 2005 (see "Recent Developments" below), we believe that our cash and cash equivalents on hand, cash generated from our operations and our availability under our senior credit facility is adequate to satisfy our working capital and... -

Page 30

... 2004. Interest payments on our fixed rate debt are calculated based on their scheduled payment dates. The debt amounts exclude approximately $3.2 million of non-debt balances arising from the interest rate swap transactions described in Item 8., Note 15., Financial Statements and Supplementary Data... -

Page 31

...global consumer products through brands such as BRK®, Campingaz®, Coleman®, First Alert®, Health o meter®, Mr. Coffee®, Oster® and Sunbeam®. Product lines added include appliances, personal care and wellness, home safety equipment and outdoor leisure and camping products. Had AHI been a part... -

Page 32

... of our financial condition and results of operations, and/or require management's significant judgments and estimates: Revenue recognition and allowances for product returns We recognize revenue when title transfers. In most cases, title transfers at the time product is shipped to customers. We... -

Page 33

..., cash flows or competitive position of our Company. It is possible, that as additional information becomes available, the impact on our Company of an adverse determination could have a different effect. New Accounting Pronouncements In December 2004, the Financial Accounting Standards Board... -

Page 34

... net income and earnings per share in Note 1., Significant Accounting Policies of Item 8., Financial Statements and Supplementary Data included herein. Statement 123 (R) also requires the benefits of tax deductions in excess of recognized compensation cost to be reported as a financing cash flow... -

Page 35

...sales and profits; We depend on a single manufacturing facility for certain products; Competition in our industries may hinder our ability to execute our business strategy, achieve profitability, or maintain relationships with existing customers; If we fail to develop new or expand existing customer... -

Page 36

...; Our significant indebtedness could adversely affect our financial health; We will require a significant amount of cash to service our indebtedness. Our ability to generate cash depends on many factors beyond our control; The indenture related to our 9 3â„ 4% senior subordinated notes due 2012... -

Page 37

... this exposure. The Company does not invest or trade in any significant derivative financial or commodity instruments, nor does it invest in any foreign financial instruments. NYSE Corporate Governance Disclosure Jarden Corporation filed as exhibits to its 2004 Annual Report on Form 10-K, the... -

Page 38

... assessment and those criteria, management concluded that the Company maintained effective internal control over financial reporting as of December 31, 2004. On June 28, 2004, the Company acquired approximately 75.4% of the issued and outstanding stock of Bicycle Holding, Inc., including its wholly... -

Page 39

... Public Accounting Firm The Board of Directors and Stockholders of Jarden Corporation We have audited management's assessment, included in the accompanying Management's Report on Internal Control Over Financial Reporting, that Jarden Corporation and subsidiaries (the "Company") maintained effective... -

Page 40

... Company Accounting Oversight Board (United States), the consolidated balance sheets of Jarden Corporation and subsidiaries as of December 31, 2004 and 2003, and the related consolidated statements of income, comprehensive income, stockholders' equity, and cash flows for each of the three years... -

Page 41

... with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Jarden Corporation's internal control over financial reporting as of December 31, 2004, based on criteria... -

Page 42

Jarden Corporation Consolidated Statements of Income (in thousands, except per share amounts) Year ended December 31, 2004 2003 2002 Net sales ...$838,609 Costs and expenses: Cost of sales ...563,210 Selling, general and administrative expenses ...146,901 Restricted stock charges ...32,415 Operating... -

Page 43

...and cash equivalents ...Accounts receivable, net of allowances of $14,149 and $11,880, respectively ...Income taxes receivable ...Inventories, net ...Deferred taxes on income ...Prepaid expenses and other current assets ...Total current assets ...Non-current assets: Property, plant and equipment, at... -

Page 44

... 2,211 4,335 Net cash provided by financing activities ...98,066 284,796 111,547 Cash flows from investing activities Additions to property, plant and equipment ...(10,761) (12,822) (9,277) Acquisitions of businesses, net of cash acquired of $4,287 and $6,685 in 2004 and 2003, respectively ...(258... -

Page 45

Jarden Corporation Consolidated Statements of Changes in Stockholders' Equity (in thousands) Accumulated Other Comprehensive (Loss) Income Cumulative Interest Minimum Common Stock Treasury Stock Additional Paid-in Retained Loans Translation Rate Pension Shares Amount Shares Amount Capital Earnings ... -

Page 46

Jarden Corporation Consolidated Statements of Comprehensive Income (in thousands) Year ended December 31, 2004 2003 2002 Net income ...$42,434 $31,778 $36,309 Foreign currency translation ...3,480 4,009 191 Interest rate swap unrealized (loss) gain: Change during period ...(472) (57) - Maturity of ... -

Page 47

...of American Household, Inc. ("AHI") on January 24, 2005 ("AHI Acquisition") (see Note 19) the Company also sells global consumer products through such brands as Campingaz®, Coleman®, First Alert®, Health o meter®, Mr. Coffee®, Oster® and Sunbeam® brands. See Business Segment Information (Note... -

Page 48

... Financial Statements (cont'd) December 31, 2004 Prepaid Media and Advertising Costs Direct advertising costs (primarily media expenses) related to infomercial sales are recorded as prepaid assets when paid in advance. The expense is recognized when the infomercial is aired. All production... -

Page 49

... fair value. Taxes on Income Deferred taxes are provided for differences between the financial statement and tax basis of assets and liabilities using enacted tax rates. The Company established a valuation allowance against a portion of the net tax benefit associated with all carryforwards... -

Page 50

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 Had compensation cost for the Company's stock option plans been determined based on the fair value at the grant dates for awards under those plans, the Company's net income and earnings per share would have been... -

Page 51

... forma net income and earnings per share in Note 1 to the Company's consolidated financial statements. Statement 123 (R) also requires the benefits of tax deductions in excess of recognized compensation cost to be reported as a financing cash flow, rather than as an operating cash flow as required... -

Page 52

... on the Company's consolidated financial statements. Final authoritative guidance could require the Company to change this assessment. 3. Acquisitions 2004 Activity On June 28, 2004, the Company acquired approximately 75.4% of the issued and outstanding stock of Bicycle Holding, Inc., including... -

Page 53

... included in the branded consumables segment from March 18, 2004. 2003 Activity On September 2, 2003, the Company acquired all of the issued and outstanding stock of Lehigh Consumer Products Corporation and its subsidiary ("Lehigh" and the "Lehigh Acquisition"). Lehigh is a leading supplier of rope... -

Page 54

... balances shown above. The 2004, 2003 and 2002 acquisitions discussed above were all entered into as part of the Company's strategy of acquiring branded consumer products businesses with leading market positions in niche markets for products used in and around the home. In connection with the... -

Page 55

... per share data) Net sales ...Operating income ...Net income ...Diluted earnings per share ... 5. Business Segment Information The Company reports four business segments: branded consumables, consumer solutions, plastic consumables and other. In the branded consumables segment, the Company markets... -

Page 56

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 Net sales, operating earnings, capital expenditures, depreciation and amortization, and assets employed in operations by segment are summarized as follows: Year Ended December 31, 2004 2003 2002 (thousands of ... -

Page 57

... corporate facilities and equipment. Within the branded consumables segment are four product lines: kitchen products, home improvement products, playing card products and other specialty products. Kitchen products include food preparation kits, home canning and accessories, kitchen matches, plastic... -

Page 58

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 The Company's sales are principally within the United States. Our international operations are mainly based in Canada, Spain, Mexico and the U.K. Export sales are also made to countries in Europe, Latin America,... -

Page 59

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 Branded Consumables 2003 Intangible assets not subject to amortization: Goodwill ...Trademarks ...Intangible assets not subject to amortization ...Intangible assets subject to amortization: Non-compete agreement... -

Page 60

... Activity On June 28, 2004, in connection with its USPC Acquisition, the Company completed a $116 million add-on to its Term B loan facility ("Term B Add-on") under its Second Amended Credit Agreement. The proceeds from the Term B Add-on offering were used to partially fund the USPC Acquisition. The... -

Page 61

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 2003 Activity In connection with the Lehigh Acquisition (see Note 3), the Company's Amended Credit Agreement, amended and restated in 2003, provided for up to $280 million of senior secured loans, consisting of ... -

Page 62

...the Bank of America prime rate and (b) the federal funds rate plus .50%, plus, in each case, an applicable margin ranging from 2.00% to 2.75% for Eurodollar Rate loans and from .75% to 1.50% for Base Rate loans. The Old Credit Agreement contained restrictions on the conduct of the Company's business... -

Page 63

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 As of December 31, 2004 and 2003, the Company's long-term debt included approximately $3.2 million and $2.6 million, respectively, of non-debt balances arising from the interest rate swap transactions related to... -

Page 64

... use is limited to future taxable income of the Company. The carryforwards expire in the United States in 2021 and in Canada in 2008. The Company maintained a valuation allowance against a portion of the net tax benefit associated with all carryforwards and temporary differences at December 31, 2004... -

Page 65

..., the potential range of income tax effects of such Repatriation Provision cannot be reasonably estimated prior to the issuance of the Company's Consolidated Financial Statements. As a result, the Company has not provided United States income taxes on undistributed foreign earnings of approximately... -

Page 66

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 The following table is a reconciliation of the projected benefit obligation and the fair value of the deferred benefit pension plan assets and the status of the Company's unfunded postretirement benefit ... -

Page 67

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 The rate of compensation increase assumption is 3.25% to 4.25% for the USPC pension plan and is not applicable to the Company's other pension plans. The healthcare cost trend on covered charges for the USPC ... -

Page 68

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 percentage point decrease in health care costs would affect the aggregate annual service and interest costs under the Company's postretirement plans by less than $0.1 million. 11. Equity and Stock Plans On ... -

Page 69

... upon the event of a change in control. During the fourth quarter of 2003, the Company recorded a non-cash restricted stock charge of approximately $21.8 million related to the lapsing of restrictions over all the restricted stock issuances to three of the Company's executive officers, discussed... -

Page 70

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 of (i) a change in control; or (ii) the earlier of our common stock achieving a closing price of $28 (up from $23.33) or the Company achieving annualized revenues of $800 million. However, if such restrictions ... -

Page 71

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 currently involved in will have a material adverse effect upon the financial condition, results of operations, cash flows or competitive position of the Company. It is possible, that as additional information ... -

Page 72

...loss, in the event of nonperformance by the other party to its current existing swap, a large financial institution. However, the Company does not anticipate non-performance by the other party. Cash Flow Hedges In December 2004, the Company entered into two interest rate swaps, effective in January... -

Page 73

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 as the term loan facilities. The swaps are considered to be cash flow hedges and are also considered to be effective hedges against changes in future interest payments of the Company's floating-rate debt ... -

Page 74

... Company's previously reported net sales and gross profit amounts in 2003 to conform to the presentation in 2004. These reclassifications have no impact on previously reported net income. (4) Fourth quarter of 2003 includes a non-cash restricted stock charge of $21.8 million and related tax benefit... -

Page 75

...global consumer products through brands such as BRK®, Campingaz®, Coleman®, First Alert®, Health o meter®, Mr. Coffee®, Oster® and Sunbeam®. Product lines added include appliances, personal care and wellness, home safety equipment and outdoor leisure and camping products. Had AHI been a part... -

Page 76

Jarden Corporation Notes to Consolidated Financial Statements (cont'd) December 31, 2004 On January 24, 2005, the Company entered into two interest rate swaps, effective on January 26, 2005, that converted an aggregate of $125 million of floating rate interest payments (excluding our 2% applicable ... -

Page 77

...-7070 Corporate Counsel Kane Kessler, PC New York, New York Willkie Farr & Gallagher LLP New York, New York Consumer Solutions Health o meter,® Mr. Coffee,® Oster,® Sunbeam® Boca Raton, FL 561-912-4100 FoodSaver,® VillaWare® San Francisco, CA 415-371-7200 First Alert,® BRK® Chicago, IL 630... -

Page 78