Southwest Airlines 2015 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2015 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.a brand new five-gate international terminal and customs facility at Houston’s William P.

Hobby Airport in October 2015. That marked the first international scheduled service out

of Hobby Airport since 1969.

Finally, the last AirTran branded flights operated on December 28, 2014. So, 2015

represented the first year Southwest operated all of the former AirTran flights in the

Southwest livery and brand.

Taken all together, it was an exceptionally ambitious and successful year of

network growth and development. Despite the stout increase in capacity, we were able to

drive even stronger traffic growth, with load factors increasing in 2015 to an annual

record 83.6 percent.

In addition, our award-winning frequent flyer program, Rapid Rewards®, delivered

another year of significant revenue growth. Most notably, in July 2015, we were delighted

to amend and extend our co-branded credit card agreement with our long-standing Partner,

Chase Bank USA, N.A. Since we re-launched Rapid Rewards in 2011, we have more than

doubled the membership, the credit card holders, and the revenues from the program.

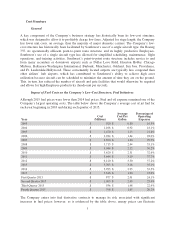

While operating revenues grew, operating expenses fell due to a 29.1 percent

plunge in economic jet fuel costs per gallon. Even excluding jet fuel costs, Southwest

compared well with the year ago period as CASM (operating expenses per available seat

mile), excluding fuel and special items, was virtually flat. And, 2015 costs included a

significant increase in ProfitSharing for our Employees correlating with the increased

profits. Of note, the continuing work to modernize the fleet, including the retirement of the

Boeing 717s, the accelerated retirement and declining mix of the Boeing 737 Classics,

and the increasing mix of Boeing 737-800s, are all continuing to pay dividends in terms of

lower fuel burn, lower maintenance, and more seats per departure. Lastly, our fleet

utilization was less than optimal during the conversion of AirTran into Southwest. With the

conversion behind us, we began to gradually restore our fleet utilization to more historic

levels throughout 2015. All combined, we had an excellent cost performance in 2015.

With revenues up and costs down, our operating profit surged 85 percent. That

resulted in record cash flow from operations of $3.2 billion and strong free cash flow2of

$1.1 billion. Our financial position strengthened, as did our investment grade credit

ratings with an upgrade to Baa1 with Moody’s Investor Service and an upgrade to BBB+

with Fitch Ratings. We were able to return $1.4 billion to Shareholders in 2015 in the form

of dividends and share repurchases. And, we were able to maintain strong liquidity with

$3.1 billion of cash and short-term investments at year-end 2015, along with a $1 billion,

fully-available, bank line-of-credit. In May 2015, our Board of Directors authorized a $1.5

billion share repurchase program and increased the quarterly dividend by 25 percent to

$0.075 per share.

We ended the year 2015 with 704 aircraft – all Boeing 737s (B737). By year-end

2014, we completed the retirement of the 88 Boeing 717s acquired via the AirTran

2Free cash flow is calculated as operating cash flows of $3.24 billion less capital expenditures of $2.04 billion less assets

constructed for others of $102 million plus reimbursements for assets constructed for others of $24 million.