Southwest Airlines 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SOUTHWEST AIRLINES CO.

2015 ANNUAL REPORT TO SHAREHOLDERS

To our Shareholders:

The year 2015 was a gratifying, successful, and record-setting year. After five

years of intense work on five strategic initiatives, 2015 was the first full year to

demonstrate results – and the results were superb. Record traffic, record revenues,

record profits, and a record year-end stock price (LUV). Southwest®boosted its available

seat miles (capacity) 43 percent since 2010, driven by the acquisition of AirTran in 2011.

And, Southwest achieved an all-time high pre-tax return on invested capital, excluding

special items1(ROIC), of 32.7 percent. All combined, since 2010, Shareholder value has

increased more than 3 fold; dividends per share have increased more than 16 fold; and

$4.3 billion has been returned to Shareholders in dividends and share repurchases.

Southwest has transformed, as the results so clearly demonstrate. Our results were

further enhanced by dramatically lower jet fuel costs, driven by a collapse in oil prices. It

was our 43rd consecutive year of profitability, an unprecedented achievement in the

domestic airline industry.

Our 2015 net income was a record $2.2 billion, or $3.27 per diluted share, easily

surpassing the previous record, set a year ago. Excluding special items, our record 2015

earnings were $2.4 billion, or $3.52 per diluted share, which was 75.1 percent higher

compared with 2014.

Total operating revenues were up 6.5 percent to $19.8 billion, on a healthy

capacity increase of 7.2 percent, compared with 2014. Given the continuing sluggishness

of the overall domestic economy, our 2015 capacity increase appears aggressive, at first

blush; however, Southwest capitalized on several secular opportunities that converged in

2014/2015. First, the long-awaited October 2014 repeal of the domestic restrictions at

Dallas Love Field allowed us to increase the flight activity at Love by 50 percent resulting

in over half of our year-over-year capacity growth in 2015. Our Dallas market presence,

coupled with the pent up demand for low fares, drove a nearly 150 percent increase in

our traffic (as measured by revenue passenger miles), and an extraordinary, all-around

success with our Dallas Love Field expansion.

Next, we were able to acquire scarce slots and gates at Washington Reagan

National and New York LaGuardia Airports, adding 28 and 6 daily flights, respectively.

While we don’t have the presence in these two airports we have in the DFW Metroplex,

we are very pleased with the performance of these new flights.

Following the integration of AirTran into Southwest in 2014, including the launch of

Southwest international service in July 2014, we opened four new international

destinations in 2015: San Jose, Costa Rica; Puerto Vallarta, Mexico; Belize City, Belize;

and Liberia, Costa Rica. These destinations were timed in 2015 to support the opening of

1Additional information regarding non-GAAP financial measures is included in the accompanying Form 10-K for the fiscal

year ended December 31, 2015.

Table of contents

-

Page 1

... service in July 2014, we opened four new international destinations in 2015: San Jose, Costa Rica; Puerto Vallarta, Mexico; Belize City, Belize; and Liberia, Costa Rica. These destinations were timed in 2015 to support the opening of 1 Additional information regarding non-GAAP financial measures... -

Page 2

... award-winning frequent flyer program, Rapid Rewards®, delivered another year of significant revenue growth. Most notably, in July 2015, we were delighted to amend and extend our co-branded credit card agreement with our long-standing Partner, Chase Bank USA, N.A. Since we re-launched Rapid Rewards... -

Page 3

...old restrictions. As measured by the number of originating domestic passengers boarded and based on data available from the U.S. Department of Transportation (DOT), as of September 30, 2015. 4 First and second checked pieces of luggage, size and weight limits apply. 5 Fare differences might apply. 3 -

Page 4

... proud of our People for these record results. Please join me in thanking them. Sincerely, Gary C. Kelly Chairman, President, and Chief Executive Officer March 15, 2016 6 Size and weight limits apply. Some airlines may allow free checked bags on select routes or for qualified circumstances. -

Page 5

... Dallas, Texas (Address of principal executive offices) 74-1563240 (IRS Employer Identification No.) 75235-1611 (Zip Code) Registrant's telephone number, including area code: (214) 792-4000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Common Stock ($1.00 par value... -

Page 6

-

Page 7

... Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services PART IV Item 15. Exhibits and Financial Statement Schedules... -

Page 8

-

Page 9

... 704 Boeing 737 aircraft. During 2015, the Company also added 20 domestic nonstop destinations from Dallas Love Field. These routes were made possible by the repeal of certain federal flight restrictions at Dallas Love Field in October 2014. At year-end 2015, Southwest offered a total of 180 weekday... -

Page 10

...December 31, 2015, Southwest served 637 nonstop city pairs. Southwest's point-to-point service has also enabled it to provide its markets with frequent, conveniently timed flights and low fares. For example, Southwest currently offers 20 weekday roundtrips from Dallas Love Field to Houston Hobby, 14... -

Page 11

.... Southwest's use of a single aircraft type has allowed for simplified scheduling, maintenance, flight operations, and training activities. Southwest's point-to-point route structure includes service to and from many secondary or downtown airports such as Dallas Love Field, Houston Hobby, Chicago... -

Page 12

... fare products include the privilege of two free checked bags (weight and size limits apply). In addition, regardless of the fare product, Southwest does not charge fees for changes to flight reservations. • "Wanna Get Away" fares are generally the lowest fares and are typically subject to advance... -

Page 13

...automatic check-in before general boarding positions become available, improving Customers' seat selection options (priority boarding privileges are already a benefit of being an "A-List" tier member under the Company's Rapid Rewards Frequent Flyer Program). Southwest's Pet Policy provides Customers... -

Page 14

... of Southwest's co-branded Chase Visa credit card are able to redeem their points for items other than travel on Southwest, such as international flights on other airlines, cruises, hotel stays, rental cars, gift cards, event tickets, and more. In addition to earning points for revenue flights and... -

Page 15

...fees, change fees, or hidden fees. Southwest continues to be the only major U.S. airline that offers to all ticketed Customers up to two checked bags that fly free (weight and size limits apply). Through both its national and local marketing campaigns, Southwest has continued to aggressively promote... -

Page 16

...and one car seat free of charge, in addition to the two free checked bags. The Company also continues to promote all of the many other reasons to fly Southwest such as its low fares, network size, Customer Service, free live television offerings, and its Rapid Rewards frequent flyer program. In 2014... -

Page 17

... activities relate to areas such as unfair and deceptive practices and unfair competition by air carriers, deceptive airline advertising (concerning, e.g., fares, ontime performance, schedules, and code-sharing), and violations of rules concerning denied boarding compensation, ticket refunds... -

Page 18

... fee information for "basic ancillary services," including fees for a first checked bag, second checked bag, carry-on items, and advance seat selection. Second, the proposed rule would require enhanced reporting of information to the DOT by mainline carriers for their domestic code-share partner... -

Page 19

... and in-flight entertainment; and (v) a potential DOT proposed rule to restrict passenger cell phone voice calls on aircraft. Aviation Taxes and Fees The statutory authority for the federal government to collect most types of aviation taxes, which are used, in part, to finance programs administered... -

Page 20

... security measures, the TSA regulates the types of liquid items that can be carried onboard aircraft. In addition, as part of its Secure Flight program, the TSA requires airlines to collect a passenger's full name (as it appears on a government-issued ID), date of birth, gender, and Redress Number... -

Page 21

...the TSA Known Crewmember® program, which is a risk-based screening system that enables TSA security officers to positively verify the identity and employment status of flightcrew members. The program expedites flight crew member access to sterile areas of airports. The Company works collaboratively... -

Page 22

... also increases engine life; galley refreshes with dry goods weight reduction; Company optimized routes (flying the best wind routes to take advantage of tailwinds or to minimize headwinds); improvements in flight planning algorithms to better match the Company's aircraft flight management system... -

Page 23

... use of airspace. RNP combines the capabilities of advanced aircraft avionics, Global Positioning System ("GPS") satellite navigation (instead of less precise ground-based navigation), and new flight procedures to (i) enable aircraft to carry navigation capabilities rather than relying on airports... -

Page 24

...of the Company's credit and lease agreements. The policies principally provide coverage for public and passenger liability, property damage, cargo and baggage liability, loss or damage to aircraft, engines, and spare parts, and workers' compensation. In addition, the Company carries a cyber-security... -

Page 25

...competitive advantage by differentiating Southwest from all of its major competitors by not charging additional fees for items such as first and second checked bags, flight changes, seat selection, snacks, curb-side check-in, and telephone reservations. Routes, Frequent Flyer Programs, and Schedules... -

Page 26

..., and trains. Inconveniences and delays associated with air travel security measures can increase surface competition. In addition, surface competition can be significant during economic downturns when consumers cut back on discretionary spending and fewer choose to fly, or when gasoline prices are... -

Page 27

..., Provisioning, Freight Agents 11,000 Southwest Customer Service Agents, Customer Representatives Southwest Material Specialists (formerly known as Stock Clerks) 6,300 300 Southwest Mechanics Southwest Aircraft Appearance Technicians Southwest Facilities Maintenance Technicians 2,300 200... -

Page 28

...date this report is filed. The Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. Item 1A. Risk Factors The airline industry is particularly sensitive to changes in economic conditions; in... -

Page 29

... competitive nature of the airline industry generally, and the risk that higher fares will drive a decrease in demand. The Company attempts to manage its risk associated with volatile jet fuel prices by utilizing over-thecounter fuel derivative instruments to hedge a portion of its future jet fuel... -

Page 30

... Disclosures About Market Risk," and in Note 1 and Note 10 to the Consolidated Financial Statements. The Company is also reliant upon the readily available supply and timely delivery of jet fuel to the airports that it serves. A disruption in that supply could present significant challenges... -

Page 31

... them to better control costs per available seat mile. In addition, like Southwest, some competitors have plans to add a significant number of new aircraft to their fleets, which could potentially decrease their operating costs through better fuel efficiencies, and lower maintenance costs. Some of... -

Page 32

... Agents; Flight Attendants; Material Specialists; Facilities Maintenance Technicians; Flight Crew Training Instructors; and Source of Support Representatives, are in unions currently in negotiations for labor agreements, which could continue to put pressure on the Company's labor costs. Increasing... -

Page 33

...execute its strategic plans. Southwest has historically been regarded as a growth airline. However, organic growth remains challenging because (i) the opportunities for domestic expansion could be limited; (ii) the Company's international network is small and not yet developed; and (iii) the Company... -

Page 34

... demand for air travel and also have resulted in increased safety and security costs for the Company and the airline industry generally. Safety measures create delays and inconveniences and can, in particular, reduce the Company's competitiveness against surface transportation for short-haul routes... -

Page 35

... increase costs for safety, security, compliance, or other Customer Service standards; changes in laws that may limit the Company's ability to enter into fuel derivative contracts to hedge against increases in fuel prices; changes in laws that may limit or regulate the Company's ability to promote... -

Page 36

... with respect to pricing, routes, frequent flyer programs, scheduling, capacity, Customer Service, comfort and amenities, cost structure, aircraft fleet, and code-sharing and similar activities. The Company's future results will suffer if it does not effectively manage its expanded operations... -

Page 37

...the first item of checked luggage in violation of Section 1 of the Sherman Act. The initial complaint sought treble damages on behalf of a putative class of persons or entities in the United States who directly paid Delta and/or AirTran such fees on domestic flights beginning December 5, 2008. After... -

Page 38

... York on behalf of putative classes of consumers alleging collusion among the Company, American Airlines, Delta Air Lines, and United Airlines to limit capacity and maintain higher fares in violation of Section 1 of the Sherman Act. Since then, a number of similar class action complaints have been... -

Page 39

...affect the Company's financial results. See Note 1 to the Consolidated Financial Statements for further information. Item 1B. None. Item 2. Aircraft Southwest operated a total of 704 Boeing 737 aircraft as of December 31, 2015, of which 95 and 28 were under operating and capital leases, respectively... -

Page 40

...checkpoint, and an upgraded Southwest ticketing area. The Company controlled this expansion and related financial terms pursuant to an Airport Use and Lease Agreement with the City of Houston. Additional information regarding this project is provided below under "Management's Discussion and Analysis... -

Page 41

... Financial Statements. As of December 31, 2015, the Company operated seven Customer Support and Services call centers. The centers located in Atlanta, San Antonio, Chicago, Albuquerque, and Oklahoma City occupy leased space. The Company owns its Houston and Phoenix centers. The Company performs... -

Page 42

... York on behalf of putative classes of consumers alleging collusion among the Company, American Airlines, Delta Air Lines, and United Airlines to limit capacity and maintain higher fares in violation of Section 1 of the Sherman Act. Since then, a number of similar class action complaints have been... -

Page 43

... to May 2008, Senior Vice President Enterprise Spend Management from August 2004 to September 2006, Vice President Technology from 2002 to 2004, Vice President Purchasing from 2001 to 2002, Controller from 1997 to 2001, Director Revenue Accounting from 1994 to 1997, and Manager Sales Accounting from... -

Page 44

.... Thomas M. Nealon has served as the Company's Executive Vice President Strategy & Innovation since January 2016. Prior to becoming an executive officer of the Company, Mr. Nealon served on the Company's Board of Directors from December 2010 until November 2015. Mr. Nealon has also served as Group... -

Page 45

... II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities The Company's common stock is listed on the New York Stock Exchange ("NYSE") and is traded under the symbol "LUV." The following table shows the high and low prices per share of... -

Page 46

...stock price performance. COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN AMONG SOUTHWEST AIRLINES CO., S&P 500 INDEX, AND NYSE ARCA AIRLINE INDEX 400 350 Total Cumulative Return - Dollars 300 250 200 150 100 50 0 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 Period Ending Southwest Airlines... -

Page 47

...common stock to the Company. In total, the average purchase price per share for the 12,892,204 shares repurchased under the Third Quarter ASR Program, upon completion of the Third Quarter ASR Program in November 2015, was $38.78. Item 6. Selected Financial Data The following financial information... -

Page 48

... to as "capacity," which is a measure of the space available to carry passengers in a given period. (4) Revenue passenger miles divided by available seat miles. (5) Seats flown is calculated using total number of seats available by aircraft type multiplied by the total trips flown by the same... -

Page 49

...Additional information regarding this special item is provided in the Note Regarding Use of Non-GAAP Financial Measures and a reconciliation of revenue excluding special items related to accounting changes in the accompanying pages. (9) Calculated as passenger revenue divided by available seat miles... -

Page 50

Item 7. Operations Management's Discussion and Analysis of Financial Condition and Results of Reconciliation of Reported Amounts to Non-GAAP Financial Measures (unaudited) (in millions, except per share and per ASM amounts) Year ended December 31, 2015 2014 $ 19,820 $ 18,605 (172) - $ 19,648 $ 18,... -

Page 51

... of tax. Return on Invested Capital (ROIC) (in millions) (unaudited) Year Ended Year Ended Year Ended December 31, 2015 December 31, 2014 December 31, 2013 Operating Income, as reported Deduct: Special revenue adjustment Add: Union contract bonuses Add (Deduct): Net impact from fuel contracts Add... -

Page 52

... of items that the Company believes are not indicative of its ongoing operations. These include a one-time Special revenue adjustment due to the July 2015 amended co-branded credit card agreement (the "Agreement") with Chase Bank USA, N.A. ("Chase") and the resulting change in accounting methodology... -

Page 53

.... For the twelve months ended December 31, 2015, the Company's exceptional earnings performance, combined with its actions to prudently manage invested capital, produced a 32.7 percent pre-tax Return on invested capital, excluding special items ("ROIC"). This represented a significant increase 45 -

Page 54

... most robust schedule ever offered at Dallas Love Field, with 180 daily departures to 50 nonstop destinations. The Company connected Central America to the Company's network with the addition of Liberia, Costa Rica; San Jose, Costa Rica; and Belize City, Belize in 2015. The Company began service to... -

Page 55

... aircraft. Additional information regarding the Company's aircraft delivery schedule is included in Note 4 to the Consolidated Financial Statements. During 2015, the following events took place regarding the Company's unionized Employee groups in contract negotiations: • Dispatchers, represented... -

Page 56

... EarlyBird Check-in® and A1-15 select boarding positions sold at the gate, which was partially offset by the decrease in revenues from the termination of AirTran passenger service and related ancillary fees. While some yield softness has continued into January, demand for low-fare air travel, thus... -

Page 57

... Company expects its first quarter 2016 unit costs, excluding fuel, special items, and profitsharing to increase approximately two percent, compared with first quarter 2015. See the previous Note Regarding Use of Non-GAAP Financial Measures. Salaries, wages, and benefits expense for 2015 increased... -

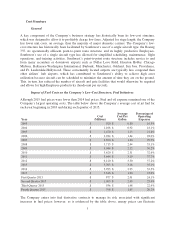

Page 58

...hedge accounting, both the dollar and per ASM decreases were attributable to lower jet fuel prices. The Company's average economic jet fuel price per gallon decreased 29.1 percent year-over-year, from $2.92 for 2014 to $2.07 for 2015. The Company also slightly improved fuel efficiency, when measured... -

Page 59

... in AOCI at December 31, 2015 (net of tax) $ (618) (409) (21) (1,048) Year 2016 2017 2018 Total $ $ Based on forward market prices and the amounts in the above table (and excluding any other subsequent changes to the fuel hedge portfolio), the Company's jet fuel costs per gallon could exceed... -

Page 60

...On a dollar basis, the majority of the increase was due to the purchase and capital lease of new and used aircraft since 2014, the majority of which replaced B717s removed from service in late 2014. The Company currently expects Depreciation and amortization expense per ASM for first quarter 2016 to... -

Page 61

... 2015 decreased 4.8 percent, compared with 2014, as the dollar increases were more than offset by the 7.2 percent increase in capacity. On a dollar basis, the increase was equally attributable to higher personnel expenses associated with travel costs of the Company's flight crew and credit card fees... -

Page 62

... Financial Measures (unaudited) (in millions, except per share and per ASM amounts) Year ended December 31, 2014 2013 Fuel and oil expense, unhedged Add (Deduct): Fuel hedge (gains) losses included in Fuel and oil expense Fuel and oil expense, as reported Deduct: Net impact from fuel contracts Fuel... -

Page 63

... presents the Company's Operating expenses per ASM for 2014 and 2013, followed by explanations of these changes on a per ASM basis and/or on a dollar basis: (in cents, except for percentages) Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Aircraft rentals Landing fees... -

Page 64

...and oil expense for 2014 decreased 8.6 percent, compared with 2013. Excluding the impact of fuel hedge accounting, both the dollar and per ASM decreases were primarily attributable to lower jet fuel prices. The Company's average economic jet fuel price per gallon decreased 6.4 percent year-over-year... -

Page 65

... of maintenance agreement contract rate increases, and the remainder of the increase was due to individually insignificant items. Other Other (gains) losses, net, primarily includes amounts recorded as a result of the Company's hedging activities. See Note 10 to the Consolidated Financial Statements... -

Page 66

... fund stock repurchases, pay dividends, and provide working capital. Net cash used in investing activities for 2015, 2014, and 2013 was $1.9 billion, $1.7 billion, and $1.4 billion, respectively. Investing activities in 2015, 2014, and 2013 included payments for new aircraft delivered to the Company... -

Page 67

... on flight equipment purchase contracts in the Consolidated Balance Sheet until the aircraft is delivered, at which time deposits previously made are deducted from the final purchase price of the aircraft and are reclassified as Flight equipment. See Note 4 to the Consolidated Financial Statements... -

Page 68

... collateral related to its fuel hedging positions. Although the letters of credit are off-balance sheet, the majority of the obligations to which they relate are reflected as liabilities in the Consolidated Balance Sheet. Outstanding letters of credit totaled $184 million at December 31, 2015. The... -

Page 69

... other sources of funds the City of Dallas may apply to the repayment of the bonds (including but not limited to passenger facility charges collected from passengers originating from the airport); and (ii) a "Revenue Credit Agreement" pursuant to which the City of Dallas will reimburse the Company... -

Page 70

... City of Houston ("City") entered into an Airport Use and Lease Agreement ("Lease") to control the execution of this expansion and the financial terms thereof. The project cost approximately $156 million, and the Company provided the funding for, and management of the project. In return, the Company... -

Page 71

... on seasonal travel patterns, fare sale activity, and activity associated with the Company's frequent flyer program. For air travel on Southwest, the amount of tickets that will expire unused are estimated and recognized in Passenger revenue once the scheduled flight date has passed. Estimating the... -

Page 72

... regulations on aging aircraft, and changing market prices of new and used aircraft of the same or similar types. The Company evaluates its estimates and assumptions each reporting period and, when warranted, adjusts these estimates and assumptions. Generally, these adjustments are accounted for on... -

Page 73

... to manage its risk associated with changing jet fuel prices. See "Quantitative and Qualitative Disclosures about Market Risk" for more information on these risk management activities, and see Note 10 to the Consolidated Financial Statements for more information on the Company's fuel hedging program... -

Page 74

...fuel price volatility. The discontinuation of hedge accounting for specific hedges and for specific refined products, such as unleaded gasoline, can also be a result of these factors. Depending on the level at which the Company is hedged at any point in time, as the fair value of the Company's hedge... -

Page 75

...2015, 2014, and 2013, and has not changed for either assessing or measuring hedge ineffectiveness during these periods. The Company believes it is unlikely that materially different estimates for the fair value of financial derivative instruments and forward jet fuel prices would be made or reported... -

Page 76

... activity during a 24-month time period. In addition, Southwest co-branded Chase Visa credit card holders are able to redeem their points for items other than travel on Southwest Airlines, such as international flights on other airlines, cruises, hotel stays, rental cars, gift cards, event tickets... -

Page 77

... or not the customer has a co-branded credit card. During fourth quarter 2014, the Company obtained sufficient historical behavioral data to develop a predictive statistical model to analyze the amount of spoilage expected for points sold to business partners, which indicated an increase in the... -

Page 78

... economic useful lives. Goodwill and indefinite-lived intangible assets are not amortized, but tested for impairment annually, as of October 1st, or more frequently if events or circumstances indicate that impairment may exist. The Company applies a fair value based impairment test to the carrying... -

Page 79

...represented a hedge for a portion of its anticipated jet fuel purchases for each year from 2016 through 2018. See Note 10 to the Consolidated Financial Statements for further information. The Company may increase or decrease the size of its fuel hedge based on its expectation of future market prices... -

Page 80

... example, if market prices for the commodities used in the Company's fuel hedging activities were to decrease by 25 percent from market prices as of December 31, 2015, given the Company's fuel derivative portfolio, its aircraft collateral facilities, and its investment grade credit rating, it would... -

Page 81

...the governance structure that it has in place is adequate given the size and sophistication of its hedging program. Financial Market Risk The vast majority of the Company's tangible assets are aircraft, which are long-lived. The Company's strategy is to maintain a conservative balance sheet and grow... -

Page 82

...which totaled $1.5 billion at December 31, 2015. See Notes 1 and 11 to the Consolidated Financial Statements for further information. The Company currently invests available cash in certificates of deposit, highly rated money market instruments, investment grade commercial paper, treasury securities... -

Page 83

...fuel hedge counterparties because it had additional room available under its existing aircraft collateral facilities. The Company currently has agreements with organizations that process credit card transactions arising from purchases of air travel tickets by its Customers utilizing American Express... -

Page 84

Item 8. Financial Statements and Supplementary Data Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2015 December 31, 2014 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and... -

Page 85

... Statement of Income (in millions, except per share amounts) Year ended December 31, 2015 OPERATING REVENUES: Passenger Freight Special revenue adjustment Other Total operating revenues OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Aircraft rentals... -

Page 86

Southwest Airlines Co. Consolidated Statement of Comprehensive Income (in millions) Year ended December 31, 2015 NET INCOME Unrealized gain (loss) on fuel derivative instruments, net of deferred taxes of ($181), ($430), and $31 Unrealized gain on interest rate derivative instruments, net of ... -

Page 87

Southwest Airlines Co. Consolidated Statement of Stockholders' Equity (in millions, except per share amounts) Year ended December 31, 2015, 2014, and 2013 Capital in excess of par value Accumulated other comprehensive income (loss) Common Stock Retained earnings Treasury stock Total Balance at... -

Page 88

... 2015 2014 2013 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to cash provided by operating activities: Depreciation and amortization Unrealized (gain) loss on fuel derivative instruments Deferred income taxes Changes in certain assets and liabilities: Accounts... -

Page 89

... market funds, and investment grade commercial paper issued by major corporations and financial institutions. Cash and cash equivalents are stated at cost, which approximates fair value. As of December 31, 2015, $835 million in cash collateral deposits were provided by the Company to its fuel hedge... -

Page 90

... consist of amounts due from credit card companies associated with sales of tickets for future travel, and amounts due from business partners in the Company's frequent flyer program. The allowance for doubtful accounts was immaterial at December 31, 2015 and 2014. In addition, the provision for... -

Page 91

...lives for each aircraft and its related parts. The impact of this change on the year ended December 31, 2015 was immaterial. The impact of this change in estimate in 2016 is an approximate $89 million increase to Depreciation and amortization expense. The Company evaluates its long-lived assets used... -

Page 92

... Balance Sheet, as of December 31, 2015 and 2014: Year ended December 31, 2015 Year ended December 31, 2014 (in millions) Customer relationships/ marketing agreements Trademarks/trade names Owned domestic slots Leased domestic slots (b) Gate leasehold rights (a) Total Weightedaverage useful... -

Page 93

... from the sale of frequent flyer points that related to free travel and these amounts were deferred and recognized as Passenger revenue when the ultimate free travel awards are flown. On July 1, 2015, the Company executed an amended co-branded credit card agreement ("Agreement") with Chase Bank USA... -

Page 94

...of the accounting change is that the Company estimated the selling prices and volumes over the term of the Agreement in order to determine the allocation of proceeds to each of the deliverables (travel points to be awarded; use of the Southwest Airlines' brand and access to Rapid Reward Member lists... -

Page 95

... to reduce the risk of its exposure to jet fuel price increases. These instruments consist primarily of purchased call options, collar structures, call spreads, put spreads, and fixed price swap agreements, and upon proper qualification are accounted for as cash-flow hedges. The Company also has... -

Page 96

... counterparties, the type of investment, and the amount invested in any individual security or money market fund. To manage risk associated with financial derivative instruments held, the Company selects and will periodically review counterparties based on credit ratings, limits its exposure to... -

Page 97

... cost method for frequent flyer accounting, which will require the Company to re-value its liability earned by Customers associated with flight points with a relative fair value approach, resulting in a significant increase in the liability. The Company is continuing to evaluate the new guidance... -

Page 98

...per share amounts): Year ended December 31, 2015 2014 2013 NUMERATOR: Net income Incremental income effect of interest on 5.25% convertible notes Net income after assumed conversion DENOMINATOR: Weighted-average shares outstanding, basic Dilutive effect of Employee stock options and restricted stock... -

Page 99

...to its delivery schedule. A total of six additional options were added to the schedule as well. As of December 31, 2015, the Company had firm deliveries and options for Boeing 737-700, 737-800, 737 MAX 7, and 737 MAX 8 aircraft as follows: The Boeing Company 737 NG -800 Firm Orders Options 2016 2017... -

Page 100

...") with the City of Houston ("City"), effective June 2012, to expand the existing Houston Hobby airport facility. As provided in the MOA, the Company and the City entered into an Airport Use and Lease Agreement ("Lease") to control the execution of this expansion and the financial terms thereof. Per... -

Page 101

... their estimated useful lives. The amount of depreciation recorded for the year ended December 31, 2015, associated with the LFMP assets in service was $36 million. The corresponding LFMP liabilities are being reduced primarily through the Company's airport rental payments to the City of Dallas as... -

Page 102

... with various union contract groups during 2015, the Company has recorded a liability for estimated bonuses that would be paid out to union members upon ratification of labor agreements. The liability excludes certain immaterial benefit costs that are included as a component of Accounts payable. The... -

Page 103

... interest rate swap agreements which expire between 2016 and 2020. As of December 31, 2015, three Boeing 737 aircraft were financed under a fixed-rate facility. Each note is secured by a first mortgage on the aircraft to which it relates. As of December 31, 2015, the weighted average interest rate... -

Page 104

... was effectively separated and accounted for as a free-standing derivative. A fair value calculation, utilizing similar market yields and the Company's common stock price, was performed for the debt with and without the equity to measure the equity component. The value allocated to the conversion... -

Page 105

... certificates are due semi-annually until the balance of the certificates mature on August 1, 2022. Prior to their issuance, the Company also entered into swap agreements to hedge the variability in interest rates on the Pass Through Certificates. The swap agreements were accounted for as cash flow... -

Page 106

... majority of the obligations to which they relate are reflected as liabilities in the Consolidated Balance Sheet. Outstanding letters of credit totaled $184 million at December 31, 2015. The net book value of the assets pledged as collateral for the Company's secured borrowings, primarily aircraft... -

Page 107

... have purchase options at or near the end of the lease term at fair market value, generally limited to a stated percentage of the lessor's defined cost of the aircraft. On July 9, 2012, the Company signed an agreement with Delta Air Lines, Inc. and Boeing Capital Corp. to lease or sublease all 88... -

Page 108

... are on capital lease. The Company paid the majority of the costs to convert the aircraft to the Delta livery and perform certain maintenance checks prior to the delivery of each aircraft. The agreement to pay these conversion and maintenance costs is a "lease incentive" under applicable accounting... -

Page 109

...) through various share-based compensation arrangements. See Note 9 to the Consolidated Financial Statements for information regarding the Company's equity plans. 9. STOCK PLANS Share-based Compensation The Company accounts for share-based compensation utilizing fair value, which is determined... -

Page 110

... in 2015, approximately 36 thousand shares at a weighted average grant price of $24.91 in 2014, and approximately 63 thousand shares at a weighted average grant price of $14.34 in 2013, to members of its Board of Directors. A remaining balance of up to 23 million shares of the Company's common stock... -

Page 111

...sold put option), and fixed price swap agreements in its portfolio. Although the use of collar structures and swap agreements can reduce the overall cost of hedging, these instruments carry more risk than purchased call options in that the Company could end up in a liability position when the collar... -

Page 112

... price levels of those contracts, these volumes represent the maximum economic hedge in place and may vary significantly as market prices fluctuate. Upon proper qualification, the Company accounts for its fuel derivative instruments as cash flow hedges. Generally, utilizing hedge accounting... -

Page 113

... half 2015, dictated that WTI crude oil based derivatives again qualified for hedge accounting. Ineffectiveness is inherent in hedging jet fuel with derivative positions based in other crude oil related commodities. Due to the volatility in markets for crude oil and related products, the Company is... -

Page 114

... within the Consolidated Balance Sheet: Asset derivatives Balance Sheet location Fair value at 12/31/2015 Fair value at 12/31/2014 Liability derivatives Fair value at 12/31/2015 Fair value at 12/31/2014 (in millions) Derivatives designated as hedges* Fuel derivative contracts Prepaid expenses and... -

Page 115

... fuel contracts Balance Sheet location Offset against Accrued liabilities Offset against Other noncurrent liabilities Accrued liabilities $ December 31, 2015 235 600 46 $ December 31, 2014 68 198 16 All of the Company's fuel derivative instruments and interest rate swaps are subject to agreements... -

Page 116

...(ii) December 31, 2015 Net amounts of liabilities Gross amounts presented in the offset in the Balance Sheet Balance Sheet (a) (i) (ii) (iii) = (i) + (ii) December 31, 2014 Balance Sheet Description location Fuel derivative contracts Fuel derivative contracts Fuel derivative contracts Interest rate... -

Page 117

...recorded expense associated with premiums paid for fuel derivative contracts that settled/expired during 2015, 2014, and 2013 of $124 million, $62 million, and $60 million, respectively. These amounts are excluded from the Company's measurement of effectiveness for related hedges and are included as... -

Page 118

... of Other assets. The corresponding adjustment related to the net asset associated with the Company's fair value hedges is to the carrying value of the long-term debt. Agreements totaling a net liability of $49 million are fair value hedges and cash flow hedges and are classified as a component of... -

Page 119

... position of the fuel hedging program and its relative market position with each counterparty. At December 31, 2015, the Company had agreements with all of its active counterparties containing early termination rights and/or bilateral collateral provisions whereby security is required if market risk... -

Page 120

...provided at 100 percent of fair value of fuel derivative contracts. (c) Thresholds may vary based on changes in credit ratings within investment grade. (d) The Company has the option of providing cash, letters of credit, or pledging aircraft as collateral. (e) The Company has the option of providing... -

Page 121

... information available for the types of derivative contracts it holds. Included in Other available-for-sale securities are the Company's investments associated with its excess benefit plan which consist of mutual funds that are publicly traded and for which market prices are readily available... -

Page 122

... the Company's earnings. The following tables present the Company's assets and liabilities that are measured at fair value on a recurring basis at December 31, 2015, and December 31, 2014: Fair value measurements at reporting date using: Quoted prices in Significant Significant active markets other... -

Page 123

... Short-term investments: Treasury bills Certificates of deposit Interest rate derivatives (see Note 10) Fuel derivatives: Swap contracts (b) Option contracts (b) Other available-for-sale securities Total assets Liabilities Fuel derivatives: Swap contracts (b) Option contracts (b) Interest rate... -

Page 124

... 2014. The following tables present the Company's activity for items measured at fair value on a recurring basis using significant unobservable inputs (Level 3) for 2015 and 2014: Fair value measurements using significant unobservable inputs (Level 3) (in millions) Balance at December 31, 2014 Total... -

Page 125

... inputs used to determine the fair value of these agreements are unobservable. The Company utilizes indicative pricing from counterparties and a discounted cash flow method to estimate the fair value of the Level 3 items. (in millions) Carrying value Estimated fair Fair value level value hierarchy... -

Page 126

... (LOSS) Comprehensive income includes changes in the fair value of certain financial derivative instruments that qualify for hedge accounting, unrealized gains and losses on certain investments, and actuarial gains/losses arising from the Company's postretirement benefit obligation. A rollforward of... -

Page 127

... plans to the accrued postretirement benefit cost recognized in Other non-current liabilities on the Company's Consolidated Balance Sheet at December 31, 2015 and 2014. (in millions) Funded status Unrecognized net actuarial gain Unrecognized prior service cost Accumulated other comprehensive income... -

Page 128

... method. The following actuarial assumptions were used to account for the Company's postretirement benefit plans at December 31, 2015, 2014, and 2013: 2015 Weighted-average discount rate Assumed healthcare cost trend rate (1) 4.50% 7.08% 2014 4.10% 6.88% 2013 5.05% 7.50% (1) The assumed healthcare... -

Page 129

... deferred tax liabilities DEFERRED TAX ASSETS: Fuel derivative instruments Capital and operating leases Construction obligation Accrued engine maintenance Accrued employee benefits State taxes Business partner income Other Total deferred tax assets Net deferred tax liability $ $ 2015 4,429 62 4,491... -

Page 130

... rates Nondeductible items State income taxes, net of federal benefit Other, net Total income tax provision $ 2015 1,218 15 66 (1) 1,298 $ 2014 636 9 37 (2) 680 $ 2013 423 10 25 (3) 455 $ $ $ The only periods subject to examination for the Company's federal tax return are the 2014 and 2015 tax... -

Page 131

...three years in the period ended December 31, 2015, in conformity with U.S. generally accepted accounting principles. As discussed in Note 1 to the consolidated financial statements, the Company has changed its method of accounting for its co-brand credit card agreement to apply the amendments to the... -

Page 132

... Registered Public Accounting Firm The Board of Directors and Shareholders Southwest Airlines Co. We have audited Southwest Airlines Co.'s internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control-Integrated Framework issued by the... -

Page 133

... Item 9. None. Item 9A. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure Controls and Procedures Evaluation of Disclosure Controls and Procedures. The Company maintains disclosure controls and procedures (as defined in Rule 13a-15(e) of the Securities Exchange... -

Page 134

... this evaluation, the Company's Chief Executive Officer and Chief Financial Officer have concluded that the Company's disclosure controls and procedures were effective as of December 31, 2015, at the reasonable assurance level. Management's Annual Report on Internal Control over Financial Reporting... -

Page 135

... headings "Compensation of Executive Officers" and "Compensation of Directors" in the Proxy Statement for the Company's 2016 Annual Meeting of Shareholders and is incorporated herein by reference. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters... -

Page 136

... heading "Certain Relationships and Related Transactions, and Director Independence" in the Proxy Statement for the Company's 2016 Annual Meeting of Shareholders and is incorporated herein by reference. Item 14. Principal Accounting Fees and Services The information required by this Item 14 will be... -

Page 137

... Statements: The financial statements included in Item 8. Financial Statements and Supplementary Data above are filed as part of this annual report. 2. Financial Statement Schedules: There are no financial statement schedules filed as part of this annual report, since the required information... -

Page 138

... Southwest's Annual Report on Form 10-K for the year ended December 31, 2007 (File No. 1-7259)); Supplemental Agreements Nos. 57, 58, and 59 (incorporated by reference to Exhibits 10.1, 10.2, and 10.3, respectively, to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2008... -

Page 139

...Annual Report on Form 10-K for the year ended December 31, 2014 (File No. 1-7259)); Supplemental Agreement No. 91 (incorporated by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10Q for the quarter ended June 30, 2015 (File No. 1-7259)); Supplemental Letter Agreement No. 1810-LA... -

Page 140

... Plan Executive Employment Agreement between the Company and certain Officers of the Company (incorporated by reference to Exhibit 10.2 to the Company's Annual Report on Form 10-K for the year ended December 31, 2008 (File No. 1-7259)). (2) Southwest Airlines Co. 1996 Incentive Stock Option... -

Page 141

...January 30, 2013 (File No. 1-7259)). (2) Southwest Airlines Co. Deferred Compensation Plan for Senior Leadership and NonEmployee Members of the Southwest Airlines Co. Board of Directors (incorporated by reference to Exhibit 99.1 to the Company's Current Report on Form 8-K filed May 19, 2014 (File No... -

Page 142

...be deemed incorporated by reference into any filing, in accordance with Item 601 of Regulation S-K. A copy of each exhibit may be obtained at a price of 15 cents per page, $10.00 minimum order, by writing to: Investor Relations, Southwest Airlines Co., P.O. Box 36611, Dallas, Texas 75235-1611. 134 -

Page 143

.... SOUTHWEST AIRLINES CO. February 2, 2016 By /s/ Tammy Romo Tammy Romo Executive Vice President & Chief Financial Officer (On behalf of the Registrant and in her capacity as Principal Financial & Accounting Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has... -

Page 144

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 145

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 146

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 147

... Board, President, and Chief Executive Officer Southwest Airlines Co. Executive Committee (Chair) GRACE D. LIEBLEIN Former Vice President, Global Quality General Motors Corporation (automobile company) NANCY B. LOEFFLER Consultant for Frost Bank and member of the Frost Bank Advisory Board Long-time... -

Page 148

... INFORMATION SOUTHWEST AIRLINES CO. GENERAL OFFICES P.O. Box 36611 2702 Love Field Drive Dallas, TX 75235 Telephone: 214-792-4000 FINANCIAL INFORMATION A copy of the Company's Annual Report on Form 10-K, as filed with the U.S. Securities and Exchange Commission, is included herein. Other financial...