Southwest Airlines 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

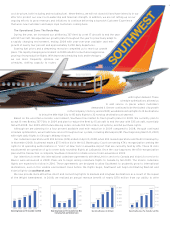

Southwest entered 2008 with a strong fuel hedging program, which served the airline

well while jet fuel prices uctuated wildly from $90 per barrel at the beginning of the year to

a summer spike of nearly $150 per barrel before collapsing to $35 per barrel in December.

We had a hedging position with over 70 percent of our jet fuel needs protected at an average

price of approximately $51 per barrel for most of 2008, which resulted in $1.3 billion cash

settlement gains for 2008. Since 1999, we have received nearly $4.5 billion in cash settlement

gains from our fuel hedging program. As a result of the rapid collapse in energy prices during

fourth quarter 2008, we effectively reduced our net fuel hedge position to approximately

ten percent of our anticipated fuel consumption in each year from 2009 through 2013. Based

on current market prices for energy and our 2009 portfolio (as of February 2, 2009), we

estimate our economic fuel costs per gallon, including fuel taxes, to be under $1.90 for full

year 2009, which would represent a decline of approximately $600 million from our 2008

fuel costs that included signicant cash proceeds from our fuel hedging program.

In addition to the productivity improvements and the savings from our fuel hedging

program, we continue to focus our efforts on several innovative projects to reduce fuel

consumption, including jet engine washing, use of Gate Services or portable electric ground

power for aircraft, use of blended winglets on our Boeing 737-300 and -700 aircraft, and

disciplined adherence to planned cruise levels and efcient airspeeds. Work also continues

to install RNP/RNAV technology in our eet, which will allow for more efcient ight plans

and reduced fuel burn and carbon emissions. These efforts substantially reduce our costs

and demonstrate our dedication to our environment.

Although economic times are difficult, we believe Southwest remains the best

positioned airline in America with a strong balance sheet and investment-grade credit

rating. Despite an unprecedented worldwide credit crisis, we were able to boost our

liquidity by $1.1 billion during the fourth quarter of 2008 through several financing

transactions. We accessed $400 million under our available $600 million revolving

credit facility, borrowed $400 million under a new term loan, and borrowed $91 million

under a new line of credit secured by a portion of our auction rate securities. In addition,

we entered into a two-tranche sale and leaseback transaction for ten of our Boeing 737-700

aircraft. The rst ve aircraft tranche closed in December 2008 for a total of $173 million.

At yearend, we had $1.8 billion in cash, including short-term investments and the

remaining fully available unsecured revolving credit line of $200 million. In

January 2009, we raised an additional $173 million in cash

upon the closing of the second tranche of our sale and

leaseback transaction for an additional ve of our 737-700

aircraft. At December 31, 2008, our unmortgaged aircraft

had an estimated market value in the $8 to $9 billion range,

and our debt to total capital was approximately 45 percent,

including off-balance sheet aircraft leases as debt.

Although we are experiencing inationary pressures in

virtually all cost categories, especially maintenance; airport

costs; and salaries, wages, and benets, we still retain a

signicant advantage over our legacy competitors with our

A billboard depicting Chicago’s new

State Bird trumpeted the latest addition to our

Flagship Fleet,

Illinois One

.

A high-ying tribute to the Land of Lincoln,

a patriotic

Illinois One

was unveiled

April 14, 2008, at Chicago Midway Airport.

SOUTHWEST AIRLINES CO. ANNUAL REPORT 2008

8