Southwest Airlines 2005 Annual Report Download - page 1

Download and view the complete annual report

Please find page 1 of the 2005 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13.2%

48.0%

2.3

pts.

75.1%

2.4

pts.

75.0%

76.3%

20.8%

3.1

pts.

19.0%

9.6%

12.7%

10.8%

1.2

pts.

2.8%

4.7%

2.2%

6.7%

Operating expenses

Operating income

Operating margin

Net income

Net margin

Net income per share – basic

Net income per share – diluted

Stockholders’ equity

Revenue passengers carried

Revenue passenger miles {RPMs} (000s)

Available seat miles {ASMs} (000s)

Passenger load factor

Passenger revenue yield per RPM

Operating revenue yield per ASM

Operating expenses per ASM

Size of fleet at yearend

2.3 %

Number of Employees at yearend

Stockholders’ equity per common share outstanding

Return on average stockholders’ equity

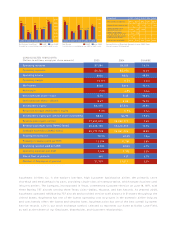

CONSOLIDATED HIGHLIGHTS

Operating revenues

16.1%

CHANGE

(Dollars in millions, except per share amounts)

$6 ,7 64

$ 8 2 0

1 0 . 8 %

$ 5 4 8

7. 2%

$.70

$. 67

$ 6 , 6 7 5

9 . 0 %

$8.32

77,693,875

60,223,100

85,172,795

70.7%

12.09¢

8.9 0 ¢

7.94¢

445

3 1, 7 2 9

$7,584

2005

$5 ,9 76

$ 5 5 4

8 . 5 %

$ 3 1 3

4. 8%

$.40

$. 38

$ 5 , 5 2 4

5 . 9 %

$6.99

7 0 , 9 0 2 , 7 7 3

5 3 , 4 1 8 , 3 5 3

7 6 , 8 6 1 , 2 9 6

69.5%

11.76¢

8.5 0 ¢

7.77¢

417

3 1, 0 11

$6,530

2004

Southwest Airlines Co. is the nation’s low-fare, high Customer Satisfaction airline. We primarily serve

shorthaul and mediumhaul city pairs, providing single-class air transportation, which targets business and

leisure travelers. The Company, incorporated in Texas, commenced Customer Service on June 18, 1971, with

three Boeing 737 aircraft serving three Texas cities—Dallas, Houston, and San Antonio. At yearend 2005,

Southwest operated 445 Boeing 737 aircraft and provided service to 61 airports in 31 states throughout the

United States. Southwest has one of the lowest operating cost structures in the domestic airline industry

and consistently offers the lowest and simplest fares. Southwest also has one of the best overall Customer

Service records. LUV is our stock exchange symbol, selected to represent our home at Dallas Love Field,

as well as the theme of our Employee, Shareholder, and Customer relationships.

2001 2002 2003 2004 2005

$600

$500

$400

$300

$200

$100

$511

$414

$241

$191

$442

$296 $313 $324

$548

$489

Net Margin

2001 2002 2003 2004 2005

GAAP

10%

8%

6%

4%

2%

9.2%

7.5%

4.4%

3.5%

7.4%

5.0% 4.8% 5.0%

7.2%

6.4%

non-GAAP

See table for a reconciliation of non-GAAP to GAAP results.

Net Income (in millions) GAAP non-GAAP

See table for a reconciliation of non-GAAP to GAAP results.

Reconciliation of Reported Amounts to non-GAAP Items

(See note on page 15.) (unaudited)

$511

16

10

$241 $442

11

$313

1 (7) (2)

(144)

(25)

(124) -

-

(18) -

Impact of fuel contracts, net

Net Income, as reported

(in millions)

Impact of government

grant proceeds, net

Impact of passenger

revenue adjustments, net

Impact of charges arising

from terrorist attacks

$414 $324

(59)

$548

-

-

--- -

$489$191 $296

Net income – non-GAAP

2001 2002 2003 2004 2005