Southwest Airlines 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13.2%

48.0%

2.3

pts.

75.1%

2.4

pts.

75.0%

76.3%

20.8%

3.1

pts.

19.0%

9.6%

12.7%

10.8%

1.2

pts.

2.8%

4.7%

2.2%

6.7%

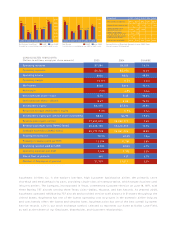

Operating expenses

Operating income

Operating margin

Net income

Net margin

Net income per share – basic

Net income per share – diluted

Stockholders’ equity

Revenue passengers carried

Revenue passenger miles {RPMs} (000s)

Available seat miles {ASMs} (000s)

Passenger load factor

Passenger revenue yield per RPM

Operating revenue yield per ASM

Operating expenses per ASM

Size of fleet at yearend

2.3 %

Number of Employees at yearend

Stockholders’ equity per common share outstanding

Return on average stockholders’ equity

CONSOLIDATED HIGHLIGHTS

Operating revenues

16.1%

CHANGE

(Dollars in millions, except per share amounts)

$6 ,7 64

$ 8 2 0

1 0 . 8 %

$ 5 4 8

7. 2%

$.70

$. 67

$ 6 , 6 7 5

9 . 0 %

$8.32

77,693,875

60,223,100

85,172,795

70.7%

12.09¢

8.9 0 ¢

7.94¢

445

3 1, 7 2 9

$7,584

2005

$5 ,9 76

$ 5 5 4

8 . 5 %

$ 3 1 3

4. 8%

$.40

$. 38

$ 5 , 5 2 4

5 . 9 %

$6.99

7 0 , 9 0 2 , 7 7 3

5 3 , 4 1 8 , 3 5 3

7 6 , 8 6 1 , 2 9 6

69.5%

11.76¢

8.5 0 ¢

7.77¢

417

3 1, 0 11

$6,530

2004

Southwest Airlines Co. is the nation’s low-fare, high Customer Satisfaction airline. We primarily serve

shorthaul and mediumhaul city pairs, providing single-class air transportation, which targets business and

leisure travelers. The Company, incorporated in Texas, commenced Customer Service on June 18, 1971, with

three Boeing 737 aircraft serving three Texas cities—Dallas, Houston, and San Antonio. At yearend 2005,

Southwest operated 445 Boeing 737 aircraft and provided service to 61 airports in 31 states throughout the

United States. Southwest has one of the lowest operating cost structures in the domestic airline industry

and consistently offers the lowest and simplest fares. Southwest also has one of the best overall Customer

Service records. LUV is our stock exchange symbol, selected to represent our home at Dallas Love Field,

as well as the theme of our Employee, Shareholder, and Customer relationships.

2001 2002 2003 2004 2005

$600

$500

$400

$300

$200

$100

$511

$414

$241

$191

$442

$296 $313 $324

$548

$489

Net Margin

2001 2002 2003 2004 2005

GAAP

10%

8%

6%

4%

2%

9.2%

7.5%

4.4%

3.5%

7.4%

5.0% 4.8% 5.0%

7.2%

6.4%

non-GAAP

See table for a reconciliation of non-GAAP to GAAP results.

Net Income (in millions) GAAP non-GAAP

See table for a reconciliation of non-GAAP to GAAP results.

Reconciliation of Reported Amounts to non-GAAP Items

(See note on page 15.) (unaudited)

$511

16

10

$241 $442

11

$313

1 (7) (2)

(144)

(25)

(124) -

-

(18) -

Impact of fuel contracts, net

Net Income, as reported

(in millions)

Impact of government

grant proceeds, net

Impact of passenger

revenue adjustments, net

Impact of charges arising

from terrorist attacks

$414 $324

(59)

$548

-

-

--- -

$489$191 $296

Net income – non-GAAP

2001 2002 2003 2004 2005

Table of contents

-

Page 1

... of the lowest operating cost structures in the domestic airline industry and consistently offers the lowest and simplest fares. Southwest also has one of the best overall Customer Service records. LUV is our stock exchange symbol, selected to represent our home at Dallas Love Field, as well as the... -

Page 2

... airline or one city. It is about helping our constituents. For a long time, I have thought the restrictions on Love Field have outlived their usefulness, and I think people ought to have the freedom to fly wherever they want and whenever they want." - U.S. Rep. Sam Johnson, The Dallas Morning News -

Page 3

... AIRLINES CO. ANNUAL REPORT 2005 In 2005, we brought out the rally caps. For Southwest's complete history at Dallas Love Field and the controversial Wright Amendment, log on to se tlovefree.com . To Our Shareholders: In 2005, Southwest Airlines recorded its 33rd consecutive year of profitability... -

Page 4

... in New Orleans. Rebuilding our service in New Orleans remains number one among competing priorities. We recently announced five more daily departures effective March 17 and coincident with the delivery of new Boeing 737 aircraft. For 2006, we presently plan to add 33 new Boeing 737s to our fleet of... -

Page 5

... deliver what they want-low fares, reliable service, frequent and convenient flights to great destinations, comfortable cabins, great inflight experience, top-rated frequent flyer program, hassle-free airports, and friendly Customer Service. As a result, Southwest earned the number-one ranking in... -

Page 6

...our passengers choose to conveniently check in using our easy self-service tools. Shopping for the best online deals can take a lot of unnecessary time. Southwest has always made it easy for travelers, with the Southwest Shortcut calendar for low fares, the weekly Click 'n' Save e-mail specials, and... -

Page 7

...-use web site, and now the southwest giftcard, travel on Southwest Airlines is the ideal gift. Rapid Rewards Not only do we offer our Customers convenient low fares, our Rapid Rewards Program is a generous and simple way for our frequent flyers to earn free travel. Members earn credits by flying or... -

Page 8

...with ATA, allowing Southwest passengers to book flights aboard ATA to such exciting destinations as Hawaii. Above, Southwest's famous Shamu One nuzzles up to a colorful Hawaii-bound ATA jet. highest productivity of any U.S. airline because of our high asset utilization and Employee proficiency. One... -

Page 9

... a history of serving close-in, conveniently located airports such as Baltimore/Washington, Chicago Midway, Dallas Love Field, Ft. Lauderdale/Hollywood, Houston Hobby, Manchester, Providence, and Oakland. However, we also have successful operations at larger airports such as Phoenix, Los Angeles, St... -

Page 10

SOUTHWEST AIRLINES CO. ANNUAL REPORT 2005 9 SlamDunk One, a soaring tribute to the historic partnership between the National Basketball Association (NBA) and its Official Airline (SWA). Unveiled on November 3, 2005, this was the first custom paint scheme to feature a Southwest marketing partner ... -

Page 11

... and feature attractive leather seats. Although we are low-cost, we invest in new planes and fly a young fleet with an average age of nine years. Southwest Airlines has always been devoted to each and every community that we serve. Thousands of times each year, Southwest Airlines and its Employees... -

Page 12

... Dallas Love Field to St. Louis and Kansas City in December 2005. We continued our efforts to expand Chicago Midway service during 2005, growing year-over-year capacity more than 40 percent. Chicago Midway is now tied with Phoenix Sky Harbor Airport as our second busiest airport at 200 daily flights... -

Page 13

... Las Vegas Burbank Ontario Albuquerque (Santa Fe Area) (Southern Virginia) Los Angeles (LAX) Orange County Tulsa Amarillo Oklahoma City Lubbock (Palm Springs Area) Little Rock Phoenix Tucson El Paso San Diego Birmingham (Love Field) Midland/ Odessa Dallas Jackson Jacksonville New Orleans... -

Page 14

... 136 86 . 1 11 .10 Commmon Stock Price Ranges and Dividends Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high, low, and close sales prices of the common stock on the Composite Tape and the quarterly dividends per share paid on the common... -

Page 15

... Size of fleet at yearend (1) (1) Includes leased aircraft (2) Includes effect of reclassification of revenue reported in 1999 through 1996 related to the sale of flight segment credits from Other to Passenger due to an accounting change in 2000 (3) Certain figures in 2001 and 2002 include special... -

Page 16

SOUTHWEST AIRLINES CO. ANNUAL REPORT 2005 ...Company's fuel hedging program that settle in future accounting periods, recorded as a result of SFAS 133, "Accounting for Derivative Instruments and Hedging Activities," as amended (2001, 2002, 2003, 2004, 2005). In management's view, comparative analysis... -

Page 17

16 SOUTHWEST AIRLINES CO. ANNUAL REPORT 2005 TRANSFER AGENT AND REGISTRAR Registered shareholder inquiries regarding stock transfers, address changes, lost stock certificates, dividend payments, or account consolidation should be directed to: Wells Fargo Shareowner Services 161 N. Concord Exchange... -

Page 18

... a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes n No ¥ The aggregate market value of the Common Stock held by non-affiliates of the registrant was approximately $10,876,320,000, computed by reference to the closing sale price of the stock on the New York Stock Exchange on June... -

Page 19

... Southwest Airlines Co. Consolidated Statement of Stockholders' Equity Southwest Airlines Co. Consolidated Statement of Cash Flows Notes To Consolidated Financial Statements Changes In and Disagreements With Accountants on Accounting and Financial Disclosure ÃÃÃÃ Controls and Procedures... -

Page 20

... aircraft serving three Texas cities Ì Dallas, Houston, and San Antonio. At year-end 2005, Southwest operated 445 Boeing 737 aircraft and provided service to 61 cities in 31 states throughout the United States. Based on monthly data for October 2005 (the latest available data), Southwest Airlines... -

Page 21

... Internet checkin and transfer boarding passes at the time of checkin. Environmental. Certain airports, including San Diego and Orange County, have established airport restrictions to limit noise, including restrictions on aircraft types to be used, and limits on the number of hourly or daily... -

Page 22

...'s Customers fly nonstop. In addition, Southwest serves many conveniently located secondary or downtown airports such as Dallas Love Field, Houston Hobby, Chicago Midway, Baltimore-Washington International, Burbank, Manchester, Oakland, San Jose, Providence, Ft. Lauderdale/Hollywood, and Long Island... -

Page 23

... through its Internet site, which has become a vital part of the Company's distribution strategy. The Company has not paid commissions to travel agents for sales since December 15, 2003. The airline industry is highly competitive as to fares, frequent flyer benefits, routes, and service, and some... -

Page 24

... as those earned by flying. Customers redeemed approximately 2.6 million, 2.5 million and 2.5 million Award Tickets and flights on Companion Passes during 2005, 2004, and 2003, respectively. The amount of free travel award usage as a percentage of total Southwest revenue passengers carried was... -

Page 25

... on Southwest's fuel hedging arrangements, see ""Management's Discussion and Analysis of Financial Condition and Results of Operations,'' and Note 10 to the Consolidated Financial Statements. Southwest's business is labor-intensive. Historically, the Company's relationships with its Employees have... -

Page 26

... its business, enhance Customer service, and increase Employee productivity, including the Company's computerized airline reservation system, flight operations systems, telecommunication systems, website, Automated Boarding Passes system, and the RAPID CHECK-IN self service kiosks. Any disruptions... -

Page 27

...Southwest leases terminal passenger service facilities at each of the airports it serves, to which it has added various leasehold improvements. The Company leases land on a long-term basis for its maintenance centers located at Dallas Love Field, Houston Hobby, Phoenix Sky Harbor, and Chicago Midway... -

Page 28

... to date by the IRS, individually or collectively, will have a material adverse effect on the Company's financial condition, results of operations, or cash flows. On December 8, 2005, Southwest Airlines Flight 1248 was involved in an accident at Chicago Midway Airport while the aircraft, a Boeing... -

Page 29

...Stock as follows: Number of Shares Purchased Exercise Price Date of Exercise Date of Option Grant Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high and low sales prices of the common stock on the Composite Tape and the quarterly dividends... -

Page 30

...dividends per common share ÃÃÃ Total assets at period-end Long-term obligations at period-end Stockholders' equity at period-end ÃÃÃ Operating Data: Revenue passengers carried Enplaned passengers Revenue passenger miles (RPMs) (000s Available seat miles (ASMs) (000s) Load factor(1 Average... -

Page 31

..., protective fuel hedging position, and excellent Employees will allow Southwest to continue to react quickly to market opportunities. The Company added Pittsburgh, Pennsylvania, and Fort Myers, Florida, to its route system in 2005, and continued to grow its Chicago Midway service. The Company has... -

Page 32

... modified its fee policy related to the weight of checked baggage during second quarter 2005. Among other changes, the limit at which baggage charges apply was reduced to 50 pounds per checked bag. The Company expects continued year-over-year increases in both freight and other revenues in first... -

Page 33

... including the effects of share-based compensation expense in the footnotes to the financial statements. See Note 1 to the Consolidated Financial Statements for these pro forma results related to years 2005, 2004, and 2003. As a result of this accounting change, the Company expects its first 14... -

Page 34

... engine components on many aircraft. The Company estimates that these and other efficiency gains saved the Company approximately $70 million during 2005, at average unhedged market jet fuel prices. As detailed in Note 10 to the Consolidated Financial Statements, the Company has hedges in place for... -

Page 35

... recognized approximately $24 million of expense related to amounts excluded from the Company's measurements of hedge effectiveness and $13 million in expense related to the ineffectiveness of its hedges and unrealized mark-to-market changes in the fair value of certain derivative contracts. Income... -

Page 36

... of the Company's operating performance for 2003, nor should they be considered in developing trend analysis for future periods. There were no special items in 2004. The following table reconciles and compares results reported in accordance with Generally Accepted Accounting Principles (GAAP... -

Page 37

... Total 7.77„ Operating expenses per ASM increased 2.2 percent to $.0777, primarily due to an increase in jet fuel prices, net of hedging gains, and an increase in salaries, wages, and benefits. These increases were partially offset by the Company's elimination of commissions paid to travel agents... -

Page 38

... air transportation for Customers. The vast majority of tickets are purchased prior to the day on which travel is provided and, in some cases, several months before the anticipated travel date. Operating cash outflows primarily are related to the recurring expenses of operating the airline. For 2005... -

Page 39

... $1.3 billion in public debt securities and pass through certificates, which it may utilize for aircraft financings or other purposes in the future. The Company may issue a portion of these securities in 2006, primarily to replace debt that is coming due and to fund current fleet growth plans. Off... -

Page 40

...applicable securities laws in the open market or in private transactions from time to time, depending on market conditions. This program was completed during first quarter 2005, resulting in the total repurchase of approximately 20.9 million of its common shares. In January 2006, the Company's Board... -

Page 41

..., for all unused tickets once the flight date has passed. These estimates are based on historical experience over many years. The Company and members of the airline industry have consistently applied this accounting method to estimate revenue from forfeited tickets at the date travel is provided... -

Page 42

..., Southwest has continued to operate all of its aircraft, generate positive cash flow, and produce profits. Consequently, the Company has not identified any impairments related to its existing aircraft fleet. The Company will continue to monitor its long-lived assets and the airline operating... -

Page 43

... change. Ineffectiveness is inherent in hedging jet fuel with derivative positions based in other crude oil-related commodities, especially considering the recent volatility in the prices of refined products. In addition, given the magnitude of the Company's fuel hedge portfolio total market value... -

Page 44

... rate debt obligations and interest rate swaps, and has commodity price risk in jet fuel required to operate its aircraft fleet. The Company purchases jet fuel at prevailing market prices, but seeks to manage market risk through execution of a documented hedging strategy. Southwest has market... -

Page 45

... with a positive fair value at the reporting date. To manage credit risk, the Company selects and will periodically review counterparties based on credit ratings, limits its exposure to a single counterparty, and monitors the market position of the program and its relative market position 26 with... -

Page 46

... Company invests available cash in certificates of deposit, highly rated money market instruments, investment grade commercial paper, auction rate securities, and other highly rated financial instruments. Because of the short-term nature of these investments, the returns earned parallel closely with... -

Page 47

... Data SOUTHWEST AIRLINES CO. CONSOLIDATED BALANCE SHEET December 31, 2005 2004 (In millions, except share data) ASSETS Current assets: Cash and cash equivalents 2,280 Short-term investments 251 Accounts and other receivables 258 Inventories of parts and supplies, at cost 150 Fuel hedge... -

Page 48

SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF INCOME Years Ended December 31, 2005 2004 2003 (In millions, except per share amounts) OPERATING REVENUES: Passenger 7,279 Freight 133 Other 172 Total operating revenues OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance... -

Page 49

SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY Years Ended December 31, 2005, 2004, and 2003 Accumulated Capital in Other Excess of Retained Comprehensive Treasury Par Value Earnings Income (Loss) Stock (In millions, except per share amounts) Common Stock Total Balance at ... -

Page 50

... Airlines, Inc Other Net cash used in investing activities 1,210) CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of long-term debt 300 Proceeds from Employee stock plans 132 Payments of long-term debt and capital lease obligations 149) Payments of cash dividends 14) Repurchase of common stock... -

Page 51

... are not limited to, significant decreases in the market value of the long-lived asset(s), a significant change in the long-lived asset's physical condition, 32 Basis Of Presentation. Southwest Airlines Co. (Southwest) is a major domestic airline that provides point-to-point, low-fare service. The... -

Page 52

... Company also sells frequent flyer credits and related services to companies participating in its Rapid Rewards frequent flyer program. Funds received from the sale of flight segment credits are accounted for under the residual value method. The portion of those funds associated with future travel... -

Page 53

...Employee stock options equal or exceed the market prices of the underlying stock on the dates of grant. Compensation expense for other stock options is not material. The following table represents the effect on net income and earnings per share if the Company had applied the fair value based method... -

Page 54

... method of accounting, and requires companies to recognize the cost of employee services received in exchange for awards of equity instruments, based on the grant date fair value of those awards, in the financial statements. Pro forma disclosure is no longer an alternative under the new standard... -

Page 55

SOUTHWEST AIRLINES CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued) January 1, 2006, will reduce first quarter net earnings by approximately $10 million ($.01 per share, diluted). See Note 13 for further information on the Company's stock-based compensation plans. Aircraft and Engine ... -

Page 56

... can exchange passengers on certain designated flights. Sales of the code share flights began January 16, 2005, with travel dates beginning February 4, 2005. As part of the December 2005 agreement with ATA, Southwest has enhanced its codeshare arrangement with ATA, subject to certain conditions... -

Page 57

...the interest-rate swap agreement. Southwest used the net proceeds from the issuance of the notes, approximately $346 million, for general corporate purposes. In February 2004 and April 2004, the Company issued two separate $29 million two-year notes, each secured by one new 737-700 aircraft. Both of... -

Page 58

.... The net book value of the assets pledged as collateral for the Company's secured borrowings, primarily aircraft and engines, was $856 million at December 31, 2005. As of December 31, 2005, aggregate annual principal maturities (not including amounts associated with interest rate swap agreements... -

Page 59

... booking travel. The Company's website, www.southwest.com, now accounts for almost 70 percent of ticket bookings and, as a consequence, demand for phone contact has dramatically decreased. During first quarter 2004, the Company closed its Reservations Centers located in Dallas, Texas, Salt Lake City... -

Page 60

...losses'' in the income statement in the period of the change. Ineffectiveness is inherent in hedging jet fuel with derivative positions based in other crude oil related commodities, especially given the magnitude of the current fair market value of the Company's fuel hedge derivatives and the recent... -

Page 61

... Consolidated Balance Sheet. The fair value of the Company's financial derivative instruments at December 31, 2005, was a net asset of approximately $1.7 billion. The current portion of these financial derivative instruments, $640 million, is classified as ""Fuel hedge contracts'' and the long-term... -

Page 62

SOUTHWEST AIRLINES CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued) the Company selects and periodically reviews counterparties based on credit ratings, limits its exposure to a single counterparty, and monitors the market position of the program and its relative market position with ... -

Page 63

... Employee stock options. Repurchases were made in accordance with applicable securities laws in the open market or in private transactions from time to time, depending on market conditions. During first quarter 2005, the Company completed this program. In total, the Company repurchased approximately... -

Page 64

SOUTHWEST AIRLINES CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued) Aggregated information regarding the Company's fixed stock option plans is summarized below: Collective Bargaining Plans Other Employee Plans Wtd. Average Wtd. Average Options Exercise Price Options Exercise Price (In ... -

Page 65

... if the Company had accounted for its Employee stock-based compensation plans and other stock options under the fair value method of SFAS 123. The fair value of each option grant is estimated on the date of grant using a modified Black-Scholes option pricing model with the following weighted-average... -

Page 66

... of the cost over the average future service of Employees expected to receive benefits under the plan. The Company used the following actuarial assumptions to account for its postretirement benefit plans at December 31: 2005 2004 2003 Wtd-average discount rate ÃÃ 5.25% 6.25% 6.75% Assumed... -

Page 67

... maintenance 87 Fuel hedges 564 Other 3 Total deferred tax liabilities DEFERRED TAX ASSETS: Deferred gains from sale and leaseback of aircraft Capital and operating leases Accrued employee benefits State taxes Net operating loss carry forward Other Total deferred tax assets 2,905 76... -

Page 68

... or collectively, will have a material adverse effect on the Company's financial condition, results of operations, or cash flows. 2005 2004 2003 (In millions, except per share amounts) Net income 548 Weighted-average shares outstanding, basic 789 Dilutive effect of Employee stock options... -

Page 69

... REGISTERED PUBLIC ACCOUNTING FIRM THE BOARD OF DIRECTORS AND SHAREHOLDERS SOUTHWEST AIRLINES CO. We have audited the accompanying consolidated balance sheets of Southwest Airlines Co. as of December 31, 2005 and 2004, and the related consolidated statements of income, stockholders' equity, and cash... -

Page 70

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Southwest Airlines Co. as of December 31, 2005 and 2004, and the related consolidated statements of income, stockholder's equity, and cash flows for each of the three years in the period... -

Page 71

...655 120 89 56 .07 .07 to the New York Stock Exchange (""NYSE'') that he was not aware of any violation by the Company of the NYSE's corporate governance listing standards. Management's Report on Internal Control over Financial Reporting. Management of the Company is responsible for establishing and... -

Page 72

...times. In complying with new regulations requiring the institution of policies and procedures, it has been the goal of Southwest's Board of Directors and senior 53 See ""Compensation of Executive Officers,'' incorporated herein by reference from the definitive Proxy Statement for Southwest's Annual... -

Page 73

... to Southwest's Annual Report on Form 10-K for the year ended December 31, 1994 (File No. 1-7259)). Indenture dated as of February 14, 2005, between Southwest Airlines Co. and The Bank of New York Trust Company, N.A., Trustee (incorporated by reference to Exhibit 4.2 to Southwest's Current Report on... -

Page 74

... reference to Exhibit 10.7 to Southwest's Annual Report on Form 10-K for the year ended December 31, 2002 (File No. 1-7259)). 1991 Employee Stock Purchase Plan as amended September 21, 2000 (incorporated by reference to Exhibit 4 to Amendment No. 1 to Registration Statement on Form S-8 (file No. 33... -

Page 75

... to Southwest Airlines Co. Profit Sharing Plan (incorporated by reference to Exhibit 10.8 to Southwest's Annual Report on Form 10-K for the year ended December 31, 2004 (File No. 1-7259)); Amendment No. 7 to Southwest Airlines Co. Profit Sharing Plan. Southwest Airlines Co. 401(k) Plan (incorporated... -

Page 76

... Financial Officer. Section 1350 Certification of Chief Executive Officer and Chief Financial Officer. A copy of each exhibit may be obtained at a price of 15 cents per page, $10.00 minimum order, by writing to: Investor Relations, Southwest Airlines Co., P.O. Box 36611, Dallas, Texas 75235-1611... -

Page 77

... behalf by the undersigned, thereunto duly authorized. SOUTHWEST AIRLINES CO. January 31, 2006 By LAURA WRIGHT Laura Wright Senior Vice President Ì Finance, Chief Financial Officer /s/ Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 78

Signature Capacity /s/ JUNE M. MORRIS June M. Morris LOUIS CALDERA Louis Caldera NANCY LOEFFLER Nancy Loeffler Director /s/ Director /s/ Director 59