Southwest Airlines 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

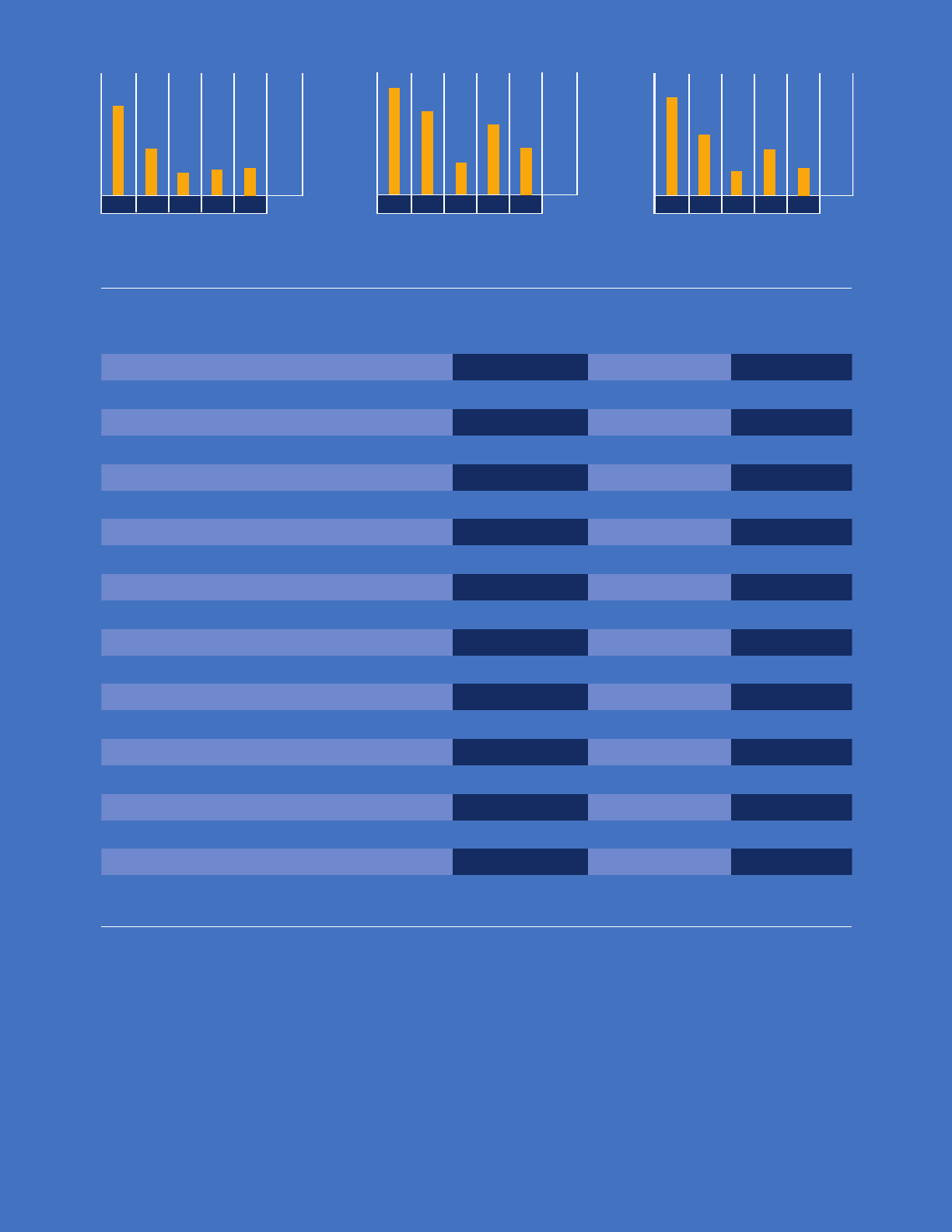

2000 2001 2002 2003

Return On Stockholders’ Equity

2000 2001 2002 2003 2004

Operating Margin

21%

18%

15%

12%

9%

6%

18.1%

11.4%

7.6% 8.5%

8.1%

20%

15%

10%

5%

19.9%*

13.7%

5.7% 5.9%

2004

9.3%

Net Income

(in millions)

Excludes cumulative effect of change

in accounting principle of $22 million Excludes cumulative effect of change

in accounting principle of $22 million

2000 2001 2002 2003

$700

$600

$500

$400

$300

$200

$100

$625*

* *

$511

$241

2004

$442

$313

9.6%

14.7%

0.4

pts.

(29.2)%

(2.6)

pts.

(28.6)%

(29.6)%

9.3%

(3.4)

pts.

9.2%

8.0%

11.4%

7.1%

2.7

pts.

(1.8)%

2.8%

2.2%

7.5%

Operating expenses

Operating income

Operating margin

Net income

Net margin

Net income per share – basic

Net income per share – diluted

Stockholders’ equity

Revenue passengers carried

Revenue passenger miles {RPMs} (000s)

Available seat miles {ASMs} (000s)

Passenger load factor

Passenger revenue yield per RPM

Operating revenue yield per ASM

Operating expenses per ASM

Size of fleet at yearend

(5.6)%

Number of Employees at yearend

Stockholders’ equity per common share outstanding

Return on average stockholders’ equity

CONSOLIDATED HIGHLIGHTS

Operating revenues

10.0%

CHANGE

(DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

$5,976

$554

8.5%

$313

4.8%

$.40

$.38

$5,524

5.9%

$6.99

70,902,773

53,418,353

76,861,296

69.5%

11.76¢

8.5 0 ¢

7.77¢

417

31,011

$6,530

2004

$5,454

$483

8.1%

$442

7.4%

$.56

$.54

$5,052

9.3%

$6.40

65,673,945

47,943,066

71,790,425

66.8%

11.97¢

8.2 7 ¢

7.60¢

388

32,847

$5,937

2003

Southwest Airlines Co. is the nation’s low-fare, high Customer Satisfaction airline. We primarily serve shorthaul and

mediumhaul city pairs, providing single-class air transportation which targets business and leisure travelers. The

Company, incorporated in Texas, commenced Customer Service on June 18, 1971, with three Boeing 737 aircraft serving

three Texas cities—-Dallas, Houston, and San Antonio. At yearend 2004, Southwest operated 417 Boeing 737 aircraft

and provided service to 60 airports in 31 states throughout the United States. Southwest has one of the lowest

operating cost structures in the domestic airline industry and consistently offers the lowest and simplest fares.

Southwest also has one of the best overall Customer Service records. LUV is our stock exchange symbol, selected to

represent our home at Dallas Love Field, as well as the theme of our Employee, Shareholder, and Customer relationships.

Table of contents

-

Page 1

... 737 aircraft serving three Texas cities- -Dallas, Houston, and San Antonio. At yearend 2004, Southwest operated 417 Boeing 737 aircraft and provided service to 60 airports in 31 states throughout the United States. Southwest has one of the lowest operating cost structures in the domestic airline... -

Page 2

..., our goal was to democratize the skies. While other airlines were charging a fistful of dollars to fly from Dallas, Texas, to Houston and San Antonio, Southwest's low fare was a mere $15- -less than bus fare! Today, we continue to offer our Customers legendary low fares, lots of daily flights, and... -

Page 3

... job security, profitsharing, and wellbeing to all of our Employees. Southwest was recently named "Best Low-Cost Carrier" by Business Traveler magazine, which is a tribute to our People's warm, caring Customer Service (to each other and to our passengers) and to the high quality, low-fare service... -

Page 4

Southwest Airlines Co. 2004 Annual Report 3 Herbert D. Kelleher Chairman of the Board Gary C. Kelly Chief Executive Officer Colleen C. Barrett President -

Page 5

...ever and did what was needed to lower our cost structure in 2004. We have a proven business strategy and the most respected and well-known airline brand in the country. We have a top-rated frequent flyer program, Rapid Rewards, and are widely recognized for our Employees' remarkable Customer Service... -

Page 6

Southwest Airlines Co. 2004 Annual Report 5 -

Page 7

...Marriott, La Quinta, and Choice® brand hotels) as well as through the use of the Southwest Airlines Rapid Rewards Visa credit card ® issued by JPMorgan Chase Bank. Proven Business Strategy Southwest has a proven and flexible business strategy. Even though we offer low fares, our strategy allows us... -

Page 8

Southwest Airlines Co. 2004 Annual Report 7 -

Page 9

...Best Low Cost Carrier" by Business Traveler magazine and was once again recognized by FORTUNE as one of America's Most Admired Companies and America's most admired airline. Our Employees consistently provide outstanding Customer Service because they genuinely care about our Company and our Customers... -

Page 10

Southwest Airlines Co. 2004 Annual Report 9 -

Page 11

... codeshare agreement, Southwest Airlines Customers will be able to initially connect in Chicago Midway for travel between select Southwest cities and the following ATA destinations: Boston Logan Airport, Denver International Airport, Southwest Florida International Airport (serving Ft. Myers/Naples... -

Page 12

Southwest Airlines Co. 2004 Annual Report 11 -

Page 13

... St. Louis Albuquerque (Santa Fe Area) (Southern Virginia) Los Angeles (LAX) Orange County Burbank Ontario Tulsa Amarillo Little Rock Oklahoma City (Palm Springs Area) San Diego Phoenix Tucson El Paso Lubbock Midland/ Odessa Dallas Birmingham (Love Field) Jackson Jacksonville New Orleans... -

Page 14

... .08 .08 COMMON STOCK PRICE RANGES AND DIVIDENDS Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high, low, and close sales prices of the common stock on the Composite Tape and the quarterly dividends per share were: PERIOD 2004 1st Quarter... -

Page 15

... assets Long-term debt less current maturities Stockholders' equity CONSOLIDATED FINANCIAL RATIOS Return on average total assets(1) Return on average stockholders' equity Operating margin Net margin CONSOLIDATED OPERATING STATISTICS Revenue passengers carried Enplaned passengers RPMs (000s) ASMs... -

Page 16

Southwest Airlines Co. 2004 Annual Report 15 2000 $ 5,468 111 71 5,650 4,629 1,021 4 1,017 392 $ 625 $.84 $.79 $.0148 $ $ $ 6,670 761 3,451 $ $ $ $ $ 1999 4,563 103 70 4, 736 3,954 782 8 774 ... -

Page 17

16 Southwest Airlines Co. 2004 Annual Report CORPORATE DATA TRANSFER AGENT AND REGISTRAR Registered shareholder inquiries regarding stock transfers, address changes, lost stock certificates, dividend payments, or account consolidation should be directed to: Wells Fargo Shareowner Services 161 N. ... -

Page 18

... computed by reference to the closing sale price of the stock on the New York Stock Exchange on June 30, 2004, the last trading day of the registrant's most recently completed second Ã'scal quarter. Number of shares of Common Stock outstanding as of the close of business on January 31, 2005: 783,771... -

Page 19

... About Market Risk Financial Statements and Supplementary Data Southwest Airlines Co. Consolidated Balance Sheet Southwest Airlines Co. Consolidated Statement of Income Southwest Airlines Co. Consolidated Statement of Stockholders' Equity Southwest Airlines Co. Consolidated Statement of Cash... -

Page 20

... Boeing 737 aircraft serving three Texas cities Ì Dallas, Houston, and San Antonio. At year-end 2004, Southwest operated 417 Boeing 737 aircraft and provided service to 60 airports in 59 cities in 31 states throughout the United States. Southwest Airlines topped the monthly domestic passenger tra... -

Page 21

... aircraft utilization, they have impacted our business. The Company has invested signiÃ'cantly in facilities, equipment, and technology to process Customers eÇciently and restore the airport experience. The Company has implemented its Automated Boarding Passes and RAPID CHECK-IN self service... -

Page 22

... service between markets such as Baltimore and Los Angeles, Phoenix and Tampa Bay, Las Vegas and Nashville, and Houston and Oakland. 4 Southwest's point-to-point route system, as compared to hub-and-spoke, provides for more direct nonstop routings for Customers and, therefore, minimizes connections... -

Page 23

... Customers can also receive credits by using the services of non-airline partners, which include car rental agencies, hotels, telecommunications companies and credit card partners, including the Southwest Airlines Chase (formerly Bank One) Visa card. Rapid Rewards oÃ...ers two types of travel awards... -

Page 24

...month period. The Companion Pass oÃ...ers unlimited free roundtrip travel to any destination available on Southwest for a designated companion of the qualifying Rapid Rewards member. In order for the designated companion to use this pass, the Rapid Rewards member must purchase a ticket or use an Award... -

Page 25

... had 193 Boeing 737-700 aircraft in service. The following table details information on the 417 aircraft in the Company's Ã-eet as of December 31, 2004: 737 Type Seats Average Age (Yrs) Number of Aircraft Number Owned Number Leased -200 300 500 700 Totals 122 137 122 137 22.0 13.7 13... -

Page 26

...Southwest leases terminal passenger service facilities at each of the airports it serves, to which it has added various leasehold improvements. The Company leases land on a long-term basis for its maintenance centers located at Dallas Love Field, Houston Hobby, Phoenix Sky Harbor, and Chicago Midway... -

Page 27

... of Option Grant Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high and low sales prices of the common stock on the Composite Tape and the quarterly dividends per share paid on the common stock were: Period Dividend High Low 176,170 4.64... -

Page 28

... equity securities of Southwest are authorized for issuance. Equity Compensation Plan Information Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants, and Rights (a) (In thousands) Weighted-Average Exercise Price of Outstanding Options, Warrants, and Rights* (b) Number... -

Page 29

...ÃÃÃÃ Cash dividends per common share Total assets at period-end Long-term obligations at periodend Stockholders' equity at period-end Operating Data: Revenue passengers carried Enplaned passengers Revenue passenger miles (RPMs) (000s Available seat miles (ASMs) (000s Load factor(1 Average... -

Page 30

... in 2005. The Company's low-cost competitive advantage, protective fuel hedging position, and excellent Employees have allowed Southwest to react quickly to market opportunities. The Company added Philadelphia to its route system in May 2004, and ramped up growth at Chicago Midway Airport. In fourth... -

Page 31

quality Customer Service Ã-ights in Philadelphia has made this city the Company's most aggressive new city start ever. Also, in January 2005, the Company announced that Pittsburgh would become the 60th city the Company Ã-ies to, with daily service beginning May 2005. ASM capacity currently is ... -

Page 32

... in severance and relocation costs associated with the Company's reservations center consolidation in Ã'rst quarter 2004. For the year 2005, the Company expects unit costs, excluding fuel, to be lower than 2004. Salaries, wages, and beneÃ'ts expense per ASM increased 2.6 percent, inclusive of $40... -

Page 33

... both pay raises and the issuance of stock options, and was ratiÃ'ed by a majority of the Company's Simulator Technicians. Fuel and oil expense per ASM increased 12.1 percent, primarily due to a 14.5 percent increase in the average jet fuel cost per gallon, net of hedging gains. The average cost per... -

Page 34

... 2005 capacity increases and aircraft Ã'nancing plans, the Company expects a year-over-year decline in aircraft rental expense per ASM in 2005. Landing fees and other rentals per ASM increased 1.9 percent primarily due to the Company's expansion of gate and counter space at several airports across... -

Page 35

...and Iraq during Ã'rst half 2003, demand improved following the war. The increase in revenue passenger miles primarily was due to a 4.2 percent increase in added capacity, as measured by available seat miles or ASMs. This was achieved through the Company's net addition of 13 aircraft during 2003 (net... -

Page 36

... jet fuel costs are net of approximately $171 million and $45 million in gains from hedging activities, respectively. See Note 10 to the Consolidated Financial Statements. Maintenance materials and repairs per ASM increased 5.3 percent primarily due to an increase in engine maintenance. The Company... -

Page 37

...nance aircraft-related capital expenditures and to provide working capital. Cash Ã-ows used in investing activities in 2004 totaled $1.9 billion compared to $1.2 billion in 2003. Investing activities in both years primarily consisted of payments for new 737-700 aircraft delivered to the Company and... -

Page 38

... the risk of loss for leased aircraft, it has not made any guarantees to the lessors regarding the residual value (or market value) of the aircraft at the end of the lease terms. As shown above and as disclosed in Note 8 to the Consolidated Financial Statements, the Company operates 95 aircraft that... -

Page 39

... year based on seasonal travel patterns and fare sale activity. The Company's ""Air traÇc liability'' balance at December 31, 2004 was $529 million, compared to $462 million as of December 31, 2003. Estimating the amount of tickets that will be refunded, exchanged, or forfeited involves some level... -

Page 40

... be caused by changes to the Company's maintenance program, changes in utilization of the aircraft (actual cycles during a given period of time), governmental regulations on aging aircraft, and changing market prices of new and used aircraft of the same or similar types. The Company evaluates its... -

Page 41

... and other data available at the time estimates were made. Financial Derivative Instruments The Company utilizes Ã'nancial derivative instruments primarily to manage its risk associated with changing jet fuel prices, and accounts for them under Statement of Financial Accounting Standards No... -

Page 42

...of new airline and airport security directives on the Company's costs and Customer demand for travel, changes in the Transportation Security Administration's scope for managing U.S. airport security, the availability and cost of war-risk and other aviation insurance, including the federal government... -

Page 43

... to manage market risk through execution of a documented hedging strategy. Southwest has market sensitive instruments in the form of Ã'xed rate debt instruments and Ã'nancial derivative instruments used to hedge its exposure to jet fuel price increases. The Company also operates 95 aircraft under... -

Page 44

... with a positive fair value at the reporting date. To manage credit risk, the Company selects and will periodically review counterparties based on credit ratings, limits its exposure to a single counterparty, and monitors the market position of the program and its relative market position with each... -

Page 45

...month period, a hypothetical ten percent change in those rates would correspondingly change the Company's net earnings and cash Ã-ows associated with these items by less than $2 million. Utilizing these assumptions and considering the Company's cash balance, short-term investments, and Ã-oating-rate... -

Page 46

... Statements and Supplementary Data SOUTHWEST AIRLINES CO. CONSOLIDATED BALANCE SHEET December 31, 2004 2003 (In millions, except share data) ASSETS Current assets: Cash and cash equivalents 1,305 Accounts and other receivables 248 Inventories of parts and supplies, at cost 137 Fuel hedge... -

Page 47

SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF INCOME Years Ended December 31, 2004 2003 2002 (In millions, except per share amounts) OPERATING REVENUES: Passenger 6,280 Freight 117 Other 133 Total operating revenues OPERATING EXPENSES: Salaries, wages, and beneÃ'ts Fuel and oil Maintenance... -

Page 48

SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY Years Ended December 31, 2004, 2003, and 2002 Accumulated Capital in Other Excess of Retained Comprehensive Treasury Par Value Earnings Income (Loss) Stock (In millions, except per share amounts) Common Stock Total Balance at ... -

Page 49

... plans Payments of long-term debt and capital lease obligations Payments of trust arrangement Payment of revolving credit facility Payments of cash dividends Repurchase of common stock Other, net Net cash provided by (used in) Ã'nancing activities NET INCREASE (DECREASE) IN CASH AND CASH... -

Page 50

... by changes to the Company's maintenance program, changes in utilization of the aircraft (actual Ã-ight hours or cycles during a given period of time), governmental regulations on aging aircraft, changing market prices of new and used aircraft of the same or similar types, etc. The Company evaluates... -

Page 51

... patterns. Frequent Flyer Program. The Company accrues the estimated incremental cost of providing free travel for awards earned under its Rapid Rewards frequent Ã-yer program. The Company also sells frequent Ã-yer credits and related services to companies participating in its Rapid Rewards frequent... -

Page 52

...No. 123, ""Accounting for Stock Based Compensation'', and supersedes APB 25. Among other items, SFAS 123R eliminates the use of APB 25 and the intrinsic value method of accounting, and requires companies to recognize the cost of employee services received in exchange for awards of equity instruments... -

Page 53

... leased Chicago Midway Airport gates and the rights to a leased aircraft maintenance hangar at Chicago Midway Airport. An initial payment of $34 million in December 2004 is classiÃ'ed as an intangible asset and is included in ""Other assets'' in the Consolidated Balance Sheet. In addition, Southwest... -

Page 54

SOUTHWEST AIRLINES CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS ÃŒ (Continued) nated Ã-ights at Chicago's Midway Airport. Sales of the code share Ã-ights began January 16, 2005, with travel dates beginning February 4, 2005. Upon ATA's emergence from bankruptcy, Southwest has committed to convert ... -

Page 55

... Trust was reÃ-ected in the Consolidated Statement of Cash Flows as ""Payments of trust arrangement''. The cost of Ã'nancing these aircraft obligations, approximately $5 million, was expensed. Retirement plans (Note 14 89 Aircraft rentals 127 Vacation pay 120 Advances and deposits 334 Deferred... -

Page 56

... $346 million, for general corporate purposes. In February 2004 and April 2004, the Company issued two separate $29 million two-year notes, each secured by one new 737-700 aircraft. Both of the notes are non-interest bearing and accrete to face value at maturity at annual rates of 2.9 percent and... -

Page 57

SOUTHWEST AIRLINES CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS ÃŒ (Continued) each class of certiÃ'cates. The trusts used the proceeds from the sale of certiÃ'cates to acquire equipment notes, which were issued by Southwest on a full recourse basis. Payments on the equipment notes held in each ... -

Page 58

... booking travel. The Company's website, southwest.com, now accounts for more than half of ticket bookings and, as a consequence, demand for phone contact has dramatically decreased. During Ã'rst quarter 2004, the Company closed its Reservations Centers located in Dallas, Texas, Salt Lake City, Utah... -

Page 59

SOUTHWEST AIRLINES CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS ÃŒ (Continued) ties for hedging jet fuel. The Company has Ã'nancial derivative instruments in the form of the types of hedges it utilizes to decrease its exposure to jet fuel price increases. The Company does not purchase or hold any ... -

Page 60

...) ""Fuel hedge contracts'' and the long-term portion is classiÃ'ed as ""Other assets'' in the Consolidated Balance Sheet. The fair value of the derivative instruments, depending on the type of instrument, was determined by the use of present value methods or standard option value models with... -

Page 61

... publicly held long-term debt were based on quoted market prices. The carrying values of all other Ã'nancial instruments approximate their fair value. 8% Notes due 2005 Zero coupon Notes due 2006 ÃÃ Pass Through CertiÃ'cates ÃÃÃÃÃ 77/8% Notes due 2007 French Credit Agreements due 2012 61... -

Page 62

... to Employees through other Employee plans are granted at the fair market value of the Company's common stock on the date of grant, have ten-year terms, and vest and become fully exercisable over three, Ã've, or ten years of continued employment, depending upon the grant type. All of the options... -

Page 63

...remaining balance of 3.5 million shares of common stock to Employees of the Company. These shares may be issued at a price equal to 90 percent of the market value at the end of each purchase period. Common stock purchases are paid for through periodic payroll deductions. Participants under the plan... -

Page 64

... if the Company had accounted for its Employee stock-based compensation plans and other stock options under the fair value method of SFAS 123. The fair value of each option grant is estimated on the date of grant using a modiÃ'ed Black-Scholes option pricing model with the following weighted-average... -

Page 65

... cost trend rates have a signiÃ'cant eÃ...ect on the amounts reported for the Company's plan. A one-percent change in all healthcare cost trend rates used in measuring the APBO at December 31, 2004, would have the following eÃ...ects: 1% Increase 1% Decrease (In millions) The Company's periodic... -

Page 66

... current DEFERRED: Federal State Total deferred 8) 178 6 184 $176 For the year 2004, Southwest Airlines Co. had a tax net operating loss of $612 million for federal income tax purposes. The Company estimates that a federal tax refund will be realized as a result of utilizing a portion of this... -

Page 67

SOUTHWEST AIRLINES CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS ÃŒ (Continued) The eÃ...ective tax rate on income before income taxes diÃ...ered from the federal income tax statutory rate for the following reasons: 2004 2003 2002 (In millions) Tax at statutory U.S. tax rates 171 Nondeductible items... -

Page 68

... PUBLIC ACCOUNTING FIRM THE BOARD OF DIRECTORS AND SHAREHOLDERS SOUTHWEST AIRLINES CO. We have audited the accompanying consolidated balance sheets of Southwest Airlines Co. as of December 31, 2004 and 2003, and the related consolidated statements of income, stockholders' equity, and cash Ã-ows... -

Page 69

... the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Southwest Airlines Co. as of December 31, 2004 and 2003, and the related consolidated statements of income, stockholder's equity, and cash Ã-ows for each of the three years in the period ended December... -

Page 70

... Ã'rm who also audited the Company's consolidated Ã'nancial statements. Ernst & Young's attestation report on manage52 Disclosure Controls and Procedures. The Company maintains controls and procedures designed to ensure that it is able to collect the information it is required to disclose in... -

Page 71

... scandals, the Securities and Exchange Commission and the New York Stock Exchange have issued multiple new regulations, requiring the implementation of policies and procedures in the corporate governance area. Since beginning business in 1971, Southwest has thrived on a culture that encourages an... -

Page 72

... certiÃ'cate representing Common Stock of Southwest (incorporated by reference to Exhibit 4.2 to Southwest's Annual Report on Form 10-K for the year ended December 31, 1994 (File No. 1-7259)). Indenture dated as of September 17, 2004 between Southwest Airlines Co. and Wells Fargo Bank, N.A., Trustee... -

Page 73

... reference to Exhibit 10.7 to Southwest's Annual Report on Form 10-K for the year ended December 31, 2002 (File No. 1-7259)). 1991 Employee Stock Purchase Plan as amended September 21, 2000 (incorporated by reference to Exhibit 4 to Amendment No. 1 to Registration Statement on Form S-8 (Ã'le No. 33... -

Page 74

... ended June 30, 2004 (File No. 1-7259)); Amendment No. 6 to Southwest Airlines Co. ProÃ't Sharing Plan. Southwest Airlines Co. 401(k) Plan (incorporated by reference to Exhibit 10.12 to Southwest's Annual Report on Form 10-K for the year ended December 31, 2001 (File No. 1-7259)); Amendment No. 1 to... -

Page 75

... by reference to Exhibit 10.27 to Southwest's Annual Report on Form 10-K for the year ended December 31, 2002 (File No. 1-7259)). 2002 Customer Service/Reservations Non-QualiÃ'ed Stock Option Plan (incorporated by reference to Exhibit 10.28 to Southwest's Annual Report on Form 10-K for the... -

Page 76

... behalf by the undersigned, thereunto duly authorized. SOUTHWEST AIRLINES CO. By LAURA WRIGHT Laura Wright Senior Vice President Ì Finance, Chief Financial OÇcer /s/ February 4, 2005 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 77

Signature Capacity /s/ JUNE M. MORRIS June M. Morris LOUIS CALDERA Louis Caldera NANCY LOEFFLER Nancy LoeÉer Director /s/ Director /s/ Director 59