Royal Caribbean Cruise Lines 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

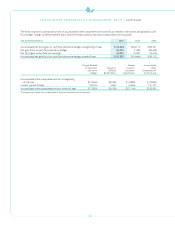

Fuel Swap Agreements

The fair values of our fuel swap agreements were estimated based

on quoted market prices for similar or identical financial instru-

ments to those we hold. Our exposure to market risk for changes

in fuel prices relates to the forecasted consumption of fuel on

our ships. We use fuel swap agreements to mitigate the impact

of fluctuations in fuel prices. As of December 31, 2007 and 2006,

we had fuel swap agreements, designated as cash flow hedges,

to pay fixed prices for fuel with an aggregate notional amount

of $223.9 million, maturing through 2009, and $205.3 million,

maturing through 2008, respectively.

Cross Currency Swap Agreements

The fair values of our cross currency swap agreements were esti-

mated based on the present value of expected future cash flows.

Our exposure to market risk for fluctuations in foreign currency

exchange rates relates to our euro-denominated long-term debt.

As of December 31, 2007 we had cross currency swap agreements

designated as fair value hedges with an estimated fair value of

$54.0 million, maturing in 2014.

Other Financial Instruments

The carrying amounts of all other financial instruments approxi-

mate fair value at December 31, 2007 and 2006.

NOTE 14. COMMITMENTS

AND CONTINGENCIES

Capital Expenditures

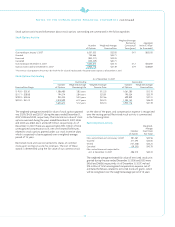

As of December 31, 2007,we had one Freedom-class ship, two ships

of a newProjectGenesis classand four Solstice-classshipson order

for an aggregate additional capacity of approximately 25,800 berths.

The aggregate cost of the ships is approximately $7.0 billion, of

which wehavedeposited $499.6 million as of December 31, 2007.

(See Note 13. Fair Value of Financial Instruments).

As of December 31, 2007, we anticipated overall capital expendi-

tures, including the seven ships on order, will be approximately

$1.9 billion for 2008, $2.0 billion for 2009, $2.2 billion for 2010

and $1.0 billion for 2011.

Recently we reached an agreement with Meyer Werft to build a fifth

Solstice-class ship for Celebrity Cruises, subject to certain conditions,

for an additional capacity of approximately 2,850 berths, expected

to enter service in the fourth quarter of 2012. Based on current

exchange rates, we estimate the all-in cost of this ship will be

approximately $912.0 million. This amount is not included in the

anticipated overall capital expenditures reflected above.

Litigation

In April 2005, a purported class action lawsuit was filed in the

United States District Court for the Southern District of Florida

alleging thatCelebrity Cruises improperly requires its cabin stew-

ards to share guest gratuities with assistant cabin stewards. The

suit sought payment of damages, including penalty wages under

the U.S.Seaman’s Wage Act. In March 2006, the Southern District

of Florida dismissed the suit and held that the case should be

arbitrated pursuant to the arbitration provision in Celebrity’s

collective bargaining agreement. In June 2007, the United States

11th Circuit Court of Appeals affirmed the District Court’s order

dismissing the suit and subsequently denied the plaintiff’s peti-

tion for re-hearing and petition for re-hearing enbanc. In January

2008, the United States Supreme Court denied the plaintiff’s

petition requesting that the Court grant certiorari jurisdiction

over the action. We are not able at this time to estimate the

impact of this proceeding on us.

In January 2006, a purported class action lawsuit was filed in the

United States District Court for the Southern District of New York

alleging that we infringed rights in copyrighted works and other

intellectual property by presenting performances on our cruise

ships without securing the necessary licenses. The suit seeks

payment of damages, disgorgement of profits and a permanent

injunction against future infringement. In April 2006, we filed a

motion to sever and transfer the case to the United States District

Court for the Southern District of Florida. The motion is pending.

We are not able at this time to estimate the impact of this

proceeding on us.

We have a lawsuit pending in the Circuit Court for Miami-Dade

County,Florida against Rolls Royce, co-producer of the Mermaid

pod-propulsion system on Millennium-class ships, for the recur-

ring Mermaid pod failures. Alstom Power Conversion, the other

co-producer of the pod-propulsion system, settled out of this

suit in January 2006 for $38.0 million. The $38.0 million settlement

resulted in a gain of $36.0 million, net of reimbursements to

insurance companies, which we have recorded within other income

in our consolidated statements of operations for the year ended

December 31, 2006. We are not able at this time to estimate the

outcome tous of the Rolls Royce proceeding.

Celebrity Cruises has been awarded damages in connection with

its pending case in New York federal court against Essef Corp. for

claims stemming from a 1994 outbreak of Legionnaires’ disease on

one of Celebrity Cruises’ ships. The award reflects the culmination

of twojury trials held in June 2006 and June 2007, respectively, as

most recently modified by the trial judge in January 2008. Judg-

ment has not yet been entered and when entered, the judgment

is subject to appeal. The award would result in a net payment to

Celebrity Cruises (after costs and payment to insurers) of approxi-

mately $15.0 million. We are not able at this time to estimate the

outcome of this proceeding, and as of December 31, 2007, no

amount of this award has been recognized in our consolidated

financial statements.

In July 2006, a purported class action lawsuit was filed in the

United States District Court for the Central District of California

alleging that we failed to timely pay crew wages and failed to

pay proper crew overtime. The suit seeks payment of damages,

including penalty wages under the U.S. Seaman’s Wage Act and

equitable relief damages under the California Unfair Competition

Law. In December 2006, the District Court granted our motion to

dismissthe claim and held that it should be arbitrated pursuant

to the arbitration provision in Royal Caribbean’s collective bar-

gaining agreement. In January 2007, the plaintiffs appealed the

order tothe United States Ninth Circuit Court of Appeals. We are

not able atthis time toestimate the impact of this proceeding.