Royal Caribbean Cruise Lines 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

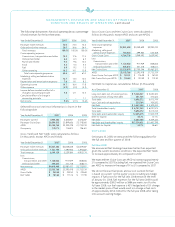

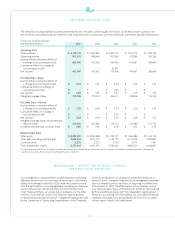

Our cruise operating expenses consist of the following:

Commissions, transportation and other expenses consist of those

costs directly associated with passenger ticket revenues, including

travel agent commissions, air and other transportation expenses,

port costs that vary with passenger head counts and related

credit card fees.

Onboard and other expenses consist of the direct costs associ-

ated with onboard and other revenues. These costs include the

cost of products sold onboard our ships, vacation protection

insurance premiums, costs associated with pre- and post-cruise

tours and related credit card fees. These costs also include mini-

mal costs associated with concession revenues, as the costs are

mostly incurred by third party concessionaires.

Payroll and related expenses consist of costs for shipboard

personnel.

Food expenses include food costs for both passengers and crew.

Fuel expenses include fuel and related delivery and storage costs,

including the financial impact of fuel swap agreements.

Other operating expenses consist primarily of operating costs

such as repairs and maintenance, port costs that do not vary with

passenger head counts, vessel operating lease costs, costs associ-

ated with Pullmantur Cruises’ land-based tours, vessel related

insurance and entertainment.

Wedo not allocatepayroll and related costs, food costs, fuel costs

or other operating costs to the expense categories attributable

to passenger ticket revenues or onboard and other revenues since

theyareincurred toprovide the total cruise vacation experience.

NON-GAAP FINANCIAL MEASURES

Available Passenger Cruise Days (“APCD”) are our measurement of

capacity and represent double occupancy per cabin multiplied by

the number of cruise days for the period.

Gross Cruise Costs represent the sum of total cruise operating

expenses plus marketing, selling and administrative expenses.

Gross Yields represent total revenues per APCD.

Net Cruise Costs represent Gross Cruise Costs excluding commis-

sions, transportation and other expenses and onboard and other

expenses (each of which is described under the Terminology head-

ing). In measuring our ability to control costs in a manner that

positively impacts net income, we believe changes in Net Cruise

Costs to be the most relevant indicator of our performance.

A reconciliation of historical Gross Cruise Costs to Net Cruise

Costs is provided below under Summary of Historical Results of

Operations.We have not provided a quantitative reconciliation

of projected Gross Cruise Costs to projected Net Cruise Costs due

tothe significant uncertainty in projecting the costs deducted to

arriveat this measure. Accordingly, we do not believe that recon-

ciling information for such projected figures would be meaningful.

Net Debt-to-Capital is a ratio which represents total long-term

debt, including current portion of long-term debt, less cash and

cash equivalents (“Net Debt”) divided by the sum of Net Debt and

total shareholders’ equity. We believe Net Debt and Net Debt-to-

Capital, along with total long-term debt and shareholders’ equity

are useful measures of our capital structure. A reconciliation of

historical Debt-to-Capital to Net Debt-to-Capital is provided

below under Summary of Historical Results of Operations.

Net Revenues represent total revenues less commissions, trans-

portation and other expenses and onboard and other expenses

(each of which is described under the Terminology heading).

Net Yields represent Net Revenues per APCD. We utilize Net

Revenues and Net Yields to manage our business on a day-to-day

basis as we believe that it is the most relevant measure of our

pricing performance because it reflects the cruise revenues

earned by us net of our most significant variable costs, which are

commissions, transportation and other expenses and onboard and

other expenses. A reconciliation of historical Gross Yields to Net

Yields is provided belowunder Summary of Historical Results of

Operations. Wehave not provided a quantitative reconciliation

of projected Gross Yields to projected Net Yields due to the

significant uncertainty in projecting the costs deducted to arrive

at this measure. Accordingly, we do not believe that reconciling

information for such projected figures would be meaningful.

Occupancy, in accordance with cruise vacation industry practice, is

calculated by dividing Passenger Cruise Days by APCD. A percentage

in excessof 100% indicates that three or more passengers occupied

some cabins.

Passenger Cruise Days represent the number of passengers carried

for the period multiplied bythe number of daysof their respec-

tive cruises.

EXECUTIVE OVERVIEW

Over the past five years, we have experienced higher passenger

ticket prices and onboard revenues while maintaining strong

occupancies. As a result, Net Yields have grown from $146.63

in 2003 to $183.64 in 2007. The industry’s focus has shifted so that

alarger portion of the revenue growth has come from markets

outside of North America. We have responded to this shift by

redeploying some of our ships to certain international markets

such as Europe, Latin America and Asia, as well as focusing on the

continued development of our international passenger sourcing.

As a result, our passenger ticket revenues generated by sales

originating outside of North America has increased from approxi-

mately 19% in 2003 to 30% in 2007. Due to the recent recovery

in North American bookings and continued strengthening inter-

nationally, we expect to see further yield improvements in 2008,

in spiteof the current weakening of the U.S. economy and the

tighter credit markets. These current economic conditions,

however, could eventually have an adverse effect on vacationers’

discretionary income and consumer confidence, which could

result in a lower demand for cruises, lower cruise prices and lower

onboardrevenues in the future.

14

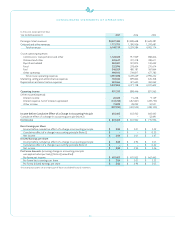

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS continued