Royal Caribbean Cruise Lines 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

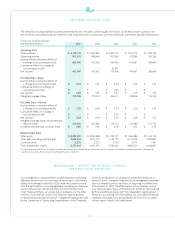

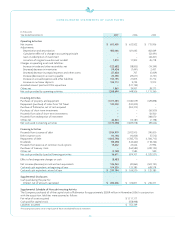

Net cash used in investing activities decreased to $1.2 billion in

2007 from $1.8 billion in 2006. The decrease was primarily due to

$553.3 million related to the purchase of Pullmantur, net of cash

acquired, during 2006 that did not recur in 2007. The decrease

was also due to the purchase of $100.0 million of notes from

TUI Travel during 2006 which were repaid in 2007. The decrease

was partially offset by an increase in capital expenditures which

were $1.3 billion in 2007, compared to $1.2 billion in 2006. Capital

expenditures were primarily related to the purchase of Pacific

Star,the deliveries of Liberty of the Seas in 2007 and Freedom

of the Seas in 2006 as well as progress payments for ships under

construction in both years.

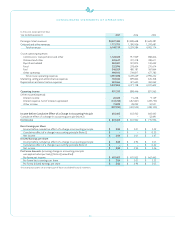

Net cash provided by financing activities was $36.6 million in 2007

compared to $879.7 million in 2006. The decrease was primarily

due to a decrease in proceeds from debt issuances of $998.9 mil-

lion and an increase in repayments of debt of $20.0 million. The

decrease was also partially offset by $164.6 million of treasury

stock purchased during 2006 that did not recur in 2007. During

2007, we received net proceeds of €990.9 million, or $1.3 billion,

from a bond offering consisting of €1.0 billion, or $1.3 billion, of

5.625% senior unsecured notes due 2014. In addition, we received

$589.0 million through an unsecured term loan due through 2014

to purchase Liberty of the Seas and drew $50.0 million on our

unsecured revolving credit facility. During 2007, we made debt

repayments on various loan facilities and capital leases, including

apayment of $906.5 million to retire the €701.0 million outstand-

ing balance on our unsecured bridge loan facility. In addition,

we made $465.0 million in payments towards our unsecured

revolving credit facility, a payment of $200.0 million to retire

our 7%unsecured senior notes due 2007,and a payment of

$61.2 million to repay term loans secured by two Celebrity ships.

During 2007 and 2006 we received $19.6 million and $23.0 million,

respectively,in connection with the exercise of common stock

options and we paid cash dividends on our common stock of

$98.3 million and $124.5 million, respectively. Net Debt-to-Capital

decreased to 44.7% in 2007 compared to 46.6% in 2006. Similarly,

our Debt-to-Capital ratio decreased to 45.7% in 2007 from 47.1%

in 2006.

Interest capitalized during 2007 increased to $39.9 million from

$27.8 million in 2006 primarily due to a higher average level of

investment in ships under construction.

Future Capital Commitments

Our future capital commitments consist primarily of new ship orders.

As of December 31, 2007, we had one Freedom-class ship and two

ships of a new Project Genesis class designated for Royal Caribbean

International and four Solstice-class ships, designated for Celebrity

Cruises, on order for an aggregate additional capacity of approxi-

mately 25,800 berths. The aggregate cost of the seven ships is

approximately $7.0 billion, of which we have deposited $499.6 mil-

lion as of December 31, 2007. Approximately 7.7% of the aggregate

cost of ships was exposed to fluctuations in the euro exchange

rate at December 31, 2007. (See Note 13. Fair Value of Financial

Instruments toour consolidated financial statements.)

As of December 31, 2007 we anticipated overall capital expendi-

tures, including the seven ships on order, will be approximately

$1.9 billion for 2008, $2.0 billion for 2009, $2.2 billion for 2010,

and $1.0 billion for 2011.

Recently we reached an agreement with Meyer Werft to build a

fifth Solstice-class ship for Celebrity Cruises, subject to certain

conditions, for an additional capacity of approximately 2,850

berths, expected toenter servicein the fourth quarter of 2012.

Based on current exchange rates, we estimate the all-in cost of

this ship will be approximately $320,000 per berth. This amount

is not included in the anticipated overall capital expenditures

reflected above.

19

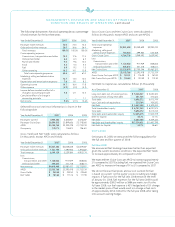

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS continued

CONTRACTUAL OBLIGATIONS AND OFF-BALANCE SHEET ARRANGEMENTS

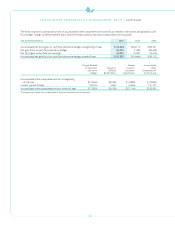

As of December 31, 2007, our contractual obligations were as follows (in thousands):

Payments Due by Period

Lessthan Morethan

Total 1 year 1-3 years 3-5 years 5 years

Long-term debt obligations1$ 5,645,940 $ 348,402 $1,044,574 $ 929,375 $3,323,589

Capital lease obligations152,332 3,323 6,344 3,747 38,918

Operating lease obligations2,3 545,747 67,042 112,938 329,540 36,227

Ship purchaseobligations45,571,652 1,490,376 3,407,191 674,085 –

Other5630,440 123,722 139,601 136,869 230,248

Total $12,446,111 $2,032,865 $4,710,648 $2,073,616 $3,628,982

1Amounts exclude interest.

2We are obligated under noncancelable operating leases primarily for a ship, offices, warehouses and motor vehicles.

3Under the Brilliance of the Seas lease agreement, we may be required to make a termination payment of approximately £126.0 million, or approximately $250.3 million,

based on the exchange rate at December 31, 2007, if the lease is canceled in 2012. This amount is included in the three to five years category. (See Note 14. Commitments

and Contingencies toour consolidated financial statements.)

4Amounts represent contractual obligations with initial terms in excess of one year.

5Amounts represent future commitments with remaining terms in excess of one year to pay for our usage of certain port facilities, marine consumables, services and

maintenance contracts.