Royal Caribbean Cruise Lines 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

Other

During 2007, we received proceeds from the repayment of

$100.0 million of notes from TUI Travel, which we purchased

in March 2006.

In July 2005, TUI Travel redeemed in full its convertible preferred

shares. We received $348.1 million in cash, resulting in a net gain

of $44.2 million, primarily due to foreign exchange, which was

recorded as a component of other income.

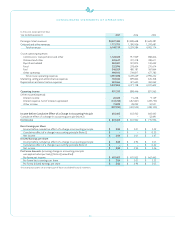

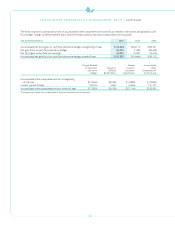

NOTE 6. LONG-TERM DEBT

Long-term debt consists of the following (in thousands):

2007 2006

Unsecured revolving credit facility,

LIBOR plus 0.485% and a facility fee

of 0.14% due 2012

$ 30,000

$ 445,000

Unsecured senior notes and

senior debentures, 6.75% to 8.75%,

due 2008 through 2016, 2018 and 2027

2,623,029

2,804,608

€1.0 billion unsecured senior notes,

5.625%, due 2014

1,437,429

–

€750 million unsecured Bridge Loan,

EURIBOR plus 0.625%, due 2007

–

925,110

$570 million unsecured term loan,

3.77% due 2006 through 2013

447,857

529,286

$589million unsecured term loan,

4.215%due 2007 through 2014

546,929

–

$300 million unsecured term loan,

LIBOR plus 0.8%, due 2009 through 2010

200,000

200,000

$225 million unsecured term loan,

LIBOR plus 0.75%, due 2006 through 2012

160,695

192,848

€6.0 million unsecured revolving

credit lines, EURIBOR plus 0.8%

to 1.25% due 2007

–

7,961

Unsecured term loans,

LIBOR plus 0.7%, due 2010

200,000

200,000

Secured term loans,

LIBOR plus 0.85%, due through 2008

–

61,149

Capital lease obligations

52,333

47,782

5,698,272

5,413,744

Less – current portion

(351,725)

(373,422)

Long-term portion

$5,346,547

$5,040,322

During 2007, we issued €1.0 billion, or approximately $1.3 billion,

of 5.625% senior unsecured notes due 2014 at a price of 99.638%

of par.The net proceeds from the offering were used to retire

the €701.0 million, or approximately $906.5 million, outstanding

balance on our unsecured bridge loan facility obtained to finance

our acquisition of Pullmantur. The remainder of the net proceeds,

approximately €289.0 million, or approximately $374.8 million,

was used to repay a portion of the outstanding balance on our

unsecured revolving credit facility. Also in 2007, we entered into

interest rate swap agreements that effectively changed this fixed

ratedebt toEURIBOR-based floating rate debt, and we entered

intocross currency swap agreements that effectively changed

€300.0 million of floating EURIBOR-based debt to $389.1 million

floating LIBOR-based debt.

During 2007, we entered into and drew in full a $589.0 million

unsecured term loan due through 2014 at a rate of 4.215%. The

proceeds were used towards the purchase of Liberty of the Seas,

which was delivered in April 2007.

During 2007, we amended and restated our unsecured revolving

credit facility to increase the amount available from $1.0 billion to

$1.2 billion, reduce the effective interest rate to LIBOR plus 0.485%,

change the 0.175% commitment fee to a 0.140% facility fee and

extend the maturity date from March 27, 2010 to June 29, 2012.

Under certain of our agreements, the contractual interest rate

and commitment fee vary with our debt rating.

The unsecured senior notes and senior debentures are not

redeemable prior to maturity.

Our debt agreements contain covenants that require us, among

other things, to maintain minimum net worth and fixed charge

coverage ratio and limit our Net Debt-to-Capital ratio. We are in

compliancewith all covenants as of December 31, 2007. Follow-

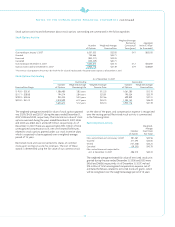

ing is a schedule of annual maturities on long-term debt as of

December 31, 2007 for each of the next five years (in thousands):

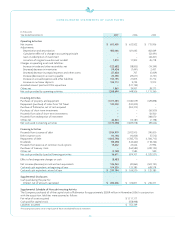

Year

2008 $351,725

2009 351,318

2010 699,599

2011 703,805

2012 229,316

NOTE 7. SHAREHOLDERS’ EQUITY

Wedeclared cash dividends on our common stock of $0.15 per

sharein each of the quarters of 2007and 2006.

NOTE 8. STOCK-BASED EMPLOYEE

COMPENSATION

As discussed in Note 2, Summary of Significant Accounting

Policies,we adopted the provisions of SFAS 123R effective

January 1, 2006. Wehavethree stock-based compensation plans,

which provide for awards to our officers, directors and key

employees. The plans consist of a 1990 Employee Stock Option

Plan, a 1995 Incentive Stock Option Plan and a 2000 Stock Award

Plan. The 1990 Stock Option Plan and the 1995 Incentive Stock

Option Plan terminated by their terms in March 2000 and

February 2005, respectively. The 2000 Stock Award Plan, as

amended, provides for the issuance of (i) incentive and non-

qualified stock options, (ii) stock appreciation rights, (iii) restricted

stock,(iv) restricted stock units and (v) performance shares of up

to13,000,000 shares of our common stock. During any calendar

year, no one individual shall be granted awards of more than

500,000 shares. We awarded 271,594, 204,154 and 160,574

restricted stock units in 2007, 2006 and 2005, respectively.