Royal Caribbean Cruise Lines 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

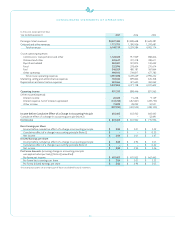

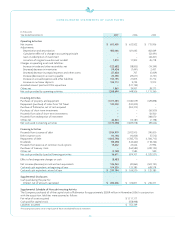

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended December 31, 2007 2006 2005

Operating Activities

Net income

$ 603,405

$ 633,922 $ 715,956

Adjustments:

Depreciation and amortization

483,066

421,645 402,069

Cumulative effect of a change in accounting principle

–

– (52,491)

Gain on redemption of investment

–

– (44,207)

Accretion of original issue discount on debt

1,810

17,902 45,718

Changes in operating assets and liabilities:

Increase in trade and other receivables, net

(122,682)

(38,855) (19,349)

(Increase) decrease in inventories

(19,424)

(7,441) 2,457

(Increase) decrease in prepaid expenses and other assets

(37,650)

707 (5,009)

Increase (decrease) in accounts payable

23,398

(29,671) (3,741)

Increase in accrued expenses and other liabilities

150,195

21,815 31,772

Increase in customer deposits

184,713

9,724 9,912

Accreted interest paid on LYONs repurchase

–

(121,199) –

Other, net

1,863

39,957 28,273

Net cash provided byoperating activities

1,268,694

948,506 1,111,360

Investing Activities

Purchases of property and equipment

(1,317,381)

(1,180,579) (429,898)

Repayment (purchase) of notes from TUI Travel

100,000

(100,000) –

Purchase of Pullmantur, net of cash acquired

–

(553,312) –

Purchases of short-term investments

–

– (56,500)

Proceeds from sale of short-term investments

–

– 56,500

Proceeds from redemption of investment

–

– 348,070

Other,net

46,823

(15,187) (7,198)

Net cash used in investing activities

(1,170,558)

(1,849,078) (89,026)

Financing Activities

Proceeds from issuance of debt

1,934,979

2,933,915 390,000

Debt issuance costs

(10,146)

(10,004) (5,512)

Repayments of debt

(1,805,798)

(1,785,773) (1,564,715)

Dividends

(98,298)

(124,460) (118,764)

Proceeds from exercise of common stock options

19,632

23,026 21,996

Purchases of treasury stock

–

(164,582) (249,122)

Other, net

(3,758)

7,585 590

Net cash provided by (used in) financing activities

36,611

879,707 (1,525,527)

Effect of exchange rate changes on cash

(8,483)

––

Net increase (decrease) in cash and cash equivalents

126,264

(20,865) (503,193)

Cash and cash equivalents at beginning of year

104,520

125,385 628,578

Cash and cash equivalents at end of year

$ 230,784

$ 104,520 $ 125,385

Supplemental Disclosures

Cash paid during the year for:

Interest, net of amount capitalized

$ 285,206

$ 376,817 $ 236,477

Supplemental Schedule of Noncash Investing Activity

The Company purchased all of the capital stock of Pullmantur for approximately $558.9 million in November 2006. In conjunction

with the acquisition, liabilities were assumed as follows:

Fair value of assets acquired $ 1,111,117

Cash paid for capital stock (558,948)

Liabilities assumed $ 552,169

The accompanying notes are an integral part of these consolidated financial statements.