Royal Caribbean Cruise Lines 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

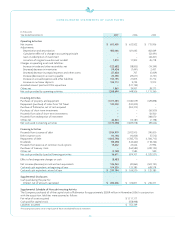

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

Options and restricted stock units outstanding as of December 31,

2007 vest in equal installments over four to five years from the

date of grant. Generally, options and restricted stock units are

forfeited if the recipient ceases to be a director or employee

before the shares vest. Options are granted at a price not less

than the fair value of the shares on the date of grant and expire

not later than ten years after the date of grant.

In September 2006, the Compensation Committee amended the

Company’s 2000 Stock Award Plan. The amendment extends

the period during which a participant must exercise non-qualified

options following a termination of service to one year. It also

limits the period for exercise of both qualified and non-qualified

options following termination of service due to a participant’s

death or disability to one year. This amendment is effective for

options granted on or after September 18, 2006. The amendment

did not have any impact on our 2007 and 2006 consolidated

financial statements.

We also provide an Employee Stock Purchase Plan to facilitate

the purchase by employees of up to 800,000 shares of common

stock in the aggregate. Offerings to employees are made on a

quarterly basis. Subject to certain limitations, the purchase price

for each share of common stock is equal to 90% of the average

of the market prices of the common stock as reported on the

NewYork Stock Exchange on the first business day of the pur-

chase period and the last business day of each month of the

purchase period. Shares of common stock of 20,759, 18,116 and

14,476 were issued under the ESPP at a weighted-average price of

$37.25, $36.00 and $40.83 during 2007, 2006 and 2005, respectively.

Under an executive compensation program approved in 1994, we

award to a trust 10,086 shares of common stock per quarter, up to

amaximum of 806,880 shares.

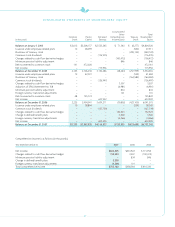

Total compensation expense recognized for employee stock

based compensation for the year ended December 31, 2007 was

$19.0 million, of which $16.3 million was included within market-

ing, selling and administrative expenses and $2.7 million within

payroll and related expenses. Total compensation expense recog-

nized for employee stock based compensation for the year ended

December 31, 2006 was $18.4 million, of which $13.8 million was

included within marketing, selling and administrative expenses

and $4.6 million within payroll and related expenses.

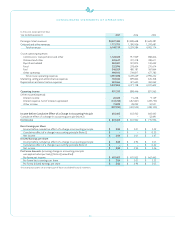

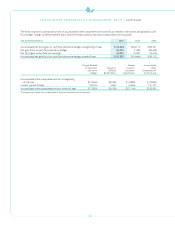

The following table illustrates the effect on income before cumu-

lativeeffectof a changein accounting principle, net income and

earningsper shareas if we had applied the fair value recognition

provisions of SFAS 123 to such compensation for the year ended

December 31, 2005 (in thousands, except per share data):

Income before cumulative effect of a change in

accounting principle $663,465

Deduct: Total stock-based employee compensation

expense determined under fair value method

for all awards (9,732)

Pro forma income before cumulative effect of a

change in accounting principle 653,733

Add: Interest on dilutive convertible notes 48,128

Pro forma income before cumulative effect of a

change in accounting principle for

diluted earnings per share $701,861

Net income, as reported $715,956

Deduct: Total stock-based employee compensation

expense determined under fair value method

for all awards (9,732)

Pro forma net income 706,224

Add: Interest on dilutive convertible notes 48,128

Pro forma net income for diluted earnings per share $754,352

Weighted-average common shares outstanding 206,217

Dilutive effect of stock options and restricted stock awards 2,498

Dilutive effect of convertible notes 25,772

Diluted weighted-average shares outstanding 234,487

Earnings per share before cumulative effect of a change

in accounting principle:

Basic – as reported $ 3.22

Basic – pro forma $ 3.17

Diluted – as reported $ 3.03

Diluted – pro forma $ 2.99

Earningsper share:

Basic – as reported $ 3.47

Basic – pro forma $ 3.42

Diluted – as reported $ 3.26

Diluted – pro forma $ 3.22

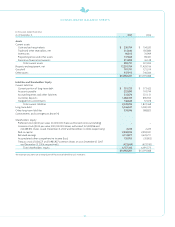

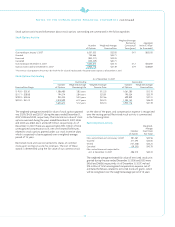

The fair value of each stock option grant is estimated on the

date of grant using the Black-Scholes option pricing model. The

estimated fair value of stock options, less estimated forfeitures,

is amortized over the vesting period using the graded-vesting

method. The assumptions used in the Black-Scholes option-

pricing model areas follows:

2007 2006 2005

Dividend yield

1.3%

1.4% 1.0%

Expected stock price volatility

28.0%

33.0% 48.8%

Risk-free interest rate

4.8%

4.5% 3.5%

Expected option life

5years

5years 5 years

Upon the adoption of SFAS 123R, expected volatility was based on

acombination of historical and implied volatilities. The risk-free

interest rate is based on U.S. Treasury zero coupon issues with a

remaining term equal to the expected option life assumed at the

date of grant. The expected term was calculated based on historical

experienceand represents the time period options actually remain

outstanding. Weestimated forfeitures based on historical pre-

vesting forfeitures and shall revise those estimates in subsequent

periods if actual forfeitures differ from those estimates. For

purposes of calculating pro forma information for the period prior

to fiscal 2006, we accounted for forfeitures as they occurred.