Royal Caribbean Cruise Lines 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

approximately $9.4 million. At December 31, 2004, we have an

interest rate swap agreement that effectively changes $25 mil-

lion of LIBOR-based floating rate debt to fixed rate debt of

4.395% beginning January 2005.

Market risk associated with our operating lease for

Brilliance of the

Seas

is the potential increase in rent expense from an increase in

sterling LIBOR rates. As of January 2005, we have effectively

changed 58% of the operating lease obligation from a floating rate

to a fixed rate obligation with a weighted-average rate of 4.81%

through a combination of interest rate swap agreements and rate

fixings with the lessor. A hypothetical one percentage point

increase in sterling LIBOR rates would increase our 2005 rent

expense by approximately $2.0 million, based on the exchange rate

at December 31, 2004, net of the effect of interest rate swaps.

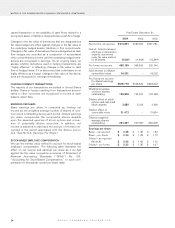

CONVERTIBLE NOTES

The estimated fair values of our Liquid Yield Option™ Notes

and zero coupon convertible notes fluctuate with the price of

our common stock and at December 31, 2004 were $962.8

million and $756.8 million, respectively. A hypothetical 10%

decrease or increase in our December 31, 2004 common

stock price would decrease or increase the value of our Liquid

Yield Option™ Notes and zerocoupon convertible notes by

approximately $96.1 million and $74.3 million, respectively.

FOREIGN CURRENCY EXCHANGE RATE RISK

Our primary exposure to foreign currency exchange rate risk

relates to our firm commitments under ship construction con-

tracts (including a ship lengthening contract), denominated in

euros. We entered into euro denominated forward contracts to

manage this risk. The estimated fair value of such eurodenomi-

nated forward contracts at December 31, 2004, was a net unre-

alized gain of approximately $110.9 million, based on quoted mar-

ket prices for equivalent instruments with the same remaining

maturities. These eurodenominated forwardcontracts mature

through 2007. At December 31, 2004, approximately 26% of the

cost of the ship construction contracts was exposed to fluctua-

tions in the euro exchange rate. A hypothetical 10% strengthen-

ing of the euroas of December 31, 2004, assuming no changes

in comparative interest rates, would result in a $140.6 million

increase in the United States dollar value of the foreign currency

denominated ship construction contracts. This increase would be

partially offset by an increase in the fair value of our eurodenom-

inated forward contracts of approximately $104.3 million.

We are also exposed to foreign currency exchange rate fluctua-

tions on the United States dollar value of our foreign currency

denominated forecasted transactions. To manage this exposure,

we take advantage of any natural offsets of our foreign currency

revenues and expenses and enter into foreign currency forward

contracts and/or option contracts for a portion of the remaining

exposure related to these forecasted transactions. Our principal

net foreign currency exposure relates to the euro, the Norwegian

kroner, British pound sterling and the Canadian dollar. At

December 31, 2004, the estimated fair value of such contracts

was an unrealized loss of approximately $6.0 million based on

quoted market prices for equivalent instruments with the same

remaining maturities. A hypothetical 10% strengthening of the

principal foreign currencies as of December 31, 2004, assuming

no changes in comparative interest rates, would result in a $5.8

million increase in the United States dollar value of the 2005 for-

eign currency denominated forecasted transactions. This increase

would be offset by a decrease in the fair value of our 2005 foreign

currency forward contracts of approximately $6.4 million.

FUEL PRICE RISK

Our exposure to market risk for changes in fuel prices relates to the

consumption of fuel on our ships. Fuel cost, as a percentage of our

total revenues, was approximately 5.5% in 2004, 5.2% in 2003 and

4.5% in 2002. Historically, we have used fuel swap agreements and

zerocost collars to mitigate the financial impact of fluctuations in

fuel prices. As of December 31, 2004, we had fuel swap agree-

ments to pay fixed prices for fuel with an aggregate notional amount

of approximately $35.4 million, maturing through 2005. The esti-

mated fair value of these contracts at December 31, 2004 was an

unrealized gain of $8.1 million. We estimate that a hypothetical 10%

increase in our weighted-average fuel price from that experienced

during the year ended December 31, 2004 would increase our

2005 fuel cost by approximately $28.2 million. This increase would

be partially offset by an increase in the fair value of our fuel swap

agreements of approximately $3.9 million.

MANAGEMENT’S REPORTON INTERNAL CONTROL

OVER FINANCIAL REPORTING

Our management is responsible for establishing and maintaining

adequate internal control over financial reporting, as such term is

defined in Exchange Act Rule 13a-15(f). Under the supervision

and with the participation of our management, including our

Chairman and Chief Executive Officer and Executive Vice

President and Chief Financial Officer, we conducted an evaluation

of the effectiveness of our internal control over financial reporting

based on the framework in

Internal Control-Integrated Framework

issued by the Committee of Sponsoring Organizations of the

Treadway Commission. Based on our evaluation under the frame-

work in

Internal Control-Integrated Framework

,our management

concluded that our internal control over financial reporting was

effective as of December 31, 2004. Our management’s assess-

ment of the effectiveness of our internal control over financial

reporting as of December 31, 2004 has been audited by

PricewaterhouseCoopers LLP, an independent registered public

accounting firm, as stated in their reportwhich is included herein.

ROYAL CARIBBEAN CRUISES LTD. 17

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)