Royal Caribbean Cruise Lines 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

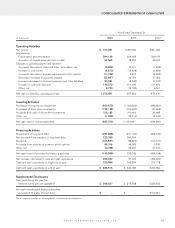

Net Cruise Costs increased 16.5% in 2004 compared to 2003.

The increase was due to the 10.3% increase in capacity men-

tioned above and a 5.6% increase in Net Cruise Costs per

APCD. The increase in Net Cruise Costs per APCD was pri-

marily attributed to increases in fuel prices, marketing, selling

and administrative expenses, crew salaries and medical

expenses, port expenses and costs associated with hurri-

canes. The weighted-average fuel price (net of the financial

impact of fuel swap agreements) for the year ended December

31, 2004 increased 14% per metric ton from the year ended

December 31, 2003. As a percentage of total revenues, fuel

costs were 5.5% and 5.2% for 2004 and 2003, respectively.

The increase in marketing, selling and administrative expenses

was primarily attributable to increases in general and adminis-

trative costs associated with the expansion of our reservations

and sales force and additional information technology projects.

In addition, advertising costs increased primarily due to an

increase in television media spending and the launch of the

Cirque du Soleil and Xpeditions marketing campaigns for

Celebrity Cruises. The increase in port expenses was primarily

attributed to itinerarychanges. In 2004, we incurred approxi-

mately $11.3 million in costs related to the impact of hurri-

canes. In 2003, other operating expenses were reduced by

approximately $5.8 million in connection with a litigation settle-

ment. Gross Cruise Costs per APCD increased 6.7% in 2004

compared to 2003 primarily due to the same reasons dis-

cussed above for Net Cruise Costs per APCD.

Depreciation and amortization expenses increased 8.7% in

2004 compared to 2003. The increase was primarily due to

incremental depreciation associated with the full year effect of

the addition of two new ships in 2003 and one new ship in 2004.

OTHER INCOME (EXPENSE)

Gross interest expense increased to $317.2 million in 2004

from $284.3 million in 2003. The increase was primarily attrib-

utable to a higher average debt level and higher interest rates.

Interest capitalized during 2004 decreased to $7.2 million from

$15.9 million in 2003 due to a lower average level of invest-

ment in ships under construction.

YEAR ENDED DECEMBER 31, 2003 COMPARED TO

YEAR ENDED DECEMBER 31, 2002

REVENUES

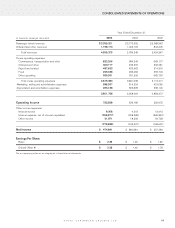

Gross Yields and Net Yields were calculated as follows (in

thousands, except APCD and Yields):

Year Ended December 31,

2003 2002

Passenger ticket revenues $ 2,775,055 $2,589,942

Onboard and other revenues 1,009,194 844,405

Total revenues 3,784,249 3,434,347

Less:

Commissions, transportation

and other ,684,344 669,177

Onboard and other ,249,537 208,231

Net revenues $ 2,850,368 $ 2,556,939

APCD 19,439,238 17,334,204

Gross Yields $194.67 $ 198.13

Net Yields $146.63 $ 147.51

Net revenues increased 11.5% in 2003 compared to 2002. The

increase was due to a 12.1% increase in capacity,offset by a

0.6% decrease in Net Yields. The increase in capacity was pri-

marily associated with the full year effect of the additions of

Constellation

,

Brilliance of the Seas

and

Navigator of the Seas

in 2002 and the addition of two new ships in 2003. The increase

in capacity was partially offset by the cancellation of 46 days of

sailings in 2003 due to unscheduled drydocks and the transfer

of

Viking Serenade

to Island Cruises, our joint venture with First

Choice Holidays PLC, in 2002. The decrease in Net Yields was

primarily due to lower cruise ticket prices and occupancy levels

attributable to consumer apprehension towards travel prior to

and during the war in Iraq and economic uncertainty. The

decrease was partially offset by an increase in net onboard and

other revenues due to the assumption of certain onboard func-

tions previously handled by a concessionaire. Occupancy in

2003 was 103.2% compared to 104.5% in 2002. Gross Yields

decreased 1.7% in 2003 compared to 2002 primarily due to the

same reasons discussed above for Net Yields.

Onboardand other revenues included concession revenues of

$163.0 million and $162.0 million in 2003 and 2002, respec-

tively, which increased in 2003 primarily due to the same rea-

sons discussed above for net revenues.

ROYAL CARIBBEAN CRUISES LTD. 13

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)