Royal Caribbean Cruise Lines 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

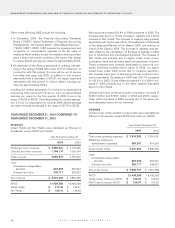

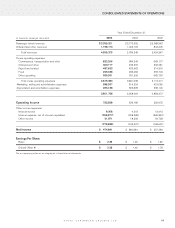

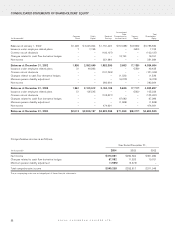

EXPENSES

Gross Cruise Costs and Net Cruise Costs were calculated as

follows (in thousands, except APCD and costs per APCD):

Year Ended December 31,

2003 2002

Total cruise operating expenses $ 2,381,035 $ 2,113,217

Marketing, selling and

administrative expenses ,514,334 431,055

Gross Cruise Costs 2,895,369 2,544,272

Less:

Commissions, transportation

and other ,684,344 669,177

Onboard and other ,249,537 208,231

Net Cruise Costs $ 1,961,488 $ 1,666,864

APCD 19,439,238 17,334,204

Gross Cruise Costs per APCD $148.94 $ 146.78

Net Cruise Costs per APCD $100.90 $ 96.16

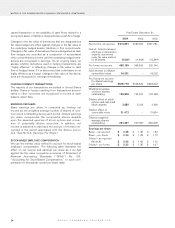

Net Cruise Costs increased 17.7% in 2003 compared to 2002

due to the 12.1% increase in capacity discussed above and a

4.9% increase in Net Cruise Costs per APCD. The increase in

Net Cruise Costs per APCD was primarily attributed to the

assumption of certain onboardfunctions previously handled by a

concessionaire, fuel prices, the full year impact of the

Brilliance

of the Seas

lease payments and new initiatives associated with

the Celebrity Cruises marketing campaign. The change in the

concession arrangement resulted in higher payroll and related

expenses and onboard and other expenses, partially offset by a

decrease in food costs. Fuel costs as a percentage of total rev-

enues were 5.2% and 4.5% for 2003 and 2002, respectively.

The increase in Net Cruise Costs per APCD in 2003 was further

impacted by the fact that 2002 reflected lower spending levels

as a result of business decisions taken subsequent to the events

of September 11, 2001. In addition, included in other operating

expenses in 2002 was a charge of $20.0 million recorded in con-

nection with a litigation settlement. In 2003, we reduced the

amount of the charge by approximately $5.8 million based on the

actual number of claims filed. Gross Cruise Costs per APCD

increased 1.5% in 2003 compared to 2002 primarily due to the

same reasons discussed above for Net Cruise Costs per APCD.

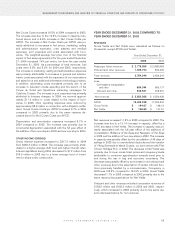

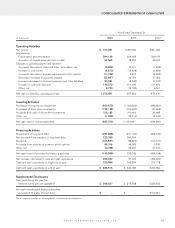

Depreciation and amortization expenses increased 7.0% in 2003

compared to 2002. The increase was primarily due to incremen-

tal depreciation associated with the full year effect of the addi-

tion of two new ships in 2002 and two new ships in 2003.

OTHER INCOME (EXPENSE)

Gross interest expense decreased to $284.3 million in 2003

from $290.3 million in 2002. The decrease was primarily attrib-

utable to lower interest rates. Interest capitalized during 2003

decreased to $15.9 million from $23.4 million in 2002 due to a

lower average level of investment in ships under construction

and lower interest rates.

Included in other income in 2002 was $33.0 million of net pro-

ceeds received in connection with the termination of the P&O

Princess merger agreement and $12.3 million of compensation

from shipyards related to the late delivery of ships.

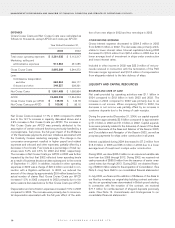

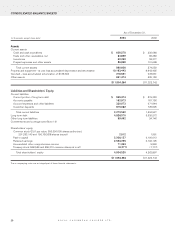

LIQUIDITY AND CAPITAL RESOURCES

SOURCES AND USES OF CASH

Net cash provided by operating activities was $1.1 billion in

2004 compared to $0.9 billion in both 2003 and 2002. The

increase in 2004 compared to 2003 was primarily due to an

increase in net income. When comparing 2003 to 2002, the

decrease in net income was partially offset by an increase in

customer deposits due to the timing of cash receipts.

During the year ended December 31, 2004, our capital expendi-

tures were approximately $0.6 billion compared to approximate-

ly $1.0 billion in 2003 and $1.0 billion in 2002. Capital expendi-

tures were primarily related to the deliveries of

Jewel of the Seas

in 2004;

Serenade of the Seas

and

Mariner of the Seas

in 2003;

and

Constellation

and

Navigator of the Seas

in 2002, as well as

progress payments for ships under construction in all years.

Interest capitalized during 2004 decreased to $7.2 million from

$15.9 million in 2003 and $23.4 million in 2002 due to a lower

average level of investment in ships under construction.

During 2004, we drew $225.0 million on an unsecured variable rate

term loan due 2006 through 2012. During 2003, we received net

cash proceeds of $590.5 million from the issuance of senior unse-

cured notes due through 2013. During 2002, we obtained financ-

ing of $320.0 million related to the acquisition of

Constellation

.(See

Note 6.

Long-Term Debt

to our consolidated financial statements.)

In July 2002, we financed the addition of

Brilliance of the Seas

to

our fleet by novating our original ship building contract and enter-

ing into an operating lease denominated in British pound sterling.

In connection with the novation of the contract, we received

$77.7 million for reimbursement of shipyard deposits previously

made. (See Note 12.

Commitments and Contingencies

to our

consolidated financial statements.)

ROYAL CARIBBEAN CRUISES LTD.

14

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)