Royal Caribbean Cruise Lines 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

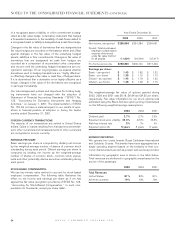

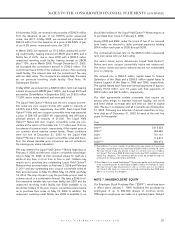

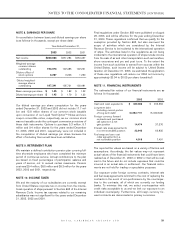

NOTE 8. EARNINGS PER SHARE

A reconciliation between basic and diluted earnings per share

is as follows (in thousands, except per share data):

Year Ended December 31,

2003 2002 2001

Net income $280,664 $351,284 $254,457

Weighted-average

common shares

outstanding 194,074 192,485 192,231

Dilutive effect of

stock options 3,267 3,246 1,250

Diluted weighted-

average shares

outstanding 197,341 195,731 193,481

Basic earnings per share $ 1.45 $ 1.82 $ 1.32

Diluted earnings per share $ 1.42 $ 1.79 $ 1.32

Our diluted earnings per share computation for the years

ended December 31, 2003 and 2002 did not include 17.7 mil-

lion and 13.8 million shares of our common stock issuable

upon conversion of our Liquid Yield OptionTM Notes and zero

coupon convertible notes, respectively, as our common stock

was not issuable under the contingent conversion provisions of

these debt instruments. Options to purchase 5.3 million, 8.7

million and 9.4 million shares for the years ended December

31, 2003, 2002 and 2001, respectively, were not included in

the computation of diluted earnings per share because the

effect of including them would have been antidilutive.

NOTE 9. RETIREMENT PLAN

We maintain a defined contribution pension plan covering full-

time shoreside employees who have completed the minimum

period of continuous service. Annual contributions to the plan

are based on fixed percentages of participants’ salaries and

years of service, not to exceed certain maximums. Pension

cost was $9.4 million, $8.5 million and $8.3 million for the years

2003, 2002 and 2001, respectively.

NOTE 10. INCOME TAXES

We and the majority of our subsidiaries are currently exempt

from United States corporate tax on income from the interna-

tional operation of ships pursuant to Section 883 of the Internal

Revenue Code. Income tax expense related to our remaining

subsidiaries was not significant for the years ended December

31, 2003, 2002 and 2001.

Final regulations under Section 883 were published on August

26, 2003, and will be effective for the year ending December

31, 2004. These regulations confirmed that we qualify for the

exemption provided by Section 883, but also narrowed the

scope of activities which are considered by the Internal

Revenue Service to be incidental to the international operation

of ships. The activities listed in the regulations as not being

incidental to the international operation of ships include income

from the sale of air and other transportation such as transfers,

shore excursions and pre and post tours. To the extent the

income from such activities is earned from sources within the

United States, such income will be subject to United States

taxation. At December 31, 2003, we estimated the application

of these new regulations will reduce our 2004 net income by

approximately $0.04 to $0.05 per share (unaudited).

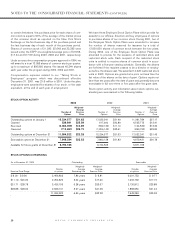

NOTE 11. FINANCIAL INSTRUMENTS

The estimated fair values of our financial instruments are as

follows (in thousands):

2003 2002

Cash and cash equivalents $ 330,086 $ 242,584

Long-term debt

(including current portion

of long-term debt) (6,092,777) (5,039,646)

Foreign currency forward

contracts and purchased

call options in a net

gain position 14,474 37,376

Interest rate swap agreements

in a net receivable position 23,945 62,835

Fuel swap and zero cost

collar agreements in a

net receivable position 4,016 7,491

The reported fair values are based on a variety of factors and

assumptions. Accordingly, the fair values may not represent

actual values of the financial instruments that could have been

realized as of December 31, 2003 or 2002 or that will be real-

ized in the future and do not include expenses that could be

incurred in an actual sale or settlement. Our financial instru-

ments are not held for trading or speculative purposes.

Our exposure under foreign currency contracts, interest rate

and fuel swap agreements is limited to the cost of replacing the

contracts in the event of non-performance by the counterpar-

ties to the contracts, all of which are currently our lending

banks. To minimize this risk, we select counterparties with

credit risks acceptable to us and we limit our exposure to an

individual counterparty. Furthermore, all foreign currency for-

ward contracts are denominated in primary currencies.

ROYAL CARIBBEAN CRUISES LTD. 29

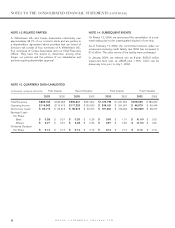

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)