Royal Caribbean Cruise Lines 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

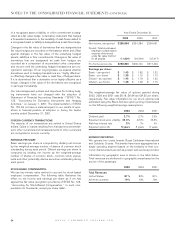

ACCOUNTING PRONOUNCEMENTS

Goodwill represents the excess of cost over the fair value of

net assets acquired, and prior to January 1, 2002, it was amor-

tized over 40 years using the straight-line method. Upon adop-

tion of SFAS No. 142, “Goodwill and Other Intangible Assets”

on January 1, 2002, we ceased to amortize goodwill. Goodwill

amortization was $10.4 million in 2001. In addition, we were

required to perform an initial impairment review of our goodwill

upon adoption, annually thereafter and whenever events or

changes in circumstances indicate that the carrying amount of

these assets may not be fully recoverable. We completed our

initial and annual impairment tests and determined that goodwill

was not impaired. For the year ended December 31, 2001, net

income, excluding the amortization of goodwill, would have

been $264.9 million and basic and diluted earnings per share

would have been $1.38 and $1.37, respectively.

In November 2002, the Financial Accounting Standards Board

(“FASB”) issued FASB Interpretation Number (“FIN”) 45,

“Guarantor’s Accounting and Disclosure Requirements for

Guarantees, Including Indirect Guarantees of Indebtedness of

Others.” FIN 45 requires recognition of an initial liability for the

fair value of the guarantor’s obligation upon issuance of certain

guarantees. Disclosure requirements have been expanded to

include information about each guarantee, even if the likelihood

of any required payment is remote. We adopted the disclosure

requirements of FIN 45 as of December 31, 2002. On January

1, 2003, we adopted the initial recognition and measurement

provisions which were effective on a prospective basis for

guarantees issued or modified after December 31, 2002. The

implementation of FIN 45 did not have a material impact on our

results of operations or financial position at adoption or during

the year ended December 31, 2003.

In January 2003, the FASB issued FIN 46, “Consolidation of

Variable Interest Entities, an Interpretation of ARB No. 51.” In

December 2003, the FASB issued a revision to FIN 46 (“FIN

46-R”). The modifications that were incorporated into FIN 46-

R did not impact us or our implementation of FIN 46. FIN 46

requires consolidation of variable interest entities by the pri-

mary beneficiary if certain criteria are met. For variable interest

entities created or acquired after January 31, 2003, we adopt-

ed the provisions of FIN 46 in our first quarter of 2003. For vari-

able interest entities created or acquired prior to February 1,

2003, we adopted the provisions of FIN 46 in our second quar-

ter of 2003. We have evaluated our joint ventures, minority

interests in affiliates and other arrangements to determine if

they are variable interest entities. One of our minority interests,

a ship repair facility in which we invested in April 2001, is a vari-

able interest entity under FIN 46; however, we are not the pri-

mary beneficiary and accordingly do not consolidate this entity.

As of December 31, 2003, our investment in this entity includ-

ing equity and loans, which is also our maximum exposure to

loss, was approximately $41 million.

In January 2003, we adopted SFAS No. 146, “Accounting for

Costs Associated with Exit or Disposal Activities.” SFAS No.

146 requires that liabilities for costs associated with an exit

activity or disposal of long-lived assets be recognized when the

liabilities are incurred and when the fair value can be deter-

mined. The implementation of SFAS No. 146 had no impact on

our results of operations or financial position at adoption or

during the year ended December 31, 2003.

In April 2003, the FASB issued SFAS No. 149, “Amendment

of Statement 133 on Derivative Instruments and Hedging

Activities.” SFAS No. 149 amends and clarifies accounting and

reporting for derivative instruments, in particular, the circum-

stances under which a contract with an initial net investment

meets the characteristics of a derivative and when a derivative

contains a financing component. For contracts entered into or

modified after June 30, 2003, we adopted the provisions of

SFAS No. 149 in our third quarter of 2003. The implementation

of SFAS No. 149 had no impact on our results of operations or

financial position at adoption or during the year ended

December 31, 2003.

In May 2003, the FASB issued SFAS No. 150, “Accounting for

Certain Financial Instruments with Characteristics of both

Liabilities and Equity.” SFAS No. 150 establishes standards to

classify and measure certain financial instruments as liabilities

which, under previous guidance, were classified as equity. For

financial instruments entered into or modified after May 31,

2003, we adopted the provisions of SFAS No. 150 in our sec-

ond quarter of 2003. For financial instruments entered into or

modified prior to June 1, 2003, we adopted the provisions of

SFAS No. 150 in our third quarter of 2003. The implementation

of SFAS No. 150 had no impact on our results of operations or

financial position at adoption or during the year ended

December 31, 2003.

In December 2003, the FASB issued a revision to SFAS No.

132, “Employers’ Disclosures about Pensions and Other

Postretirement Benefits, an amendment of FASB Statements

No. 87, 88 and 106.” The revised SFAS No. 132 requires addi-

tional disclosures about the assets, obligations, cash flows and

net periodic benefit cost of defined benefit pension plans and

other postretirement benefit plans. The new disclosures are

effective for financial statements with fiscal years ending after

December 15, 2003. The implementation of the revised SFAS

No. 132 had no impact on the disclosures to our financial state-

ments for the year ended December 31, 2003.

ROYAL CARIBBEAN CRUISES LTD. 25

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)