Royal Caribbean Cruise Lines 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROYAL CARIBBEAN CRUISES LTD. 15

In July 2002, we financed the addition of

Brilliance of the Seas

to

our fleet by novating our original ship building contract and enter-

ing into an operating lease denominated in British pound sterling.

In connection with the novation of the contract, we received

$77.7 million for reimbursement of shipyard deposits previously

made. (See Note 12. Commitments and Contingencies.)

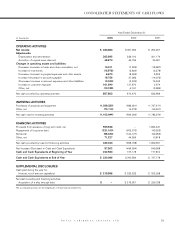

During 2003, we received net cash proceeds of $0.6 billion

from the issuance of senior unsecured notes due through

2013. During 2002, we obtained financing of $0.3 billion relat-

ed to the acquisition of

Constellation

. During 2001, we

received net cash proceeds of $1.8 billion from the issuance of

Liquid Yield OptionTM Notes, senior notes, term loans, zero

coupon convertible notes and drawings on our revolving credit

facility as well as obtained financing of $0.3 billion related to

the acquisition of

Summit

. (See Note 6. Long-Term Debt.)

We made principal payments totaling approximately $231.1

million, $603.3 million and $45.6 million under various term

loans, senior notes, revolving credit facilities and capital leases

during 2003, 2002 and 2001, respectively.

During 2003, 2002 and 2001, we paid quarterly cash dividends

on our common stock totaling $98.3 million, $100.1 million and

$100.0 million, respectively.

FUTURE CAPITAL COMMITMENTS

We have two ships on order designated for the Royal Caribbean

International fleet. We are scheduled to take delivery of

Jewel

of the Seas

, a Radiance-class ship, in the second quarter of

2004. In September 2003, we entered into an agreement with

a shipyard to purchase an Ultra-Voyager ship scheduled for

delivery in the second quarter of 2006. We have an option,

exercisable through August 2004, to purchase an additional

Ultra-Voyager ship for delivery, subject to certain conditions, in

2007. The option has a price of approximately 0.6 billion euros.

With the two ships currently on order we will increase capacity

by 5,712 berths. The aggregate cost of the two ships is approx-

imately $1.2 billion, of which we have deposited $93.2 million as

of December 31, 2003. We anticipate overall capital expendi-

tures will be approximately $0.7 billion, $0.3 billion and $0.9 bil-

lion for 2004, 2005 and 2006, respectively.

CONTRACTUAL OBLIGATIONS AND OFF-BALANCE

SHEET ARRANGEMENTS

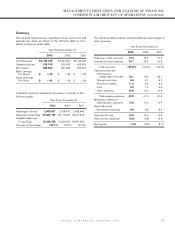

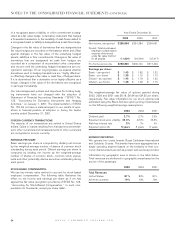

As of December 31, 2003, our contractual obligations, with ini-

tial or remaining terms in excess of one year, were as follows

(in thousands):

Payments due by period

Less than 1 1-3 3-5 More than 5

Total year years years years

Long-term debt obligations (1) $5,465,806 $292,895 $1,637,579 $1,648,315 $1,887,017

Capital lease obligations ,369,998 22,337 , 50,158 , 58,470 ,239,033

Operating lease obligations (2)(3) ,607,619 47,040 , 88,772 , 84,030 ,387,777

Ship purchase obligations 1,152,444 481,109 ,671,335 – –

Other (4) ,306,712 65,281 , 77,709 , 47,878 ,115,844

Total $7,902,579 $908,662 $2,525,553 $1,838,693 $2,629,671

(1) The holders of our zero coupon convertible notes may require us to purchase any notes outstanding at an accreted value of $397.6 million on May 18, 2004.

The holders of our Liquid Yield OptionTM Notes may require us to purchase any notes outstanding at an accreted value of $697.2 million on February 2, 2005.

We may choose to pay any amounts in cash or common stock or a combination thereof. We have a $345.8 million loan facility due 2007 available to us to satisfy

the obligation on our zero coupon convertible notes. In addition, we have our unsecured revolving credit facility due 2008 available to us to satisfy these obligations.

The loan and credit facilities are included in the three to five years category.

(2) We are obligated under noncancelable operating leases primarily for ship, office and warehouse facilities, computer equipment and motor vehicles.

(3) Under the

Brilliance of the Seas

lease agreement, we may be required to make a termination payment of approximately £126 million, or approximately $224 million

based on the exchange rate at December 31, 2003, if the lease is canceled at year 10. This amount is included in the more than five years category. (See Note 12.

Commitments and Contingencies.)

(4) We have future commitments to pay for our usage of certain port facilities, marine consumables, information technology hardware and software,

maintenance contracts, and communication services.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (CONTINUED)