Royal Caribbean Cruise Lines 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Based on the above, we expect 2004 earnings per share to be

in the range of $2.10 to $2.30.

Our Liquid Yield OptionTM Notes become convertible during the

second, third and fourth quarters of 2004 if the share price of

our common stock closes above $46.08, $46.64 and $47.20,

respectively, for 20 days out of the last 30 trading days of each

quarter. If the notes become convertible, full year earnings per

share would be reduced by approximately $0.02.

Year Ended December 31, 2003 Compared to

Year Ended December 31, 2002

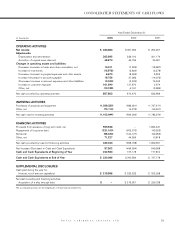

REVENUES

Passenger ticket revenues increased 7.1% to $2.8 billion in

2003 compared to $2.6 billion in 2002. The increase in pas-

senger ticket revenues was primarily due to a 12.1% increase

in capacity, partially offset by lower cruise ticket prices and

occupancy levels. The increase in capacity was primarily asso-

ciated with the full year effect of the additions of

Constellation

,

Brilliance of the Seas

and

Navigator of the Seas

and the deliv-

eries of

Serenade of the Seas

and

Mariner of the Seas

in

2003. The increase in capacity was partially offset by the can-

cellation of sailings due to the unanticipated drydock of two

ships in 2003 and the transfer of

Viking Serenade

to Island

Cruises, our joint venture with First Choice Holidays PLC, in

2002. Lower cruise ticket prices and occupancy levels were

attributable to consumer apprehension towards travel prior to

and during the war in Iraq and continued economic uncertainty.

Occupancy in 2003 was 103.2% compared to 104.5% in 2002.

Onboard and other revenues increased 19.5% to $1.0 billion in

2003 compared to $0.8 billion in 2002. The increase was main-

ly attributable to a 19.8% increase in shipboard revenues

resulting primarily from an increase in capacity and the assump-

tion of certain onboard functions previously handled by a con-

cessionaire. Included in onboard and other revenues were con-

cession revenues of $163.0 million and $162.0 million in 2003

and 2002, respectively.

Gross Yields and Net Yields for 2003 decreased 1.7% and

0.6%, respectively, compared to 2002, primarily due to lower

cruise ticket prices and occupancy levels.

EXPENSES

Operating expenses increased 12.7% to $2.4 billion in 2003

compared to $2.1 billion in 2002. The increase was primarily

due to costs associated with an increase in capacity, the

assumption of certain onboard functions previously handled by

a concessionaire, fuel costs and the

Brilliance of the Seas

lease. The change in the concession arrangement resulted in

higher payroll and related expenses and onboard and other

expenses, partially offset by a decrease in food costs. Fuel

costs as a percentage of total revenues were 5.2% and 4.5%

for 2003 and 2002, respectively. Included in other operating

expenses in 2002 was a charge of $20.0 million recorded in

connection with a litigation settlement. In 2003, we reduced the

amount of the charge by approximately $5.8 million based on

the actual number of claims filed in these actions. (See Note

12. Commitments and Contingencies.) Operating expenses

per Available Passenger Cruise Day increased 0.5% in 2003

compared to 2002.

Marketing, selling and administrative expenses increased

19.3% to $514.3 million in 2003 compared to $431.1 million in

2002. The increase in 2003 was primarily attributable to new

initiatives associated with the Celebrity Cruises marketing

campaign and a return to more normalized spending levels. The

year 2002 reflected lower spending levels as a result of busi-

ness decisions taken subsequent to the events of September

11, 2001. Marketing, selling and administrative expenses as a

percentage of total revenues were 13.6% and 12.6% in 2003

and 2002, respectively. On a per Available Passenger Cruise

Day basis, marketing, selling and administrative expenses in

2003 increased 6.4% from 2002.

Net Cruise Costs per Available Passenger Cruise Day

increased 4.9% in 2003 compared to 2002. The increase in

2003 was primarily attributed to higher payroll and related

expenses, fuel costs,

Brilliance of the Seas

lease payments,

marketing costs associated with the Celebrity Cruises market-

ing campaign and a return to more normalized spending levels,

partially offset by the reduction in the litigation settlement

charge and a decrease in food costs.

Depreciation and amortization expenses increased 7.0% to

$362.7 million in 2003 from $339.1 million in 2002. The

increase was primarily due to incremental depreciation associ-

ated with the addition of new ships.

OTHER INCOME (EXPENSE)

Gross interest expense decreased to $284.3 million in 2003

from $290.3 million in 2002. The decrease was primarily attrib-

utable to lower interest rates. Capitalized interest decreased to

$15.9 million in 2003 from $23.4 million in 2002 due to a lower

average level of investment in ships under construction and

lower interest rates.

Included in other income (expense) in 2002 was $33.0 million

of net proceeds received in connection with the termination of

the P&O Princess merger agreement and $12.3 million of com-

pensation from shipyards related to the late delivery of ships.

ROYAL CARIBBEAN CRUISES LTD. 13

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (CONTINUED)