Royal Caribbean Cruise Lines 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

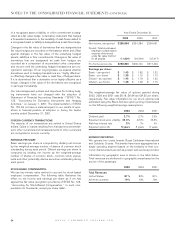

Our off-balance sheet arrangements consist primarily of oper-

ating lease commitments as discussed in Note 12.

Commitments and Contingencies. Under the

Brilliance of the

Seas

operating lease, we have agreed to indemnify the lessor

to the extent its after-tax return is negatively impacted by unfa-

vorable changes in corporate tax rates and capital allowance

deductions. These indemnifications could result in an increase

in our annual lease payments. We are unable to estimate the

maximum potential increase in such lease payments due to the

various circumstances, timing or combination of events that

could trigger such indemnifications. Under current circum-

stances we do not believe an indemnification is probable.

Some of the contracts that we enter into include indemnifica-

tion provisions that obligate us to make payments to the coun-

terparty if certain events occur. These contingencies generally

relate to changes in taxes, increased lender capital costs and

other similar costs. The indemnification clauses are often stan-

dard contractual terms and were entered into in the normal

course of business. There are no stated or notional amounts

included in the indemnification clauses and we are not able to

estimate the maximum potential amount of future payments, if

any, under these indemnification clauses. We have not been

required to make any payments under such indemnification

clauses in the past and, under current circumstances, we do

not believe an indemnification is probable.

As a normal part of our business, depending on market condi-

tions, pricing and our overall growth strategy, we continuously

consider opportunities to enter into contracts for the building of

additional ships. We may also consider the sale of ships. We

continuously consider potential acquisitions and strategic

alliances. If any of these were to occur, they would be financed

through the incurrence of additional indebtedness, the

issuance of additional shares of equity securities or through

cash flows from operations.

FUNDING SOURCES

As of December 31, 2003, our liquidity was $1.1 billion con-

sisting of approximately $330.1 million in cash and cash equiv-

alents and $780.0 million available under our unsecured revolv-

ing credit facility due 2008. (See Note 6. Long-Term Debt.)

Since December 31, 2003, we have received additional com-

mitments to our revolving credit facility bringing the amount

available under this facility to $1.0 billion. The other terms of

the facility were unchanged. (See Note 14. Subsequent

Events.) We have also decided not to use the secured export

financing previously available to us. In January 2004, we

entered into an 8-year, $200.0 million unsecured term loan, at

LIBOR plus 1.75%, which can be drawn any time prior to July

1, 2004. Capital expenditures, scheduled debt payments and

potential obligations under our zero coupon convertible notes

and Liquid Yield OptionTM Notes (as discussed above in foot-

note (1) of the contractual obligations table) will be funded

through a combination of cash flows from operations, draw-

downs under our available credit facilities, the incurrence of

additional indebtedness and the sales of equity or debt securi-

ties in private or public securities markets. There can be no

assurances that cash flows from operations and additional

financing from external sources will be available in accordance

with our expectations.

Our financing agreements contain covenants that require us,

among other things, to maintain minimum liquidity, net worth, and

fixed charge coverage ratio and limit our debt to capital ratio. We

are in compliance with all covenants as of December 31, 2003.

If A. Wilhelmsen AS. and Cruise Associates, our two principal

shareholders, cease to own a specified percentage of our com-

mon stock, we may be obligated to prepay indebtedness out-

standing under the majority of our credit facilities, which we

may be unable to replace on similar terms. If this were to occur,

it could have an adverse impact on our operations and liquidity.

We believe our availability under current existing credit facili-

ties, cash flows from operations and our ability to obtain new

borrowings and/or raise new capital will be sufficient to fund

operations, debt payment requirements and capital expendi-

tures over the next twelve-month period.

FINANCIAL INSTRUMENTS AND OTHER

GENERAL

We are exposed to market risk attributable to changes in inter-

est rates, foreign currency exchange rates and fuel prices. We

minimize these risks through a combination of our normal oper-

ating and financing activities and through the use of derivative

financial instruments pursuant to our hedging practices and

policies. The financial impacts of these hedging instruments are

primarily offset by corresponding changes in the underlying

exposures being hedged. We achieve this by closely matching

the amount, term and conditions of the derivative instrument

with the underlying risk being hedged. We do not hold or issue

derivative financial instruments for trading or other speculative

purposes. Derivative positions are monitored using techniques

including market valuations and sensitivity analyses. (See Note

11. Financial Instruments.)

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (CONTINUED)