Royal Caribbean Cruise Lines 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

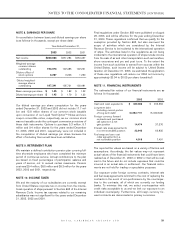

of a recognized asset or liability, or a firm commitment is desig-

nated as a fair value hedge. A derivative instrument that hedges

a forecasted transaction or the variability of cash flows related to

a recognized asset or liability is designated as a cash flow hedge.

Changes in the fair value of derivatives that are designated as

fair value hedges are recorded on the balance sheet and offset

against changes in the fair value of the underlying hedged

assets, liabilities or firm commitments. Changes in fair value of

derivatives that are designated as cash flow hedges are

recorded as a component of accumulated other comprehen-

sive income until the underlying hedged transactions are rec-

ognized in earnings. On an ongoing basis, we assess whether

derivatives used in hedging transactions are “highly effective”

in offsetting changes in fair value or cash flow of hedged items.

If it is determined that a derivative is not highly effective as a

hedge, changes in fair value of the derivatives are recognized

in earnings immediately.

Our risk-management policies and objectives for holding hedg-

ing instruments have not changed with the adoption of

Statement of Financial Accounting Standards (“SFAS”) No.

133, “Accounting for Derivative Instruments and Hedging

Activities,” on January 1, 2001. The implementation of SFAS

No. 133 did not have a material impact on our results of oper-

ations or financial position at adoption or during the twelve

months ended December 31, 2001.

FOREIGN CURRENCY TRANSACTIONS

The majority of our transactions are settled in United States

dollars. Gains or losses resulting from transactions denominat-

ed in other currencies and remeasurements of other currencies

are recognized in income currently.

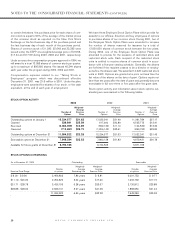

EARNINGS PER SHARE

Basic earnings per share is computed by dividing net income

by the weighted-average number of shares of common stock

outstanding during each period. Diluted earnings per share is

computed by dividing net income by the weighted-average

number of shares of common stock, common stock equiva-

lents and other potentially dilutive securities outstanding during

each period.

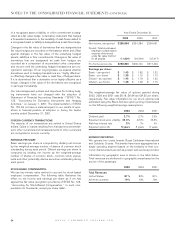

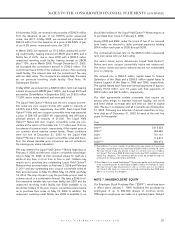

STOCK-BASED COMPENSATION

We use the intrinsic value method to account for stock-based

employee compensation. The following table illustrates the

effect on net income and earnings per share as if we had

applied the fair value recognition provisions of SFAS No. 123,

“Accounting for Stock-Based Compensation,” to such com-

pensation (in thousands, except per share data):

Year Ended December 31,

2003 2002 2001

Net income, as reported $280,664 $351,284 $254,457

Deduct: Total stock-based

employee compensation

expense determined

under fair value method

for all awards (11,834) (20,544) (37,017)

Pro forma net income $268,830 $330,740 $ 217,440

Earnings per share:

Basic – as reported $ 1.45 $ 1.82 $ 1.32

Basic – pro forma $ 1.39 $ 1.72 $ 1.13

Diluted – as reported $ 1.42 $ 1.79 $ 1.32

Diluted – pro forma $ 1.36 $ 1.69 $ 1.13

The weighted-average fair value of options granted during

2003, 2002 and 2001 was $8.18, $6.84 and $4.35 per share,

respectively. Fair value information for our stock options was

estimated using the Black-Scholes option-pricing model based

on the following weighted-average assumptions:

2003 2002 2001

Dividend yield 2.7% 2.7% 2.5%

Expected stock price volatility 42.4% 42.9% 43.3%

Risk-free interest rate 3% 3% 4%

Expected option life 5 years 5 years 5 years

SEGMENT REPORTING

We operate two cruise brands, Royal Caribbean International

and Celebrity Cruises. The brands have been aggregated as a

single operating segment based on the similarity of their eco-

nomic characteristics as well as product and services provided.

Information by geographic area is shown in the table below.

Total revenues are attributed to geographic areas based on the

source of the passenger.

2003 2002 2001

Total Revenues:

United States 81% 82% 81%

All other countries 19% 18% 19%

ROYAL CARIBBEAN CRUISES LTD.

24

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)