Rayovac 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

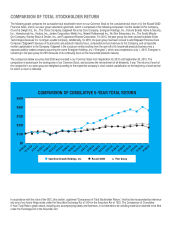

The following graph compares the cumulative total stockholder return on our Common Stock to the cumulative total return of (i) the Russell 2000

Financial Index, and (ii) our peer group selected in good faith, which is composed of the following companies: Central Garden & Pet Company,

Church & Dwight Co., Inc., The Clorox Company, Edgewell Personal Care Company, Energizer Holdings, Inc., Fortune Brands Home & Security,

Inc., Hanesbrands Inc., Hasbro, Inc., Jarden Corporation, Mattel, Inc., Newell Rubbermaid Inc., Nu Skin Enterprises, Inc., The Scotts Miracle-

Gro Company, Stanley Black & Decker, Inc., and Tupperware Brands Corporation. For 2015, the peer group has been revised to delete Exide

Technologies because it is no longer a public company. Additionally, for 2015, the peer group has been revised to add Edgewell Personal Care

Company (“Edgewell”) because of its personal care products industry focus, comparable annual revenues to the Company, and comparable

market capitalization to the Company. Edgewell is the successor entity resulting from the spin-off of its household products business into a

separate publicly-traded company assuming the name Energizer Holdings, Inc. (“Energizer”), which was completed on July 1, 2015. Energizer is

remaining in the peer group for 2015 because of its continuing focus on the household products industry.

The comparison below assumes that $100 was invested in our Common Stock from September 30, 2010 until September 30, 2015. The

comparison is based upon the closing price of our Common Stock, and assumes the reinvestment of all dividends, if any. The returns of each of

the companies in our peer group are weighted according to the respective company’s stock market capitalization at the beginning of each period

for which a return is indicated.

COMPARISON OF CUMULATIVE 5-YEAR TOTAL RETURN

$500

$400

$300

$200

$100

$0

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12

3/31/13

6/30/13

9/30/13

12/31/13

12/31/14

3/31/14

3/31/15

6/30/14

9/30/14

6/30/15

9/30/15

Spectrum Brands Holdings, Inc. Russell 2000 Peer Group

COMPARISON OF TOTAL STOCKHOLDER RETURN

In accordance with the rules of the SEC, this section, captioned “Comparison of Total Stockholder Return,” shall not be incorporated by reference

into any of our future filings made under the Securities Exchange Act of 1934 or the Securities Act of 1933. The Comparison of Cumulative

5-Year Total Return graph above, including any accompanying tables and footnotes, is not deemed to be soliciting material or deemed to be filed

under the Exchange Act or the Securities Act.