Public Storage 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Commercial Properties

not have a commanding market share, leading brand nor significant scale in any of the markets where it

operates. Instead, it has a “niche,” focusing on small to mid-size businesses, and an intensive and nimble

property operation. The key to shareholder returns in this business are bargain purchases (acquiring

properties well below replacement costs) and aggressively managing them through nimble leasing, tight

expense control and good capital management (broker commissions and tenant improvements). This

business is also more economically sensitive than self-storage. If done correctly, this business can

grown to over $90 per share, in addition to a growing dividend stream.

drive future growth from its well-located portfolio on the West Coast, Texas, Washington DC and Florida

markets.

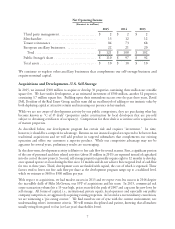

Net Operating Income

(Amounts in millions)

2015 2014 2013

Public Storage’s owned commercial properties 10 10 9

Total $ 264 $ 262 $ 250

Public Storage’s share $ 117 $ 117 $ 110

Total assets (before depreciation reserves) $ 3,097 $ 3,136 $ 3,284

Ancillary Businesses

We have four ancillary businesses: merchandise (mainly locks and boxes sold to self-storage customers),

tenant reinsurance (reinsurance of policies sold to our self-storage customers by a third-party insurance

company), third-party property management (fees we received for managing other owners’ properties) and

European ancillary businesses (sales of merchandise and insurance commissions received by Shurgard).

These businesses complement our self-storage business and each generates respectable revenue and cash

flow with no significant capital investment.

While modest in relative size, each ancillary business meaningfully contributes to Public Storage’s overall

Haga. Once again this business had an exceptional year as revenues increased by 16% in 2015, following 12%

and 9% increases in 2014 and 2013, respectively.