Public Storage 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Core funds from operations per share (“Core FFO”) represents diluted net income per share (“EPS”) before the

impact of i) depreciation expense and disposition gains or losses and ii) foreign currency gains and losses, the

application of EITF D-42, and certain other items. Free cash flow per share (“Free Cash Flow”) represents Core FFO,

less per share capital expenditures and non-cash stock based compensation expense. Core FFO and Free Cash Flow

are not substitutes for EPS and may not be comparable with other REITs due to calculation differences; however, we

believe they are helpful measures for investors and REIT analysts to understand our performance. Net Operating

Income (“NOI”) represents revenues less pre-depreciation cost of operations earned directly at our properties, and we

believe is a useful performance measure that we and the investment community use to evaluate performance and real

estate values. Each of these non-GAAP measures exclude the impact of depreciation, which is based upon historical

cost and assumes the value of buildings diminish ratably over time, while we believe that real estate values fluctuate due

Europe as if we owned them, to provide a measure of the performance of all the businesses we have a significant interest

in. However, the inclusion of these entities in these supplemental measures does not substitute for “equity in earnings

of unconsolidated real estate entities” on our income statement.

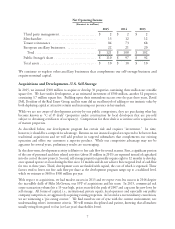

Supplemental Non-GAAP Disclosures (unaudited)

Reconciliation of Revenues including PSB and Shurgard Europe

(Amounts in millions)

For the year ended December 31,

2015 2014 2013

Consolidated revenues $ 2,382 $ 2,177 $ 1,965

Commercial and property management included in interest

and other income 16 18 16

Shurgard Europe’s revenues 237 214 207

Reconciliation of NOI

(Amounts in millions)

For the year ended December 31,

2015 2014 2013

Operating income on our income statement $ 1,232 $ 1,055 $ 951

Commercial and property management included in interest

and other income 12 13 12

Eliminate depreciation and G&A expense 514 510 454

Add -

Total net operating income 2,155 1,962 1,783

Public Storage’s share of NOI $ 1,936 $ 1,750 $ 1,579

Reconciliation of Core FFO and Free Cash Flow per Share

For the year ended December 31,

2015 2014 2013 2010 2005

EPS $ 6.07 $ 5.25 $ 4.89 $ 2.35 $ 1.97

Eliminate noncore items (including our equity share):

Depreciation expense 2.89 2.96 2.66 2.44 1.79

Real estate gains (0.17) (0.23) (0.02) (0.06) (0.13)

Foreign currency, EITF D-42, and other noncore items 0.11 0.11 (0.09) 0.49 0.06

Core FFO per share $ 8.90 $ 8.09 $ 7.44 $ 5.22 $ 3.69

Deduct capital expenditures and exclude non-cash comp (0.24) (0.36) (0.26) (0.41) (0.18)

Free Cash Flow per share $ 8.66 $ 7.73 $ 7.18 $ 4.81 $ 3.51