Progressive 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

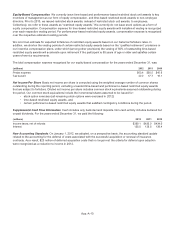

Fair Value

(millions) Level 1 Level 2 Level 3 Total Cost

December 31, 2011

Fixed maturities:

U.S. government obligations $2,963.0 $ 0 $ 0 $ 2,963.0 $ 2,842.7

State and local government obligations 0 2,002.1 0 2,002.1 1,938.6

Corporate debt securities 0 2,896.2 0 2,896.2 2,801.5

Subtotal 2,963.0 4,898.3 0 7,861.3 7,582.8

Asset-backed securities:

Residential mortgage-backed 0 364.6 62.3 426.9 452.9

Commercial mortgage-backed 0 1,855.3 21.3 1,876.6 1,829.8

Other asset-backed 0 1,218.0 2.6 1,220.6 1,210.9

Subtotal asset-backed securities 0 3,437.9 86.2 3,524.1 3,493.6

Redeemable preferred stocks:

Financials 24.1 107.2 0 131.3 124.3

Utilities 0 68.1 0 68.1 70.8

Industrials 0 174.5 0 174.5 184.2

Subtotal redeemable preferred stocks 24.1 349.8 0 373.9 379.3

Total fixed maturities 2,987.1 8,686.0 86.2 11,759.3 11,455.7

Equity securities:

Nonredeemable preferred stocks:

Financials 227.9 525.4 0 753.3 433.7

Utilities 0 53.0 0 53.0 40.0

Subtotal nonredeemable preferred stocks 227.9 578.4 0 806.3 473.7

Common equities:

Common stocks 1,834.1 0 0 1,834.1 1,427.3

Other risk investments 0 0 11.5 11.5 3.7

Subtotal common equities 1,834.1 0 11.5 1,845.6 1,431.0

Total fixed maturities and equity securities $5,049.1 $9,264.4 $97.7 14,411.2 13,360.4

Short-term investments:

Other short-term investments11,551.8 1,551.8

Total portfolio $15,963.0 $14,912.2

Debt1$ 2,664.7 $ 2,442.1

1Under the prior accounting guidance, fair value hierarchies were not required.

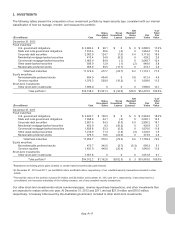

Our portfolio valuations classified as either Level 1 or Level 2 in the above tables are priced exclusively by external sources,

including: pricing vendors, dealers/market makers, and exchange-quoted prices. During 2012, we had one redeemable

preferred security with a value of $25.0 million that was transferred from Level 1 to Level 2 as it is no longer traded on an

exchange. During 2011, we had one nonredeemable preferred security with a value of $44.2 million that was transferred

from Level 1 to Level 2 due to the lack of an exchange-quoted price at year-end. The exchange price was not available due

to illiquidity in the market place. A consistent exchange-quoted price was previously available for this security, and we will

continue to monitor the security for future exchange trading volume. We recognize transfers between levels at the end of

the reporting period.

Our short-term security holdings classified as Level 1 are considered highly liquid, actively marketed, and have a very short

duration, primarily seven days or less to redemption. These securities are held at their original cost, adjusted for any

amortization of discount or premium, since that value very closely approximates what an active market participant would be

willing to pay for such securities. The remainder of our short-term securities are classified as Level 2 and are not priced

externally since these securities continually trade at par value. These securities are classified as Level 2 since they are

primarily longer-dated auction securities issued by municipalities that contain a redemption put feature back to the auction

pool with a redemption period of less than seven days. The auction pool is created by a liquidity provider and if the auction

is not available at the end of the seven days, we have the right to put the security back to the issuer at par.

App.-A-20