Porsche 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 117

Annual Report

Porsche AG

2014

Financial

Data

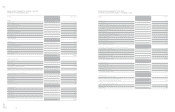

OF PORSCHEAG AS OF DECEMBER 31, 2014

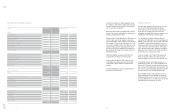

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

€ million Dec. 31, 2014 Dec. 31, 2013

ASSETS

Intangible assets 2,953 2,590

Property, plant and equipment 4,087 3,935

Equity-accounted investments 334 –

Other equity investments 23 306

Leased assets 2,294 1,708

Receivables from financial services 1,140 1,006

Other receivables and assets 8,372 8,657

Income tax assets 16 25

Deferred tax assets 562 165

Non-current assets 19,781 18,392

Inventories 2,157 1,589

Trade receivables 522 424

Receivables from financial services 556 544

Other receivables and assets 1,304 1,933

Income tax assets 141 54

Securities 39 54

Cash and cash equivalents 1,560 1,570

Current assets 6,279 6,168

26,060 24,560

EQUITY AND LIABILITIES

Subscribed capital 45 45

Capital reserves 7,150 6,321

Retained earnings 2,401 2,673

Equity before non-controlling interests 9,596 9,039

Non-controlling interests 3–

Equity 9,599 9,039

Provisions for pensions and similar obligations 2,361 1,544

Income tax provisions –2

Other provisions 811 715

Deferred tax liabilities 684 719

Financial liabilities 3,469 3,725

Other liabilities 625 255

Non-current liabilities 7,950 6,960

Income tax provisions 80 52

Other provisions 1,337 1,214

Financial liabilities 1,884 2,946

Trade payables 1,856 1,485

Other liabilities 2,868 2,524

Income tax liabilities 486 340

Current liabilities 8,511 8,561

26,060 24,560

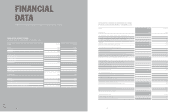

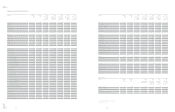

CONSOLIDATED STATEMENT OF CASH FLOWS

OF PORSCHEAG FOR THE PERIOD JANUARY 1 TO DECEMBER 31, 2014

€ million FY 2014 FY 2013

Profit before tax 3,060 2,784

Income taxes paid – 784 – 351

Depreciation and amortization 1,878 1,415

Gain/loss on the disposal of intangible assets and property, plant and equipment – 281 – 75

Share of profit or loss of equity-accounted investments 1–

Other non-cash expense/income 254 22

Change in inventories – 460 – 412

Change in receivables (excluding financial services) – 586 – 127

Change in liabilities (excluding financial liabilities) 608 107

Change in pension provisions 164 125

Change in other provisions 195 106

Change in leased assets – 775 – 753

Change in receivables from financial services – 95 76

Cash flow from operating activities 3,179 2,917

Investments in intangible assets (excluding capitalized development costs)

and property, plant and equipment – 1,047 – 1,421

Additions to capitalized development costs – 1,067 – 815

Change in equity investments – 50 – 9

Cash received from disposal of intangible assets and property, plant and equipment 170 204

Change in investments in securities 14 – 1

Change in loans – 268 – 48

Cash flow from investing activities – 2,248 – 2,090

Capital contributions 829 –

Cash paid to shareholders – 1,414 –

Proceeds from issuance of bonds 2,473 2,509

Repayment of bonds – 2,228 – 2,193

Change in other financial liabilities – 638 – 513

Cash flow from financing activities – 978 – 197

Change in cash funds – 47 630

Exchange-rate related change in cash funds 37 – 17

Cash and cash equivalents at the beginning of the period 1,570 957

Cash and cash equivalents at the end of the period 1,560 1,570

Cash and cash equivalents at the end of the period 1,560 1,570

Securities, loans and time deposits 526 1,398

Gross liquidity 2,086 2,968