Porsche 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 113

Annual Report

Porsche AG

2014

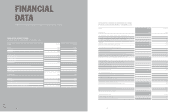

RESULTS OF OPERATIONS

The PorscheAG group’s prot after tax increased by

262million euro from 1,939million euro in the corre-

sponding prior-year period to 2,201million euro in the

reporting period. The tax rate in the reporting period was

28percent (prior year: 30percent).

Group revenue of the PorscheAG group was 17,205mil-

lion euro in the reporting period (prior year: 14,326mil-

lion euro). In the past nancial year, the PorscheAG

group sold 187,208 vehicles. This corresponds to an

increase in unit sales of 21percent compared to the pri-

or year. The principal contribution to the growth in sales

volume and revenue was made by the new Macan model

with 48,569 vehicles sold. Sales of the Cayenne model

declined by 13,883 vehicles due to a change of model.

The cost of sales increased dependent on revenue to

12,885million euro (prior year: 10,139million euro)

which represents 75percent of revenue (prior year:

71percent). The reduction in the gross margin from

29percent to 25percent is mainly the result of the

changes in the product mix following the introduction of

the Macan model as well as increased expenses in the

area of research and development. The capitalization

rate for research and development costs amounts to

55percent (prior year: 52percent). The import duties

and consumption taxes incurred in the Chinese market

also contributed to the decline in the gross margin.

Distribution expenses rose from 1,075million euro to

1,257million euro due to the higher volume of sales.

Administrative expenses declined slightly from 792million

euro to 789million euro. Distribution expenses remained

with 7percent and administrative expenses with 5percent

unchanged in relation to revenue.

The personnel expenses across all functions of the

PorscheAG group increased from 1,865million euro to

2,165million euro. The average number of employees

during the year rose by 2,746 to 21,303. The increase

mainly results from the expansion of the number of

employees at the Leipzig plant.

Depreciation and amortization across all functions in-

creased to 1,878million euro compared to 1,415million

euro in the prior year. This mainly relates to the amorti-

zation of development costs and depreciation of tools

that are disclosed under other equipment, furniture and

xtures. Depreciation of leased assets also increased

signicantly.

Other operating income rose from 610million euro to

895million euro. The increase is mainly attributable to

increased income from the reversal of provisions and

accruals as well as higher income relating to forward

exchange transactions. Other operating expenses rose

from 351million euro to 450million euro. The increase

mainly reflects higher expenses in connection with

forward exchange transactions.

Operating prot amounts to 2,719million euro, an in-

crease of 140million euro in comparison to the previous

year.

The nancial result amounts to 341million euro (prior

year: 205million euro). This item includes income of

271million euro relating to the change in accounting for

the investment in Bertrandt AG using the equity method.

In contrast, an increase was recorded in the expens-

es from fair value measurement relating principally to

exchange rate and interest rate hedging transactions that

are not included in hedge accounting.

The healthy cost structure and the sustainably high

earnings power of the group are also reected in the key

performance indicators. The PorscheAG group achieved

an operating return on sales of 16percent in the past

nancial year (prior year: 18percent). The pre-tax return

on sales was 18percent (prior year: 19percent). The

return on capital, dened as the ratio of the operating

result after tax to the average invested assets of the

automotive division, amounts to 27percent (prior year:

30percent). The post-tax return on equity was 24per-

cent (prior year: 24percent).

Financial

Analysis

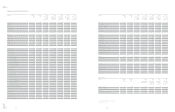

RESULTS OF OPERATIONS OF THE PORSCHE AG GROUP

FY 2014 FY 2013

€ million %€ million %

Revenue 17,205 100 14,326 100

Cost of sales – 12,885 – 75 – 10,139 – 71

Gross profit 4,320 25 4,187 29

Distribution expenses – 1,257 – 7 – 1,075 – 7

Administrative expenses – 789 – 5 – 792 – 5

Other operating income 895 6610 4

Other operating expenses – 450 – 3 – 351 – 3

Operating profit 2,719 16 2,579 18

Financial result 341 2205 1

Profit before tax 3,060 18 2,784 19

Income tax – 859 – 5 – 845 – 5

Profit after tax 2,201 13 1,939 14