Popeye's 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Popeye's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(1) Additional information concerning financial performance can be found in

Popeyes Louisiana Kitchen, Inc.’s Consolidated Financial Statements and

Management’s Discussion & Analysis of Financial Condition and Results of

Operations in the 2013 Annual Report on Form 10-K.

(2) Weighted average common shares for the computation of diluted earnings per

common share were 24.1 million, 24.5 million and 25.0 million for fiscal years

2013, 2012 and 2011, respectively.

(3) The Company defines adjusted net income for the periods presented as the

Company’s reported net income after adjusting for certain non-operating items

consisting of the following:

a) other expense (income), net, as follows:

i. fiscal 2013 includes $0.4 million loss on disposals of property and equip-

ment partially offset by $0.1 million in net gain on sale of assets;

ii. fiscal 2012 includes $0.9 million in gains on sale of real estate assets to

franchisees partially offset by $0.3 million loss on disposals of property

and equipment and $0.1 million of hurricane-related expenses, net;

iii. fiscal 2011 includes $0.8 million in expenses for the global service center

relocation, and $0.5 million in disposals of fixed assets offset by a $0.8

net gain on the sale of assets;

iv. fiscal 2010 includes $0.7 million for impairments and disposals of fixed

assets partially offset by $0.5 million for net gain on sales of assets; and

v. fiscal 2009 includes $3.3 million on the sale of assets partially offset by a

$0.4 million loss on insurance recoveries related to asset damages, a $0.2

million impairment related to restaurant closures and $0.6 million related

to impairments and disposals of fixed assets.

b) for fiscal 2013, $0.4 million in interest expenses from the retirement of the

2010 Credit Facility;

c) for fiscal 2012, $0.5 million in legal fees related to licensing arrangements;

d) for fiscal 2011, $0.5 million in accelerated depreciation related to the

Company’s relocation to a new corporate service center;

e) for fiscal 2010, $0.6 million in interest charges associated with the retire-

ment of the Company’s 2005 Credit Facility, and a $1.4 million tax audit

benefit related to the completion of a federal income tax audit for years

2004 and 2005;

f) for fiscal 2009, $1.9 million in interest charges associated with the Company’s

2005 Credit Facility amendment; and

g) the tax effect of these adjustments.

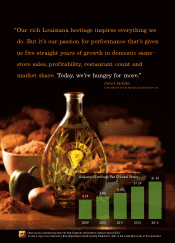

Adjusted earnings per diluted share provides the per share effect of adjusted

net income on a diluted basis. The following table reconciles on a historical

basis for fiscal years 2013, 2012, 2011, 2010 and 2009, the Company’s adjusted

earnings per diluted share on a consolidated basis to the line on its consoli-

dated statement of operations entitled net income, which the Company believes

is the most directly comparable GAAP measure on its consolidated statement of

operations:

(4) The Company defines Operating EBITDA as earnings before interest expense,

taxes, depreciation and amortization, other expenses (income), net, and legal

fees related to licensing arrangements. The following table reconciles on a

historical basis for fiscal years 2013, 2012 and 2011, the Company’s Operating

EBITDA on a consolidated basis to the line on its consolidated statement of

operations entitled net income, which the Company believes is the most

directly comparable GAAP measure on its consolidated statement of operations.

Operating EBITDA margin is defined as Operating EBITDA divided by total

revenues.

Non-GAAP Reconciliations

(in millions, except per share data) 2013 2012 2011 2010 2009

Net income $ 34.1 $ 30.4 $ 24.2 $ 22.9 $ 18.8

Other expense (income), net $ 0.3 $ (0.5) $ 0.5 $ 0.2 $ (2.1)

Interest expense associated with credit

facility retirements and amendments $ 0.4 — — $ 0.6 $ 1.9

Legal fees related to licensing

arrangements — $ 0.5 — — —

Accelerated depreciation related to

the Company’s relocation to a

new Global Service Center — — $ 0.5 — —

Tax audit benefit — — — $ (1.4) —

Tax effect $ (0.3) — $ (0.5) $ (0.3) $ 0.1

Adjusted net income $ 34.5 $ 30.4 $ 24.7 $ 22.0 $ 18.7

Adjusted earnings per diluted share $ 1.43 $ 1.24 $ 0.99 $ 0.86 $ 0.74

Weighted average diluted shares

outstanding 24.1 24.5 25.0 25.5 25.4

(in millions) 2013 2012 2011

Net income $ 34.1 $ 30.4 $ 24.2

Interest expense, net 3.7 3.6 3.7

Income tax expense 20.4 17.3 12.8

Depreciation and amortization 6.7 4.6 4.2

Other expenses (income), net 0.3 (0.5) 0.5

Legal fees related to licensing arrangements — 0.5 —

Operating EBITDA $ 65.2 $ 55.9 $ 45.4

Total Revenues $ 206.0 $ 178.8 $ 153.8

Operating EBITDA margin 31.7% 31.3% 29.5%

(in millions) 2013 2012 2011

Net income $ 34.1 $ 30.4 $ 24.2

Depreciation and amortization 6.7 4.6 4.2

Stock-based compensation expense 5.4 4.9 2.9

Maintenance capital expenditures (4.2) (3.2) (2.8)

Free cash flow $ 42.0 $ 36.7 $ 28.5

(5) The Company defines Free Cash Flow as net income plus depreciation and

amortization plus stock-based compensation expense, minus maintenance

capital expenditures which includes: for fiscal year 2013, $2.2 million in company-

operated restaurant reimages, $0.9 million of information technology hardware

and software and $1.1 million in other capital assets to maintain, replace and

extend the lives of company-operated restaurant facilities and equipment; for

fiscal 2012, $0.6 million in company-operated restaurant reimages, $1.1 million of

information technology hardware and software and $1.5 million in other capital

assets to maintain, replace and extend the lives of company-operated restau-

rant facilities; and for fiscal 2011, $1.5 million in company-operated restaurant

reimages, $0.8 million of information technology hardware and software and

$0.5 million in other capital assets to maintain, replace and extend the lives of

company-operated restaurant facilities. In 2013, maintenance capital expendi-

tures exclude $13.8 million related to the acquired restaurants in Minnesota and

California and $15.3 million for the construction of new Company-operated

restaurants. In 2012, maintenance capital expenditures exclude $16.9 million

related to the acquired restaurants in Minnesota and California and $7.2 million

for the construction of new Company-operated restaurants. In 2011, mainte-

nance capital expenditures exclude $3.3 million related to the construction of

the new corporate office and $1.5 million for the construction of new company-

operated restaurants.

The following table reconciles on a historical basis for fiscal years 2013, 2012,

and 2011, the Company’s Free Cash Flow on a consolidated basis to the line

on its consolidated statement of operations entitled net income, which the

Company believes is the most directly comparable GAAP measure on its

consolidated statement of operations.

(6) Adjusted earnings per share, Operating EBITDA and free cash flow are supple-

mental non-GAAP financial measures. The Company uses adjusted earnings per

share, operating EBITDA and free cash flow, in addition to net income, operating

profit and cash flows from operating activities, to assess its performance and

believes it is important for investors to be able to evaluate the Company using

the same measures used by management. The Company believes these

measures are important indicators of its operational strength and the perfor-

mance of its business. Adjusted earnings per diluted share, operating EBITDA,

free cash flow as calculated by the Company are not necessarily comparable to

similarly titled measures reported by other companies. In addition, adjusted

earnings per diluted share, operating EBITDA, free cash flow: (a) do not repre-

sent net income, cash flows from operations or earnings per share as defined

by GAAP; (b) are not necessarily indicative of cash available to fund cash flow

needs; and (c) should not be considered as an alternative to net income, earn-

ings per share, operating profit, cash flows from operating activities or other

financial information determined under GAAP.

(7) System-wide sales growth calculates combined sales of all restaurants that we

operate or franchise. Sales information for franchised restaurants is provided

by our franchisees. System-wide sales are unaudited.

Check out our online annual report at http://popeyes.com/investors/annual-reports/2013/

10