Popeye's 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Popeye's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

POPEYES LOUISIANA KITCHEN, INC. 2013 ANNUAL REPORT

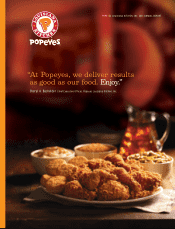

“At Popeyes, we deliver results

as good as our food. Enjoy.”

Cheryl A. Bachelder Chief Executive Officer, Popeyes Louisiana Kitchen, Inc.

Table of contents

-

Page 1

POPEYES LOUISIANA KITCHEN, INC. 2013 ANNUAL REPORT "At Popeyes, we deliver results as good as our food. Enjoy." Cheryl A. Bachelder Chief Executive Officer, Popeyes Louisiana Kitchen, Inc. -

Page 2

THE INGREDIENTS DRIVING OUR GROWTH. 15 consecutive quarters of positive same-store sales 20.8 percent market share of the domestic chicken quick service restaurant category We have 1,769 Domestic Units 365 new within last 5 years NATIONAL MEDIA -

Page 3

... in the new Popeyes Louisiana Kitchen image, bringing the total to over 1,100 restaurants, or 60% of the domestic system. 90% by year-end 2015 2015: 10% 2012: 25% 80% by year-end 2014 2014: 20% 2013: 35% On average, remodeled restaurants enjoy a 3% to 4% sales lift. 60% at year-end 2013... -

Page 4

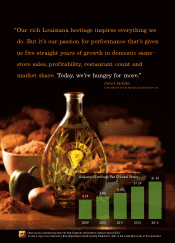

... sales, profitability, restaurant count and market share. Today, we're hungry for more." Cheryl A. Bachelder Chief Executive Officer, Popeyes Louisiana Kitchen, Inc. Adjusted Earnings Per Diluted Share $1.24 $.99 $.74 $.86 $1.43 2009 2010 2011 2012 2013 Check out our online annual report... -

Page 5

... $1.24 per diluted share in 2012. With our highly franchised business model, we generated free cash flow of $42 million as a result of our strong sales, new restaurants and increased restaurant profitability. Altogether, we added 126 net restaurants to our global footprint for a total of 2,225 and... -

Page 6

... opened two new franchise international markets, Vietnam and Chile. In 2013, Popeyes' system-wide sales increased 8.2 percent, driven largely by global same-store sales performance and the sales in our new restaurants. Global same-store sales increased 3.7 percent, compared to 6.9 percent last year... -

Page 7

... TO ACHIEVE SUPERIOR RESULTS By inspiring our people to serve, we are becoming a high-performing company that delivers not only the best food but also the best place to work and the best guest experience around. PRINCIPLES: HOW WE DO BUSINESS POPEYES LOUISIANA KITCHEN, INC. 2013 ANNUAL REPORT 3 -

Page 8

... of steadily increasing market share 5Years BUILD A DISTINCTIVE BRAND Popeyes Louisiana Kitchen is a 42-year-old brand that is behaving like a whole new concept. Over the past five years, we have excelled by building our brand and highlighting the quality of our food. Today our menu, message and... -

Page 9

... volumes than the system average. The first-year sales of our new domestic freestanding restaurants opened in 2012 were approximately $1.6 million per year, outperforming our total domestic system average unit volume by approximately 30 percent. POPEYES LOUISIANA KITCHEN, INC. 2013 ANNUAL REPORT... -

Page 10

... food, but for our business and our brand. Most importantly, we share a vision for making Popeyes a leader among quick service restaurants. Together, we are working to achieve profitable growth. It's a virtuous cycle: by increasing new restaurant sales, we are growing our national advertising fund... -

Page 11

... help franchisees gather and analyze data. Already, the way we measure and manage store-level profitability is a strength of our strategy. Our franchisees have access to software that allows them to measure and improve their results over time. POPEYES LOUISIANA KITCHEN, INC. 2013 ANNUAL REPORT 7 -

Page 12

.... The enormous enthusiasm in the franchise community has allowed us to claim an increasing share of the domestic market. WE ARE IN THE BUSINESS OF SERVICE. Our teams bring their unique passion and enthusiasm to the table each and every day. When we create the right environment for them, they are... -

Page 13

... per common share, diluted (3,6) Operating EBITDA (4,6) Operating EBITDA margin (4,6) Free cash flow (5,6) Global system-wide sales growth (7) Domestic same-store sales growth International same-store sales growth Global same-store sales growth New restaurant openings Total restaurants 2013 $ 121... -

Page 14

... million related to the construction of the new corporate office and $1.5 million for the construction of new companyoperated restaurants. The following table reconciles on a historical basis for fiscal years 2013, 2012, and 2011, the Company's Free Cash Flow on a consolidated basis to the line on... -

Page 15

... of the registrant, based on the closing sale price as reported on the NASDAQ Global Market System, was approximately $900,080,000. Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. Class Common stock, $0.01 par value per... -

Page 16

...Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item 13. Certain Relationships and Related Transactions, and Director Independence Item 14. Principal Accountant Fees and Services... -

Page 17

...") from AFC Enterprises, Inc. Popeyes develops, operates, and franchises quick-service restaurants ("QSRs" or "restaurants") under the trade names Popeyes® Chicken & Biscuits and Popeyes® Louisiana Kitchen. Within Popeyes, we manage two business segments: franchise operations and company-operated... -

Page 18

...opening dates for each restaurant. Our Popeyes franchisees currently pay a development fee ranging from $7,500 to $12,500 per restaurant. Typically these development fees are paid when the agreement is executed and are non-refundable. International Development Agreements. Our international franchise... -

Page 19

... for a Popeyes restaurant operation is fresh chicken. Companyoperated and franchised restaurants purchase their chicken from suppliers who service the Popeyes system. In order to ensure favorable pricing and to secure an adequate supply of fresh chicken, SMS has entered into supply agreements with... -

Page 20

... operations represented approximately 10.9% of our total franchise revenues. For each of 2013, 2012, and 2011, international revenues represented 6.4%, 6.9% and 7.5% of total revenues, respectively. Insurance We carry property, general liability, business interruption, crime, directors and officer... -

Page 21

...offer a franchise. We have franchise agreements related to the operation of restaurants located on various U.S. military bases which are with certain governmental agencies and are subject to renegotiation of profits or termination at the election of the U.S. government. During 2013, royalty revenues... -

Page 22

... our business as a whole. If we have adverse publicity due to any of these concerns, we may lose customers and our revenues may decline. If our franchisees are unable or unwilling to open a sufficient number of restaurants, our growth strategy could be at risk. As of December 29, 2013, we franchised... -

Page 23

..., currency exchange rates, local economic conditions, political instability and other risks associated with doing business in foreign countries. We expect that our franchise revenues generated from international operations will increase in the future, thus increasing our exposure to changes in... -

Page 24

... and investors, the market price of our common stock could decline. Factors that may cause our results or same-store sales to fluctuate include the following the opening of new restaurants by us or our franchisees; the closing of restaurants by us or our franchisees; increases in the number of... -

Page 25

... and create negative publicity which could result in a decline in our sales. Instances of food-borne illness or avian flu could adversely affect the price and availability of poultry and other foods. As a result, Popeyes restaurants could experience a significant increase in food costs if there are... -

Page 26

..., through acquisitions of third parties, we may acquire brands and related trademarks that are subject to the same risks as the brand and trademarks we currently own. Our 2013 Credit Facility may limit our ability to expand our business, and our ability to comply with the repayment requirements... -

Page 27

... franchise agreement for that site. The following table sets forth the locations by state of land and buildings which we lease or sublease to our franchisees as of December 29, 2013: Land and/ or Buildings Leased Land and Buildings Owned Total Texas ...Georgia ...California ...Minnesota... -

Page 28

...Operations Officer. From 2006 to 2008, Mr. Bower was the KFC operations leader responsible for more than 1,300 KFC franchised restaurants in the western United States. Prior to this position, he led KFC company operations in Pennsylvania, New Jersey and Delaware. From 2002 to 2003 Mr. Bower directed... -

Page 29

... 2000, he was Corporate Counsel for the Company. Andrew Skehan, age 53, was appointed our Chief Operating Officer - International in August 2011. From October 2009 until August 2011, Mr. Skehan was Chief Operating Officer - International for Wendy's/Arby's Group in Atlanta, Georgia. From April 2007... -

Page 30

... PURCHASES OF EQUITY SECURITIES Our common stock currently trades on the NASDAQ Global Market under the symbol "PLKI." The following table sets forth the high and low per share sales prices of our common stock, by quarter, for fiscal years 2013 and 2012. 2013 (dollars per share) High Low High 2012... -

Page 31

... to the indices, that all dividends were reinvested. Comparison of Cumulative Five Year Total Return Company Name / Index 12/28/2008 12/27/2009 12/26/2010 12/25/2011 12/30/2012 12/29/2013 Popeyes Louisiana Kitchen, Inc...S&P 500 Index...S&P 1500 Restaurants Index...Former Peer Group Index ... 100... -

Page 32

... Annual Report. (in millions, except per share data) 2013 2012 2011 2010 2009 Summary of Operations: Revenues:(1) Sales by company-operated restaurants(2) ...$ 78.7 121.9 Franchise royalties and fees(3) ...5.4 Rent from franchised restaurants(4) ...Total revenues ...206.0 Expenses: Restaurant food... -

Page 33

... comparability of sales by company-operated restaurants for the years presented include: (a) The Company opened nine, five and two company restaurants in 2013, 2012 and 2011, respectively. The impact of new restaurant openings net of one closure in 2013 was an increase in company-operated sales of... -

Page 34

(c) During 2010 we expensed $0.6 million as a component of interest expense, net in connection with the extinguishment of the 2005 Credit Facility term loan. (d) During 2009 we expensed $1.9 million as a component of interest expense, net in connection with the third amendment and restatement of the... -

Page 35

... same-store sales increase...International franchised restaurants same-store sales increase . Total global same-store sales increase (2) ...Company-operated restaurants (all domestic) Restaurants at beginning of year ...New restaurant openings ...Restaurant conversions, net (3) ...Permanent closings... -

Page 36

... operates, and franchises quick-service restaurants under the trade names Popeyes® Chicken & Biscuits and Popeyes® Louisiana Kitchen (collectively "Popeyes") in 47 states, the District of Columbia, Puerto Rico, Guam, the Cayman Islands, and 28 foreign countries. Popeyes has two reportable business... -

Page 37

... which has led to an increase in Popeyes market share of the chicken-QSR category to 20.8% for 2013. Company-operated restaurant same-store sales increased 2.3%, compared to 5.3% in 2012. Same-store sales in 2013 were comprised of 3.4% in our heritage markets, New Orleans and Memphis, offset by... -

Page 38

... due to an increase in same-store sales of 2.3% and new restaurant openings in 2013 and 2012. Company-operated restaurant operating profit margin was 18.7% of sales in 2013 compared to 17.3% of sales last year. The higher restaurant operating profit margin was primarily due to overall lower food and... -

Page 39

... in marketing and menu development expenses, $0.5 million increase in multi-unit management expenses in new company-operated restaurant markets in Indianapolis and Charlotte, $0.5 million increase in stock-based compensation expense, and $0.8 million increase in leadership development, global supply... -

Page 40

... tax rates. Comparisons of Fiscal Years 2012 and 2011 Sales by Company-Operated Restaurants Sales by company-operated restaurants were $64.0 million in 2012, a $9.4 million increase from 2011. The increase was primarily due to new restaurants opened and a 5.3% increase in same-store sales. Franchise... -

Page 41

.... For 2012, company-operated restaurant operating profit was $11.1 million, a $0.9 million increase compared to 2011. Company-operated restaurant operating profit was offset by a $0.9 million planned increase in restaurant support and pre-opening costs in new company-operated markets Indianapolis... -

Page 42

... 40 basis points. The increment over LIBOR and the commitment fee are determined quarterly based upon the Consolidated Total Leverage Ratio. As of December 29, 2013 and December 30, 2012, the Company's weighted average interest rates for all outstanding indebtedness under its credit facilities were... -

Page 43

...-operated restaurants ...Information technology hardware and software ...Point of sale hardware and software at company-operated restaurants ...Construction of the new corporate office(1) ...13.8 2.2 0.9 - - 7.2 $ 1.5 16.9 0.6 1.1 - - - 1.5 0.2 0.6 3.3 Other capital assets(2) ...1.1 1.5 0.5 Total... -

Page 44

..., as of December 29, 2013 : (in millions) 2014 2015 2016 2017 2018 Thereafter Total Long-term debt, excluding capital leases(1) ...$ Interest on long-term debt, excluding capital leases(1) ...Leases(2) ...Copeland formula agreement(3) ...Information technology outsourcing Business process services... -

Page 45

.... If we believe the risks inherent in the business increase, the resulting change in the discount rate could also result in future impairment of the recorded goodwill. Fair Value Measurements. Fair value is the price the Company would receive to sell an asset or pay to transfer a liability (exit... -

Page 46

... of our stock price, expected forfeiture rates, expected dividend yield and expected term. If any of the assumptions used in the models change significantly, share-based compensation expense may differ materially in the future from that recorded in the current period. Our specific weighted average... -

Page 47

... until a future date are expected to have an immaterial impact on the financial statements upon adoption. Management's Use of Non-GAAP Financial Measures Adjusted earnings per diluted share, Operating EBITDA, Company-operated restaurant operating profit and Free cash flow are supplemental non-GAAP... -

Page 48

... a historical basis for fiscal years 2013, 2012 and 2011, the Company's company-operated restaurant operating profit to the line item on its consolidated statement of operations entitled sales by company-operated restaurants, which the Company believes is the most directly comparable GAAP measure on... -

Page 49

... future growth, planned share repurchases, projections and expectations regarding same-store sales for fiscal 2014 and beyond, the Company's ability to improve restaurant level margins, guidance for new restaurant openings and closures, effective income tax rate, and the Company's anticipated 2014... -

Page 50

... increased costs through higher pricing is limited by the competitive environment in which we operate. In order to ensure favorable pricing for fresh chicken purchases and to maintain an adequate supply of fresh chicken for the Popeyes system, Supply Management Services, Inc. (a not-for-profit... -

Page 51

...Officer ("CFO"). Based on management's assessment, the CEO and CFO concluded that the Company's disclosure controls and procedures were effective as of December 29, 2013 to ensure that information required to be disclosed in the reports we file or submit under the Exchange Act is recorded, processed... -

Page 52

... public accounting firm that audited our consolidated financial statements included in this Annual Report, has also audited the effectiveness of the Company's internal control over financial reporting as of December 29, 2013. This report can be found on Page 40 of this Annual Report. (d) Changes... -

Page 53

... applies to our directors and all of our employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the Honor Code is available on our website at www.investor.popeyes.com. Copies... -

Page 54

... beginning on Page 45 of the report: Pages Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets as of December 29, 2013 and December 30, 2012 ...Consolidated Statements of Operations for Fiscal Years 2013, 2012, and 2011...Consolidated Statements of Comprehensive... -

Page 55

... Copeland Enterprises, Inc. and Popeyes Famous Fried Chicken, Inc., as amended to date. Supply Agreement dated March 21, 1989 between New Orleans Spice Company, Inc. and Biscuit Investments, Inc. Recipe Royalty Agreement dated March 21, 1989 by and among Alvin C. Copeland, New Orleans Spice Company... -

Page 56

....* Indemnification Agreement dated August 9, 2001 by and between the Company and R. William Ide, III.* AFC Enterprises, Inc. Employee Stock Purchase Plan.* AFC Enterprises, Inc. 2002 Incentive Stock Plan.* AFC Enterprises, Inc. Annual Executive Bonus Program.* Royalty and Supply Agreement dated July... -

Page 57

... Number Description 10.37(o) 10.38(v) Indemnity Agreement dated February 5, 2004 by and between the Company, Cajun Operating Company and Supply Management Services, Inc. Credit Agreement, dated as of December 18, 2013, by and among the Company, the guarantor named therein, the lenders named... -

Page 58

....1 32.2 101 Indemnification Agreement by and between the Company and Martyn R. Redgrave, dated October 9, 2013.* Indemnification Agreement by and between the Company and Joel K. Manby, dated September 5, 2013.* Statement regarding computation of per share earnings. Consent of PricewaterhouseCoopers... -

Page 59

... by reference herein. (n) Filed as an exhibit to the Form 8K of the Company filed on September 6, 2013 and incorporated by reference herein. (o) Filed as an exhibit to the Form 10-K of the Company for the fiscal year ended December 26, 2004 on March 28, 2005 and incorporated by reference herein... -

Page 60

... duly authorized on the 26th day of February 2014. POPEYES LOUISIANA KITCHEN, INC. By: /s/ CHERYL A. BACHELDER Cheryl A. Bachelder Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this report has been signed below by the following persons... -

Page 61

Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Popeyes Louisiana Kitchen, Inc.: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of operations, comprehensive income, changes in shareholders' ... -

Page 62

..., and December 30, 2012 (In millions, except share data) 2013 2012 Current assets: Cash and cash equivalents ...$ Accounts and current notes receivable, net ...Other current assets ...Advertising cooperative assets, restricted ...Total current assets ...Long-term assets: Property and equipment, net... -

Page 63

... of Operations For Fiscal Years 2013, 2012, and 2011 (In millions, except per share data) 2013 2012 2011 Revenues: Sales by company-operated restaurants ...$ 78.7 Franchise royalties and fees ...121.9 Rent from franchised restaurants ...Total revenues...Expenses: Restaurant food, beverages... -

Page 64

Popeyes Louisiana Kitchen, Inc. Consolidated Statements of Comprehensive Income For Fiscal Years 2013, 2012, and 2011 (In millions) 2013 2012 2011 Net income ...$ 34.1 Other comprehensive income Net change in fair value of cash flow hedge ...0.4 Reclassification adjustments for derivative losses ... -

Page 65

Popeyes Louisiana Kitchen, Inc. Consolidated Statements of Changes in Shareholders' Equity For Fiscal Years 2013, 2012, and 2011 (Dollars in millions) Common Stock Number of Shares Balance at December 26, 2010 ...Net income ...Other comprehensive income, net of tax ...Repurchases and retirement of ... -

Page 66

...and equipment ...Net gain on sale of assets ...Deferred income taxes ...Non-cash interest expense, net ...Provision for credit recoveries ...Excess tax benefit from share-based payment arrangements ...Stock-based compensation expense ...Change in operating assets and liabilities: Accounts receivable... -

Page 67

...For Fiscal Years 2013, 2012, and 2011 Note 1 - Description of Business Popeyes Louisiana Kitchen, Inc. ("Popeyes" or "the Company") develops, operates and franchises quick-service restaurants under the trade name Popeyes® Chicken & Biscuits and Popeyes® Louisiana Kitchen in 47 states, the District... -

Page 68

... unit, which incorporate our best estimate of sales growth and margin improvement based upon our plans for the restaurant and actual results at comparable restaurants. The carrying values of restaurant assets that are not considered recoverable are written down to their estimated fair market value... -

Page 69

... of Operations as a component of "Restaurant employee, occupancy and other expenses." Additional contributions to the advertising cooperative for national media advertising and other marketing related costs are expensed as a component of "General and administrative expenses." During 2013, 2012, and... -

Page 70

... rate swap agreements. Revenue Recognition - Sales by Company-Operated Restaurants. Revenues from the sale of food and beverage products are recognized on a cash basis. The Company presents sales net of sales tax and other sales related taxes. Revenue Recognition - Franchise Operations. Revenues... -

Page 71

...Fiscal Years 2013, 2012, and 2011 - (Continued) Gains and Losses Associated With Re-franchising. From time to time, the Company engages in re-franchising transactions. Typically, these transactions involve the sale of a company-operated restaurant to an existing or new franchisee. The Company defers... -

Page 72

Popeyes Louisiana Kitchen, Inc. Notes to Consolidated Financial Statements For Fiscal Years 2013, 2012, and 2011 - (Continued) The Company recorded $5.4 million ($3.4 million net of tax), $4.9 million ($3.1 million net of tax), and $2.9 million ($1.9 million net of tax), in total stock-based ... -

Page 73

... $0.5 million in 2014 through 2017, and $0.4 million in 2018. The remaining weighted average amortization period for these assets is 6 years. On November 7, 2012, the Company entered into a new agreement with the King Features Syndicate Division of Hearst Holdings, Inc., licensor of the Popeye® the... -

Page 74

... Liabilities Interest rate swap agreement (Note 9) Long term debt and other borrowings Total liabilities at fair value 1.3 74.4 75.7 1.3 72.8 74.1 $ $ 16.3 4.3 20.6 16.3 4.3 20.6 At December 29, 2013 and December 30, 2012, the fair value of the Company's current assets and current liabilities... -

Page 75

... 40 basis points. The increment over LIBOR and the commitment fee are determined quarterly based upon the Consolidated Total Leverage Ratio. As of December 29, 2013 and December 30, 2012, the Company's weighted average interest rates for all outstanding indebtedness under its credit facilities were... -

Page 76

... Fiscal Years 2013, 2012, and 2011 - (Continued) Future Debt Maturities. At December 29, 2013, aggregate future debt maturities, excluding capital lease obligations, were as follows: (in millions) 2014 2015 2016 2017 2018 Thereafter $ 0.3 0.3 0.3 0.3 63.4 0.4 $ 65.0 Interest Rate Swap Agreements... -

Page 77

... 2014, $2.6 million in 2015, $2.3 million in 2016, $2.0 million in 2017, $1.7 million in 2018, and $4.7 million thereafter. Note 11 - Deferred Credits and Other Long-Term Liabilities (in millions) 2013 2012 Deferred franchise revenues Deferred gains on unit conversions Deferred rentals Above-market... -

Page 78

... have been at prices which approximate the fair market value of the Company's common stock at the date of grant. The options currently granted and outstanding as of December 29, 2013 allow certain employees and directors of the Company to purchase approximately 1,000 shares of common stock. If not... -

Page 79

... volatility of the Company's stock price and other factors. The following table summarizes the non-vested stock option activity for the 52 week period ended December 29, 2013: Weighted Average Grant Date Fair Value (shares in thousands) Shares Unvested stock options outstanding at beginning... -

Page 80

... total fair value at grant date of awards which vested during 2013, 2012, and 2011, was $2.3 million, $2.5 million, and $0.4 million, respectively. Restricted Share Units The Company grants restricted stock units (RSUs) to members of its board of directors pursuant to the 2006 Incentive Stock Plan... -

Page 81

... to the Plan. Note 15 - Commitments and Contingencies Supply Contracts. Supplies are generally provided to Popeyes franchised and company-operated restaurants, pursuant to supply agreements negotiated by Supply Management Services, Inc. ("SMS"), a not-for-profit purchasing cooperative of... -

Page 82

... provided to the Company under Managed Information Technology Services Agreements with certain third party providers. At December 29, 2013, future minimum payments under these contracts are $1.6 million, $1.7 million and $0.4 million in 2014, 2015 and 2016, respectively. During 2013, 2012, and 2011... -

Page 83

...States. The Company's international franchisees operate in Korea, Indonesia, Canada, Turkey and various countries throughout Central America, Asia and Europe. Note 16 - Other Expenses (Income), Net (in millions) 2013 2012 2011 Disposals of property and equipment Net gain on sale of assets Corporate... -

Page 84

...$ 3.7 $ 3.6 $ 3.7 Note 18 - Income Taxes Total income taxes for fiscal years 2013, 2012, and 2011, were allocated as follows: (in millions) 2013 2012 2011 Income taxes in the statements of operations, net Income taxes charged (credited) to statements of shareholders' equity (deficit): Compensation... -

Page 85

... tax credits related to prior years. The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities are presented below: (in millions) 2013 2012 Deferred tax assets: Deferred franchise fee revenue State net operating loss... -

Page 86

... Statements For Fiscal Years 2013, 2012, and 2011 - (Continued) At December 29, 2013, the Company had state net operating losses ("NOLs") of approximately $122 million which expire between 2017 and 2028. The Company established a full valuation allowance on the deferred tax asset related to these... -

Page 87

... Statements For Fiscal Years 2013, 2012, and 2011 - (Continued) Note 20 - Segment Information The Company is engaged in developing, operating and franchising Popeyes Louisiana Kitchen quick-service restaurants. Based on its internal reporting and management structure, the Company has determined that... -

Page 88

Popeyes Louisiana Kitchen, Inc. Notes to Consolidated Financial Statements For Fiscal Years 2013, 2012, and 2011 - (Continued) (in millions) 2013 2012 2011 Revenues Franchise operations Company-operated restaurants $ 127.3 78.7 $ 206.0 $ 114.8 64.0 $ 178.8 99.2 54.6 $ 153.8 $ Operating profit ... -

Page 89

... Company opened four company-operated restaurants during the fourth quarter 2013 compared to five during the same period last year. Total sales of the four company-operated restaurants were $0.9 million for the fourth quarter 2013. (c) The Company recorded $1.8 million in franchise revenues related... -

Page 90

[ THIS PAGE INTENTIONALLY LEFT BLANK ] -

Page 91

... accessed through the Company's website at www.popeyes.com/investors ANNUAL MEETING PLKI's 2014 Annual Meeting will be held at: Hilton Garden Inn-Atlanta Perimeter Center 1501 Lake Hearn Drive Atlanta, GA 30319 8:30 AM ET, May 22, 2014 404-459-0500 FORM 10-K The Company's 2013 Annual Report on Form... -

Page 92

Popeyes Louisiana Kitchen, Inc. 400 Perimeter Center Terrace, Suite 1000, Atlanta, GA 30346 www.popeyes.com/investors