Polaris 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

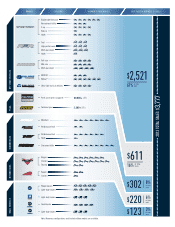

TOTAL RETURN TO SHAREHOLDERS

76%

YEAR

2013 HIGHLIGHTS

BASIS POINTS

40

UP

10.1%

*from continuing operations

TO

BASIS POINTS

GROSS MARGIN

90

UP

29.7%

TO

EARNINGS PER SHARE*

UP

23 5.40

%$

TO

NET INCOME MARGIN*

POLARIS

33%

S&P MIDCAP 400

55%

MORNINGSTAR RECREATIONAL VEHICLES INDUSTRY GROUP INDEX

30%

S&P 500

1

TOTAL RETURN TO SHAREHOLDERS YEAR

POLARIS

S&P MIDCAP 400

MORNINGSTAR RECREATIONAL VEHICLES INDUSTRY GROUP INDEX

S&P 500

5

1057%

169%

459%

105%

manufacturer Aixam Mega. This was our third

and largest deal in the Small Vehicles space,

adding scale and significant capability to this

growingbusiness, and providing an excellent

illustration of how our Growth through Adjacencies

objective will contribute to our growth. We will also

create organic adjacency growth, as evidenced

by our investment in the BRUTUS™ commercial

vehicles launch and the introduction of Dagor™

, the

largest vehicles platform in our Polaris Defense

businesstodate.

From a financial perspective, our Lean Enterprise

objective did not match those investments, but in

terms of sweat equity, the input was considerable.

Its potential impact on our company cannot be

overstated. We accelerated our kaizen activity,

created a Chief Lean Officer role to champion our

efforts, and used our Victory® business to reduce

lead times and create a model program we can

emulate. (See Victory success story on Page 7.)

Lean is all about eliminating waste and adding

value for customers, and to address the latter,

we brought on Tim Larson to lead Customer

Excellence. This is a perfect example of what we

see as the most important investment: human

capital. We have a constant focus on “Best People,

Best Team” and believe that is a critical element of

our sustainable competitive advantage.

Our final strategic objective is to deliver Strong

Financial Performance, which we certainly did

in 2013. With sales increasing 18percent from

2012, net income from continuing operations

growing 22 percent, earnings per share increasing

We certainly expect to achieve our goal of

$8billion in sales, and more than $800million in

net income by 2020. That’s why our strategy drives

each investment that wemake.

Strategic value is not an alternative to our long

history of outstanding, shareholder-friendly capital

stewardship: despite historically high levels of

investment, our return on invested capital (ROIC)

was a robust 42percent, and due to our strong

balance sheet and excellent cash conversion, our

debt-to-total-capital ratio is 35percent, even as

we paid out more than $100million in dividends

and completed share repurchases of more than

$500million.

Our commitment to be The Best in PowersportsPlus

showed in our continued market share gains from

ongoing investment in research and development,

and in the launch of a record 26new vehicles,

enabled by nearly $200million of capital expenditures

for tooling and manufacturing facility enhancements.

Our progress towards Global Market Leadership

gained momentum as we began to make

investments in new factories in Poland and India,

while also completing the acquisition of French

IN 2013, OUR TOTAL INVESTMENTS

WERE MORE THAN DOUBLE ANY

PRIOR YEAR, AND THEIR POSITIVE

IMPACT ON OUR STRATEGIC

OBJECTIVES WAS CLEARLYEVIDENT.

03

SHAREHOLDER LETTER