Polaris 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RELENTLESS

2013

POLARIS INDUSTRIES INC. ANNUAL REPORT

MAKING OUR POWERFUL PORTFOLIO EVEN STRONGER

Table of contents

-

Page 1

RELENTLESS MAKING OUR POWERFUL PORTFOLIO EVEN STRONGER 2013 POLARIS INDUSTRIES INC. ANNUAL REPORT -

Page 2

WHAT FUELS OUR SUCCESS ACROSS SO MANY BUSINESSES AND BRANDS YEAR AFTER YEAR? WE'RE RELENTLESS IN ACHIEVING OUR STRATEGIC OBJECTIVES. ALL 6,000 OF US. WHETHER IT'S CREATING WHOLE NEW VEHICLE CATEGORIES, INTEGRATING GROUNDBREAKING TECHNOLOGIES, REINVENTING OUR ASSEMBLY LINES OR CHALLENGING THE ... -

Page 3

2013 RECORD SALES 2013 RECORD NET INCOME from continuing operations UP 18% 3.8 TO UP $ BILLION 22% 381 TO $ MILLION -

Page 4

... utility and military Off-Road Vehicles (ORVs); Snowmobiles; Motorcycles; and related Parts, Garments and Accessories (PG&A). Our Small Vehicles products include on-road light-duty haulers, people movers and quadricycles. 2013 SALES BY GEOGRAPHY 72 % UNITED STATES 16 % 12 % INTERNATIONAL CANADA -

Page 5

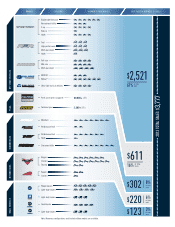

... 2013 SALES BY BUSINESS ($1,000s) Big bore/performance Recreational/utility 2-up Ride-in Youth Trail High-performance Multi-passenger Youth Full-size Mid-size Multi-passenger OFF-ROAD VEHICLES BRUTUS® Bobcat® Ultra-light tactical vehicles $2,521 67% 60,000+ OF TOTAL SALES Parts accessories... -

Page 6

... RECORD SALES AND EARNINGS GROWTH. But just as many of our customers value performance and handling over paint schemes and chassis designs, we pay as much attention to developing efï¬cient and effective business processes as we do the resulting numbers. We constantly strive to increase our products... -

Page 7

...Our progress towards Global Market Leadership gained momentum as we began to make investments in new factories in Poland and India, while also completing the acquisition of French manufacturer Aixam Mega. This was our third and largest deal in the Small Vehicles space, adding scale and signiï¬cant... -

Page 8

... a talented and experienced leadership team that promotes teamwork, and makes timely and ï¬t decisions - which leads to quick and effective execution. 1995 SHAREHOLDER LETTER From the work Steve Menneto is doing to build Indian Motorcycle into the exemplary model for these initiatives, to the... -

Page 9

...products, services and experiences that enrich their lives. STRATEGY Polaris will be a highly proï¬table, customer-centric, $8 Billion global enterprise by 2020. We will make the best off-road and on-road vehicles and products for recreation, transportation and work supporting consumer, commercial... -

Page 10

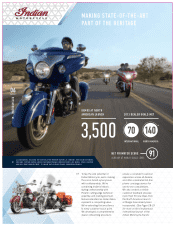

...-free phone concierge service for one-to-one consultations. We also created a nimble customer feedback process; more than 50 new ideas from the North American launch at Sturgis have already been incorporated. (See Pages 18-19 for more on the simultaneous international launch of the Indian Motorcycle... -

Page 11

...8 50 % DOWN WITH ORDERS DRIVEN BY RETAIL SALES, VICTORY DEALERS CAN STOCK A WIDER BREADTH OF PRODUCT TO MEET MORE CUSTOMER DEMANDS. % DATA FROM FIRST YEAR OF RFM: AUGUST 2012-2013 Our relentless dedication to operational excellence led to another recent industry ï¬rst: Victory became the ï¬rst... -

Page 12

...TO THE CUSTOMER'S NEEDS. NET PROMOTER SCORE Whatever the job, there's a RANGER vehicle to meet the needs. We designed a platform that allows us to cost-effectively create multiple variations - so our family of utility vehicles covers the broadest range of customer applications in the industry. Our... -

Page 13

..., and demo the industry's leading new products. In 2013, we added the RZR Experience tour, where owners and prospects can see what RZR is all about. THANKS TO THE FERVENT RZR COMMUNITY, A VIDEO OF OFF-ROAD CHAMPION RJ ANDERSON DRIVING A CUSTOM-BUILT POLARIS RZR XP 1000 BECAME THE MOSTWATCHED UTV... -

Page 14

... and stability they desired. Now we're reinventing the market again with a whole new product category. ® Our SPORTSMAN ACE is a ride-in recreational vehicle that meets the needs of customers who want the smaller size and price tag of an ATV, but the comfort, handling and security of a side-by... -

Page 15

...VOLUME MOUNTAIN MARKET SHARE 100% 12 POINTS OUR NEW AXYS PLATFORM IS AVAILABLE ON NINE RUSH® AND SWITCHBACK® MODELS. ™ TO GROW GLOBAL SALES, WE DESIGN SNOWMOBILES TARGETED TO LOCAL NEEDS. FOR EXAMPLE, OUR INDY VOYAGEUR ™ MEETS THE NEEDS OF CUSTOMERS IN NORTHERN COUNTRIES WHO USE THEIR SLEDS... -

Page 16

... B2B European customers. We plan to capitalize on the synergies through joint product development and distribution, while adding structure to support long-term growth. The acquisition more than doubled our Small Vehicles sales in 2013, giving us greater scale and expertise in Small Vehicles. -

Page 17

... ANNIVERSARY IN 2013 WITH MORE THAN 48,000 ELECTRIC VEHICLES SOLD WORLDWIDE, SAVING ALMOST 20 MILLION GALLONS OF GAS. 2013 SMALL VEHICLES SALES MIX AIXAM MEGA GOUPIL GEM OUR NEW AIXAM ENCLOSED QUADRICYCLES ARE POPULAR WITH OLDER, RURAL EUROPEANS, AS AN ALTERNATIVE TO MORE EXPENSIVE CARS OR LESS... -

Page 18

... AS PART OF THE VEHICLES PRODUCT DEVELOPMENT PROCESS-LIKE WE DID WITH THE RZR XP 1000-WE OFFER INDUSTRY-LEADING FIT AND FINISH, AND MAKE THE ACCESSORIES EASIER TO ATTACH. IT'S AN APPROACH AFTERMARKET COMPETITORS SIMPLY CAN'T MATCH. RANGER CREW 900 ACCESSORIZED WITH POLARIS ENGINEERED LOCK & RIDE... -

Page 19

... tactical gear for the military is set to launch in 2014. The brand also expanded internationally, with more than 200 overseas dealers added in 2013. ® The 2014 Indian Chief brought iconic Indian styling to a whole new level, so we expanded and upgraded our Indian accessories and apparel... -

Page 20

... LETS RIDERS: • View their current location on trails and roads • View weather conditions and forecasts • Search for trails, food, gas, lodging and Polaris dealers • Track ride routes and share with friends on social media SEE FOR YOURSELF HOW EASY IT IS TO PLAN, TRACK AND SHARE RIDES USING... -

Page 21

SOLVING CHALLENGES FOR MILITARIES WORLDWIDE 17 OFF-ROAD VEHICLES MILITARY SALES WE'RE THE LEADING ULTRA-LIGHT TACTICAL VEHICLES SUPPLIER TO THE U.S. SPECIAL FORCES, CONTINUALLY DEVELOPING NEW TECHNOLOGIES THAT MEET THE NEEDS OF THIS DEMANDING CUSTOMER. OUR TERRAIN ARMORâ„¢ NON-PNEUMATIC TIRE ... -

Page 22

... MARKET OUTSIDE OF NORTH AMERICA. better serve regions and reduce costs, we're adding more regional facilities. Our ï¬rst European manufacturing facility will start production in late 2014 in Opole, Poland, producing ATVs and sideby-sides to meet Europe/Middle to growing core powersports sales... -

Page 23

... on track to begin production in late 2014. TAP ON-ROAD SALES POTENTIAL. 2013 INTERNATIONAL SALES OFF-ROAD O FF-ROA AD VEHICLES VEHICL LES P A PG&A 47% SMALL VEHICLES SNOWMOBILES OWM LE S MOTORC CL MOTORCYCLES More than 95 percent of the global motorcycle market is outside North America. So... -

Page 24

... - Global Customer Excellence Bennett J. Morgan President and Chief Operating Officer William C. Fisher Vice President - Information Systems David C. Longren Vice President - Off-Road Vehicles and ORV Engineering Michael W. Malone Vice President - Finance and Chief Financial Officer Matthew... -

Page 25

... for the registrant's Annual Meeting of Shareholders to be held on April 24, 2014 to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this report (the ''2014 Proxy Statement''), are incorporated by reference into Part III of this Form... -

Page 26

...Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure . . Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management... -

Page 27

... utility use, Snowmobiles, Motorcycles and Small Vehicles (SV), together with the related replacement Parts, Garments and Accessories (PG&A). These products are sold through dealers and distributors principally located in the United States, Canada and Europe. Sales of ORVs, Snowmobiles, Motorcycles... -

Page 28

... Products Off-Road Vehicles. We entered the ORV market in 1985 with an ATV. We currently produce four-wheel ATVs, which provide more stability for the rider than earlier three-wheel versions. In 2000, we introduced our first youth ATV models. In 1998, we introduced the Polaris RANGER, a six-wheeled... -

Page 29

... product line to include the Victory Cross Roads↧ and Cross Country↧ models. In 2011, we acquired Indian Motorcycle Company, America's first motorcycle company, and in 2013 we re-launched the Indian brand by releasing the first three Indian motorcycle models engineered by Polaris: Indian Chief... -

Page 30

... our own engines for select models of snowmobiles since 1995, for all Victory motorcycles since 1998, for select ORV models since 2001 and for Indian motorcycles since the re-launch in 2013. During 2013, approximately 65 percent of the total vehicles we produced were powered by engines designed and... -

Page 31

... manufacturing lines as demand dictates. Sales and Marketing Our products are sold through a network of approximately 1,750 independent dealers in North America, through 22 subsidiaries and approximately 85 distributors in over 100 countries outside of North America. We sell our snowmobiles directly... -

Page 32

... years in North America and internationally for both Victory and Indian motorcycles. The SV businesses each have their own distribution networks through which their respective vehicles are distributed. GEM has approximately 270 dealers. Goupil and Aixam sell directly to customers in France, through... -

Page 33

..., retail financing or other incentives for our dealers and distributors to remain price competitive in order to accelerate retail sales to consumers and gain market share. We advertise our products directly to consumers using print advertising in the industry press and in user group publications and... -

Page 34

... vehicle, snowmobile, motorcycle and small vehicle markets in the United States, Canada and other global markets are highly competitive. Competition in such markets is based upon a number of factors, including price, quality, reliability, styling, product features and warranties. At the dealer level... -

Page 35

... new corporate average emission standards effective for model years 2006 and later, for off-road recreational vehicles, including ATVs, off-road side-by-side vehicles and snowmobiles. We have developed engine and emission technologies along with our existing technology base to meet current... -

Page 36

... a copy of these corporate governance materials should write to Polaris Industries Inc., 2100 Highway 55, Medina, Minnesota 55340, Attention: Investor Relations. Information contained on our website is not part of this report. Forward-Looking Statements This 2013 Annual Report contains not only... -

Page 37

... and Chief Operating Officer Vice President-Finance and Chief Financial Officer Vice President-Corporate Development Vice President-General Counsel, Compliance Officer and Secretary Vice President-Asia Pacific and Latin America Vice President-Parts, Garments and Accessories Vice President-Europe... -

Page 38

... and Latin America since August 2011. Mr. Dougherty joined the company in 1998 as International Sales Manager, and has held several positions, including Vice President of Global New Market Development and Vice President and General Manager of the ATV division during his tenure. Prior to Polaris, Mr... -

Page 39

...of operations. We provide a limited warranty for ORVs for a period of six months, for a period of one year for our snowmobiles and motorcycles and two years for SVs. We may provide longer warranties related to certain promotional programs, as well as longer warranties in certain geographical markets... -

Page 40

... our business and operating results. The snowmobile, off-road vehicle, motorcycle and small vehicle markets are highly competitive. Competition in such markets is based upon a number of factors, including price, quality, reliability, styling, product features and warranties. At the dealer level... -

Page 41

... affect our income from financial services. We have arrangements with each of Capital One, Sheffield and GE Bank to make retail financing available to consumers who purchase our products in the United States. During 2013, consumers financed approximately 32 percent of the vehicles we sold in the... -

Page 42

... if acquired businesses or affiliates do not achieve the financial results projected in our valuation models; • reallocation of amounts of capital from other operating initiatives and/or an increase in our leverage and debt service requirements to pay the acquisition purchase prices, which... -

Page 43

... risks include: • increased costs of customizing products for foreign countries; • difficulties in managing and staffing international operations and increases in infrastructure costs including legal, tax, accounting, and information technology; • the imposition of additional United States and... -

Page 44

... and develop new innovative products in the global markets in which we compete. Product development requires significant financial, technological, and other resources. While we expended $139.2 million, $127.4 million, and $105.6 million for research and development efforts in 2013, 2012 and 2011... -

Page 45

... privacy breaches by employees or others with permitted access to our systems may pose a risk that sensitive data may be exposed to unauthorized persons or to the public. While we have invested in protection of data and information technology, there can be no assurance that our efforts will prevent... -

Page 46

...research and development space located in North America and Europe. We have over 1.7 million square feet of warehouse and distribution center space in the United States and countries occupied by our subsidiaries that is owned or leased. We also have approximately 130,000 square feet of international... -

Page 47

PART II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities The information under the caption ''Other Investor Information'' appearing on the inside back cover of the Company's 2013 Annual Report is incorporated herein by reference. On... -

Page 48

... sets forth the information with respect to purchases made by or on behalf of Polaris of its own stock during the fourth quarter of the fiscal year ended December 31, 2013. Issuer Purchases of Equity Securities Total Number of Shares Purchased as Part of Publicly Announced Program(1) Maximum Number... -

Page 49

...-share data) 2013 2012 For the Years Ended December 31, 2011 2010 2009 2008 Statement of Operations Data Sales Data: Total sales ...Percent change from prior year ...Sales mix by product: Off-Road Vehicles ...Snowmobiles ...Motorcycles ...Small Vehicles ...Parts, Garments and Accessories . . Gross... -

Page 50

...Statement of Operations Data Sales Data: Total sales ...Percent change from prior year ...Sales mix by product: Off-Road Vehicles ...Snowmobiles ...Motorcycles ...Small Vehicles ...Parts, Garments and Accessories ...Gross Profit Data: Total gross profit ...Percent of sales ...Operating Expense Data... -

Page 51

... growth is fueled by awardwinning innovative new products leading to continued market share leadership in side-by-side vehicles and ATV's. In 2013, we also experienced growth in our motorcycles, international and adjacent market businesses. The overall North American powersports industry continued... -

Page 52

... models. ORV sales of $2,225.8 million in 2012, which include core ATV and RANGER and RZR side-by-side vehicles, increased 22 percent from 2011. This increase reflects continued market share gains for both ATVs and sideby-side vehicles driven by industry leading product offerings. Polaris' North... -

Page 53

...of model year 2013 new product introductions. Sales of snowmobiles to customers outside of North America, principally within the Scandinavian region and Russia, increased nine percent as compared to 2011. The average unit sales price in 2012 was flat when compared to 2011. Sales from the motorcycles... -

Page 54

... of North America increased 16 percent during 2012 compared to 2011. The sales increase in 2012 was driven by increased sales in all product lines and product categories driven by the addition of over 250 model year 2013 accessories, and higher PG&A related sales to owners of the Company's large... -

Page 55

... Change Total Cost of 2013 vs. 2012 Sales 2012 2011 Percent of Total Cost of Sales Change 2012 vs. 2011 ($ in millions) 2013 Purchased materials and services ...Labor and benefits ...Depreciation and amortization ...Warranty costs ... . . $2,336.1 .. 198.7 ...64.5 56.9 88% 8% 2% 2% 100% $2,008... -

Page 56

... unfavorable product mix. Operating Expenses: The following table reflects our operating expenses in dollars and as a percentage of sales: For the Years Ended December 31, Change 2013 vs. 2012 2011 Change 2012 vs. 2011 ($ in millions) 2013 2012 Selling and marketing ...Research and development... -

Page 57

... increased levels of capital lease obligations and interest bearing long-term senior notes being outstanding throughout all of 2012. Other (Income), Net: Non-operating other income was $5.1 million, $7.5 million and $0.7 million for 2013, 2012 and 2011. The change in income primarily relates to... -

Page 58

... compensation and product liability. Revenue recognition. Revenues are recognized at the time of shipment to the dealer, distributor or other customers. Historically, product returns, whether in the normal course of business or resulting from repurchases made under the floorplan financing program... -

Page 59

... criteria. Polaris recorded accrued liabilities of $100.6 million and $86.7 million for dealer holdback programs in the consolidated balance sheets as of December 31, 2013 and 2012, respectively. Share-based employee compensation. We recognize in the financial statements the grant-date fair value... -

Page 60

... products during such warranty periods at no cost to the consumers. The warranty reserve is established at the time of sale to the dealer or distributor based on management's best estimate using historical rates and trends. We record these amounts as a liability in the consolidated balance sheet... -

Page 61

... expenditures related to the expansion of many of our North America locations, including our Product Development Center near Wyoming, Minnesota, and manufacturing facilities in Roseau, Minnesota and Monterrey, Mexico. Additionally, we purchased warehouses in Wilmington, Ohio, which have become a new... -

Page 62

...companies (including Polaris Acceptance) to provide secured floor plan financing for our dealers. These arrangements provide liquidity by financing dealer purchases of our products without the use of our working capital. A majority of the worldwide sales of snowmobiles, ORVs, motorcycles and related... -

Page 63

... financial services in the accompanying consolidated statements of income. We believe that existing cash balances, cash flow to be generated from operating activities and available borrowing capacity under the line of credit arrangement will be sufficient to fund operations, new product development... -

Page 64

... dollar in relation to the Canadian dollar impacts both sales and net income. Other currencies: We operate in various countries, principally in Europe and Australia, through wholly owned subsidiaries and also sell to certain distributors in other countries. We also purchase components from certain... -

Page 65

vendor as part of the purchase process and from time to time will enter into derivative contracts to hedge a portion of the exposure to commodity risk. At December 31, 2013, derivative contracts were in place to hedge a portion of our aluminum and diesel fuel exposures during 2014. Based on our ... -

Page 66

... Financial Reporting ...Report Of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting ...Report Of Independent Registered Public Accounting Firm on Consolidated Financial Statements ...Consolidated Balance Sheets as of December 31, 2013 and 2012 ...Consolidated... -

Page 67

... one percent of operating income on the consolidated financial statement amounts as of and for the year ended December 31, 2013. Management's internal control over financial reporting as of December 31, 2013 has been audited by Ernst & Young LLP, an independent registered public accounting firm, as... -

Page 68

... Public Accounting Firm on Internal Control over Financial Reporting The Board of Directors and Shareholders of Polaris Industries Inc. We have audited Polaris Industries Inc.'s (the Company) internal control over financial reporting as of December 31, 2013, based on criteria established in Internal... -

Page 69

... of Independent Registered Public Accounting Firm on Consolidated Financial Statements The Board of Directors and Shareholders of Polaris Industries Inc. We have audited the accompanying consolidated balance sheets of Polaris Industries Inc. (the Company) as of December 31, 2013 and 2012, and the... -

Page 70

...Warranties ...Sales promotions and incentives ...Dealer holdback ...Other ...Income taxes payable ...Current liabilities of discontinued operations Total current liabilities ...Long-term income taxes payable . Capital lease obligations ...Long-term debt ...Deferred tax liabilities ...Other long-term... -

Page 71

... OF INCOME (In thousands, except per share data) For the Years Ended December 31, 2013 2012 2011 Sales ...Cost of sales ...Gross profit ...Operating expenses: Selling and marketing ...Research and development General and administrative ... $3,777,068 2,656,189 1,120,879 270,266 139,193 179... -

Page 72

POLARIS INDUSTRIES INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) For the Years Ended December 31, 2013 2012 2011 Net income ...Other comprehensive income, net of tax: Foreign currency translation adjustments, net of tax benefit (expense) of $1,841, ($182) and $6,782 ...... -

Page 73

POLARIS INDUSTRIES INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In thousands, except per share data) Number of Shares Common Stock Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Income Total Balance, December 31, 2010 ...Employee stock compensation ...... -

Page 74

... December 31, 2013 2012 2011 Operating Activities: Net income ...Loss from discontinued operations ...Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization ...Noncash compensation ...Noncash income from financial services ...Noncash loss... -

Page 75

... the ''Company''), a Minnesota corporation, and its subsidiaries are engaged in the design, engineering, manufacturing and marketing of innovative, high-quality, high-performance Off-Road Vehicles (ORV), Snowmobiles, Motorcycles and Small Vehicles (SV). Polaris products, together with related parts... -

Page 76

... at cost, which approximates fair value. Such investments consist principally of money market mutual funds. Allowance for doubtful accounts. Polaris' financial exposure to collection of accounts receivable is limited due to its agreements with certain finance companies. For receivables not serviced... -

Page 77

...the manufacture and distribution of the Company's products. Inventories are stated at the lower of cost (first-in, first-out method) or market. The major components of inventories are as follows (in thousands): December 31, 2013 December 31, 2012 Raw materials and purchased components Service parts... -

Page 78

... regulations and market conditions and may also provide longer warranties related to certain promotional programs. Polaris' standard warranties require the Company or its dealers to repair or replace defective products during such warranty periods at no cost to the consumer. The warranty reserve is... -

Page 79

... and components based upon market prices that are established with the vendor as part of the purchase process. From time to time, Polaris utilizes derivative contracts to hedge a portion of the exposure to commodity risks. During 2013 and 2012, the Company entered into derivative contracts... -

Page 80

... balance sheet date through the date the consolidated financial statements have been filed. There were no other subsequent events that required recognition or disclosure in the consolidated financial statements. Note 2. Share-Based Compensation Share-based plans. The Company grants long-term equity... -

Page 81

... compensation expenses are reflected in cost of sales and operating expenses in the accompanying consolidated statements of income. For purposes of determining the estimated fair value of option awards on the date of grant under ASC Topic 718, Polaris has used the Black-Scholes option-pricing model... -

Page 82

... stock information. The following summarizes stock option activity and the weighted average exercise price for the following plans for the each of the three years ended December 31, 2013, 2012 and 2011: Omnibus Plan (Active) Weighted Average Outstanding Exercise Shares Price Option Plan Director... -

Page 83

.... The total intrinsic value is based on the Company's closing stock price on the last trading day of the year. The weighted average fair values at the grant dates of grants awarded under the Restricted Stock Plan for the years ended December 31, 2013, 2012, and 2011 were $88.84, $70.12, and $42.54... -

Page 84

...December 31, 2013, was approximately $1,163,545,000. Polaris has agreed to repurchase products repossessed by the finance companies up to an annual maximum of no more than 15 percent of the average month-end balances outstanding during the prior calendar year. Polaris' financial exposure under these... -

Page 85

... during the periods presented. As a part of its marketing program, Polaris contributes to the cost of dealer financing up to certain limits and subject to certain conditions. Such expenditures are included as an offset to sales in the accompanying consolidated statements of income. Note 5. Goodwill... -

Page 86

... 2012 Net Non-compete agreements ...Dealer/customer related ...Developed technology ......Taxes Polaris' income from continuing operations before income taxes was generated from its United States and foreign operations as follows (in thousands): For the Years Ended December 31, 2013 2012 2011 United... -

Page 87

... of the United States signed the American Taxpayers Relief Act of 2012, which reinstated the research and development tax credit. As a result, the impact of both the 2012 and 2013 research and development tax credits were recorded in the 2013 tax provision. Undistributed earnings relating to certain... -

Page 88

... 2,608,000 shares. Shareholder rights plan. During 2000, the Polaris Board of Directors adopted a shareholder rights plan. Under the plan, a dividend of preferred stock purchase rights will become exercisable if a person or group should acquire 15 percent or more of the Company's stock. The dividend... -

Page 89

... of these amounts is as follows (in thousands): For the Years Ended December 31, 2013 2012 2011 Weighted average number of common shares outstanding ...Director Plan and deferred stock units ...ESOP ...Common shares outstanding-basic ...Dilutive effect of restricted stock awards ...Dilutive effect... -

Page 90

... during the periods presented. Summarized financial information for Polaris Acceptance reflecting the effects of the Securitization Facility is presented as follows (in thousands): For the Years Ended December 31, 2013 2012 2011 Revenues ...Interest and operating expenses ...Net income ...66 $13... -

Page 91

...): For the Years Ended December 31, 2013 2012 2011 Equity in earnings of Polaris Acceptance ...Income from Securitization Facility ...Income from HSBC/Capital One, GE Bank and Sheffield retail credit agreements ...Income from other financial services activities ... ... $ 4,983 15,187 22,481... -

Page 92

... as of the respective opening balance sheet, and each reporting period the fair value is evaluated, using level 3 inputs, with the change in value reflected in the consolidated statements of income. As of December 31, 2013 and 2012 the fair value of contingent purchase price commitments was $18,249... -

Page 93

... for 2013, 2012 and 2011, respectively. In 2013, Polaris entered into a property lease agreement for a plant in Opole, Poland. Polaris is expected to begin occupying the facility in early 2014, which will commence the lease. The Opole, Poland property lease will be accounted for as a capital lease... -

Page 94

... 31, 2014, met the criteria for cash flow hedges and the unrealized gains or losses, after tax, are recorded as a component of accumulated other comprehensive income in shareholders' equity. Polaris enters into derivative contracts to hedge a portion of the exposure related to diesel fuel and... -

Page 95

...2013 and 2012, respectively. Note 12. Segment Reporting Polaris has reviewed ASC Topic 280 and determined that the Company meets the aggregation criteria outlined since the Company's segments have similar (1) economic characteristics, (2) product and services, (3) production processes, (4) customers... -

Page 96

...Financial Data (unaudited) Diluted net Net income from income per share continuing from continuing operations Net income operations (In thousands, except per share data) Sales Gross profit Diluted net income per share 2013 First Quarter ...Second Quarter . Third Quarter . . Fourth Quarter . 2012... -

Page 97

...to the Company's management including its Chief Executive Officer and Vice President- Finance and Chief Financial Officer, in a manner that allows timely decisions regarding required disclosure. No changes have occurred during the period covered by this report or since the evaluation date that would... -

Page 98

... Beneficial Owners and Management'' and ''Equity Compensation Plan Information'' in the Company's 2014 Proxy Statement are incorporated herein by reference. Item 13. Certain Relationships and Related Transactions, and Director Independence The sections entitled ''Corporate Governance-Corporate... -

Page 99

... a reasonable cost to any person who was a shareholder of the Company as of February 21, 2014, upon receipt from any such person of a written request for any such exhibit. Such request should be sent to Polaris Industries Inc., 2100 Highway 55, Medina, Minnesota 55340, Attention: Investor Relations... -

Page 100

... of Minneapolis, State of Minnesota on February 21, 2014. POLARIS INDUSTRIES INC. By: /s/ SCOTT W. WINE Scott W. Wine Chairman and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the... -

Page 101

...Charged to Costs and Expenses Additions Through Acquisition Inventory Reserve Other Changes Add (Deduct)(2) Balance at End of Period (In thousands) 2011: Deducted from asset accounts- Allowance for obsolete inventory ...2012: Deducted from asset accounts- Allowance for obsolete inventory ...2013... -

Page 102

... Industries Inc. Deferred Compensation Plan for Directors, as amended and restated, incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed on May 12, 2009, subsequently amended on July 25, 2012, incorporated by reference to Exhibit 10.a to the Company's Quarterly... -

Page 103

..., 2009.* Polaris Industries Inc. Senior Executive Annual Incentive Compensation Plan, as amended and restated effective January 22, 2009, incorporated by reference to Exhibit 10.3 to the Company's Current Report on Form 8-K filed on May 12, 2009.* Polaris Industries Inc. Long Term Incentive Plan, as... -

Page 104

... by reference to Exhibit 10.ee to the Company's Current Report on Form 8-K filed January 17, 2008.* Polaris Industries Inc. Early Retirement Perquisite Policy for the Chief Executive Officer, incorporated by reference to Exhibit 10.y to the Company's Annual Report on Form 10-K for the year ended... -

Page 105

... following financial information from Polaris Industries Inc.'s Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on February 21, 2013, formatted in Extensible Business Reporting Language (XBRL): (i) the Consolidated Balance Sheets as of December 31, 2013 and 2012... -

Page 106

...report financial information; and b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ SCOTT W. WINE Scott W. Wine Chairman and Chief Executive Officer Date: February 21, 2014 -

Page 107

... financial information; and b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ MICHAEL W. MALONE Michael W. Malone Vice President-Finance and Chief Financial Officer Date... -

Page 108

...Scott W. Wine, Chief Executive Officer of Polaris Industries Inc., a Minnesota corporation (the ''Company''), hereby certify as follows: 1. This statement is provided pursuant to 18 U.S.C. § 1350 in connection with the Company's Annual Report on Form 10-K for the period ended December 31, 2013 (the... -

Page 109

...-Finance and Chief Financial Officer of Polaris Industries Inc., a Minnesota corporation (the ''Company''), hereby certify as follows: 1. This statement is provided pursuant to 18 U.S.C. § 1350 in connection with the Company's Annual Report on Form 10-K for the period ended December 31, 2013... -

Page 110

-

Page 111

... be addressed to: Wells Fargo Shareowner Services 1110 Centre Point Curve, Suite 101 Mendota Heights, MN 55120 1-800-468-9716 www.shareowneronline.com INTERNET ACCESS To view the Company's annual report and ï¬nancial information, products and speciï¬cations, press releases, dealer locations and... -

Page 112

...-542-0500 763-542-0599 FAX WWW.POLARIS.COM ©2014 Polaris Industries Inc. All rights reserved. Printed in the USA Printed on recycled paper containing 10 percent post-consumer ï¬ber. Bobcat® is a registered trademark of Clark Equipment Company Ariens® and Gravely® are registered trademarks of...