Peachtree 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Peachtree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168

|

|

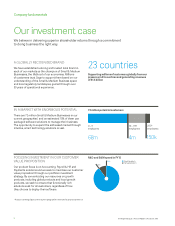

AND A PROGRESSIVE DIVIDEND

We remain focused on shareholder returns and believe

that sustainable earnings growth, a disciplined approach

to capital allocation and progressive dividend policy,

will drive superior returns for shareholders. Central to

our shareholder returns is the annual dividend which

has increased every yearsincewe joined the FTSE 100.

STRONG FREE CASH FLOW

Our aention to underlying cash conversion and a

disciplined approach to capital expenditure yields strong

levels of free cash flow (“FCF”). Generating strong FCF

is important in order to fund shareholder returns and

we aim to generate FCF as a proportion of revenue in

the 15% to 20% range.

GENERATING SUSTAINABLE REVENUE GROWTH

We have increased our organic revenue growth rate

since FY12 from 2% to 6% in FY15. As we continue to

transition towards a higher qualityrevenue model,

we have confidence in maintaining our revenue growth

by aracting new customers and deliveringgreater value,

functionality and features to our existing customers.

FCF to revenue

20.6%

14

15

16.9%

20.6%

2000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2013 2014 20152012

15 year dividend history

13.10p

Growing the annual dividend

per share

7

FINANCIAL STATEMENTSGOVERNANCESTRATEGIC REPORT

The Sage Group plc | Annual Report & Accounts 2015

FY12

2%

FY15

6%