Omron 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Stakeholders

earnings recovery and our cash reserve status. We

also paid a ¥7 interim dividend (¥18 interim dividend

in fiscal 2008), bringing annual cash dividends to ¥17

per share. Although this is ¥8 less than the previous

year, we increased the year-end dividend in light of

our performance recovery in the second half of the

period. The dividend payout ratio was 106.4%, and

the dividend on equity (DOE) ratio was 1.2%.

Seeking to maintain steady returns to shareholders,

we will deepen our emerging reform-driven mindset

sparked by the economic crisis and expedite our shift

to a rock-solid earnings structure. Our most important

task is to translate these initiatives into future leaps for-

ward, and we will take swift measures to this end.

Long-Term Management Vision

Fiscal 2010 is the final year of our long-term manage-

ment vision, entitled “Grand Design 2010.” We have

positioned fiscal 2010 as the completion year for the

“Revival Stage” of the vision. We will then set new

long-term targets for the subsequent 10-year period

starting in fiscal 2011. To help achieve those targets,

we will follow a new long-term management vision

(currently being formulated), the details of which will

be announced later.

During the Revival Stage of our current long-term

management vision, we have built a robust earnings

base. From that base, we will target long-term growth

through sensing and control technology, a key strength

of the Omron Group. We look forward to your ongo-

ing support and cooperation.

August 2010

Hisao Sakuta, President and CEO

China and other emerging nations, as well as moder-

ate recovery in capital investments, especially in the

semiconductor, electronic component, and automo-

bile sectors, which relate closely to the Omron Group.

These factors should also underpin the ongoing turn-

around in demand for factory automation control

systems. With respect to electronic components and

automotive electronic equipment, as well, we look for-

ward to a recovery trend.

For fiscal 2010, we forecast a 17.2% year-on-year

increase in consolidated net sales, to ¥615.0 billion; a

251.8% jump in operating income, to ¥46.0 billion; and

a 738.5% surge in net income attributable to share-

holders, to ¥29.5 billion.

Cash Dividends

For the period under review, we declared a year-end

dividend of ¥10 per share, up from ¥7 at the previous

fiscal year-end, reflecting our better-than-expected

17

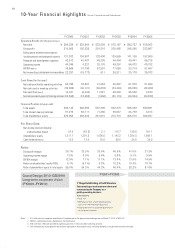

Consolidated Income (Loss) Forecast

Net sales

Gross profit

SG&A expenses

R&D expenses

Operating income

Other expenses, net

Income (loss) before

income taxes

Net income (loss) attributable

to shareholders

USD (yen)

EUR (yen)

615.0

233.5

144.5

43.0

46.0

1.5

44.5

29.5

87.0

112.1

FY2010

(Forecast)

524.7

184.3

133.4

37.8

13.1

2.9

10.2

3.5

92.9

130.3

FY2009

627.2

218.5

164.3

48.9

5.3

44.5

(39.1)

(29.2)

100.7

144.5

FY2008

(Billions of yen)

* FY2010 forecast represents the figures as of July 28, 2010, which were

upwardly revised from the initial forecast.