Omron 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In fiscal 2009, the Omron Group achieved a significant year-on-year increase

in earnings thanks to united efforts including fixed cost reductions. This

was despite our initial forecasts of a substantial decline in profits due to

the impact of the global economic crisis. In fiscal 2010, we will seek to

become leaner to “build a robust earnings structure” while “changing gears

to high growth.”

16

To Our Stakeholders

Message from the President

Fiscal 2009 in Review

Since the autumn of 2009, the world economy has

showed signs of moderate recovery, driven by China

and other emerging nations, as well as the benefits of

economic stimulus measures adopted by various

countries. Similarly, from the second quarter capital

expenditure-related demand has been gradually pick-

ing up in our main customer segments in the industrial

sector, especially automobiles and electronic com-

ponents.

In this environment, the Omron Group took advan-

tage of consumption stimulus measures in various

nations and recovery in capital expenditure-related

demand in its core businesses to achieve a recovery in

revenue. This was evidenced by sales recovery in the

Electronic and Mechanical Components Business

(EMC), Automotive Electronic Components Business

(AEC), and Industrial Automation Business (IAB).

Although the Social Systems Solutions Business (SSB)

struggled due to the completion of railway infrastruc-

ture system renewals and investment restraints, the

Healthcare Business (HCB) posted a solid perform-

ance owing to several factors. These included growth

in demand for digital thermometers following the out-

break of the H1N1 influenza virus, as well as steady

sales of blood pressure monitors amid rising health-

consciousness in China and elsewhere in Asia.

Consolidated net sales declined 16.3% year-on-

year, to ¥524.7 billion, impacted by a substantial

decline in demand until the second quarter of the

period. However, we surpassed our initial net sales

target of ¥510.0 billion by ¥14.7 billion, thanks to the

performances of our IAB, EMC, and AEC business-

es—where recovery exceeded our expectations.

With respect to earnings, we achieved cuts in fixed

and variable costs amounting to around ¥63.0 billion.

As a result, despite the considerable fall in revenue,

we posted operating income of ¥13.1 billion, up

144.9% year-on-year, and net income attributable to

shareholders of ¥3.5 billion, compared with a net loss

attributable to shareholders of ¥29.2 billion in the pre-

vious fiscal year.

Fiscal 2010 Outlook

In fiscal 2010, we expect business conditions to con-

tinue recovering, but we cannot be optimistic across

the board. In addition to the ongoing high level of

unemployment rates in advanced nations, for exam-

ple, there are concerns that the benefits of economic

stimulus measures will start fading in the second half

of the period. Meanwhile, amid worsening fiscal insta-

bility in Europe, triggered by the recent financial crisis

in Greece, the outlook remains uncertain. Having said

that, we anticipate continued economic growth in

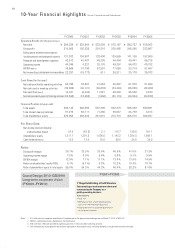

Consolidated Operating Income by Segment

IAB

EMC

AEC

SSB

HCB

Other

Eliminations & corporate

Total

18.2

4.2

(7.1)

5.2

4.8

(7.3)

(12.6)

5.3

FY2008

13.9

6.7

1.7

2.7

7.1

(7.0)

(12.0)

13.1

FY2009

FY2008

Actual

(Billions of yen)

Consolidated Operating Income Analysis (YoY)

FY2009

Actual

5.3

13.1

-23.9

-11.6 +1.4 +5.4

+36.5

Operating income gain ¥7.8 bn

(Exchange loss: ¥6.2 bn)

Gross profit down ¥34.1 bn

Sales down, product mix,

manufacturing fixed costs

Exchange loss Material

costs down

Exchange gain

(SG&A, R&D)

SG&A, R&D

down

(Billions of yen)