O'Reilly Auto Parts 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

O’REILLY AUTOMOTIVE 2012 ANNUAL REPORT

To improve upon our already outstanding customer

service, in 2012 we invested $150 million in store-

level inventory enhancements. We evaluated the

competitive position of all of our stores and stra-

tegically and systematically increased the breadth

of parts carried in our stores where it is closest to

our customers.

Enhanced Parts Availability

fundamental drivers for long-term growth in the automotive

aftermarket remain intact and our continued focus on

providing exceptional levels of service, each day, will continue

to enable us to profitably grow our market share.

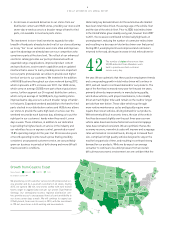

New Store Growth

New store openings are a powerful component of our

long-term growth strategy, and in 2012 our new stores

outperformed our high expectations, supported by

well trained teams who are excited to deliver O’Reilly’s

outstanding customer service, In 2012, we opened 180 stores

across the country, in both new and existing markets, with

much of our expansion market growth occurring in Florida,

the Ohio Valley, and on the East and West Coasts. We were

able to capitalize on highly profitable backfill opportunities

across the country, where the attractive real estate market,

leverage on existing distribution and advertising expenses

and the outstanding reputation of the O’Reilly brand drove a

strong return on investment. We remain very committed to

driving profitable growth, and as we increase our geographic

footprint across a greater portion of the United States,

we are excited about the expanded selection of favorable,

prospective sites available for new store openings. We

continue to identify and mentor our future managers and

are very confident that we have built a strong bench of

effective leaders ready to provide industry leading customer

service. In 2013, we plan to invest in the opening of 190 new

stores from coast to coast, with aggressive expansion into

Florida, which will be supported by our new state-of-the-

art distribution center that is scheduled to open in the first

quarter of 2014. Our existing network of 24 strategically

located regional distribution centers has capacity to service

over 400 additional stores, and with this capacity spread

throughout the country, we can effectively support each

new store with a strong management team and drive the

continued, profitable investment in our store growth.

Integration of Acquired Parts Stores

Another key component of our profitable growth strategy

has been to act as an opportunistic industry consolidator

by targeting independently owned auto parts stores, as

well as multi-store auto parts chains, that strengthen

our position as the leading automotive aftermarket parts

supplier in our existing markets and provide building blocks

for growth into new markets. Acquisitions have historically

proven to be very accretive to our profitable growth and are

a powerful way to grow our brand awareness and expand

our market share, and we continue to be excited about

future acquisition opportunities. At the end of 2012, we

were pleased to announce our purchase of the auto parts

related assets of VIP Parts, Tires & Service (“VIP”), which

is a large privately held automotive parts, tires and service

chain in the northeast. This acquisition added 56 stores

and one distribution center to our Company, but more

importantly, it established a geographic footprint into the

northeast which will act as a springboard for our continued

growth in New England. During 2013, we will integrate these

acquired stores and distribution center into our systems

and programs, and we will begin to implement our Dual

Market Strategy as we prepare for future profitable growth

throughout this new market.

The automotive aftermarket remains a highly fragmented

market, with the ten largest auto parts chains in the

United States representing approximately only 45% of

the total market share. As we continue to monitor the

competitive environment, we are confident that further

accretive acquisition opportunities still exist; we will remain

disciplined in our approach to evaluating these opportunities,

and we will continue to be opportunistic buyers as we

diligently work to further consolidate our industry while

remaining focused on profitable growth.