O'Reilly Auto Parts 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-k

on

d,”

not

store

ing

uch

et

it

es,

r

the

ooking

ng

retailers

do-it-

by

issouri.

&

and

r

O’Reilly

under

a

O’Reilly

ed

and

of

Parts,

n

s

•nts,

•

•

•

•

•

•

•

5

• loaner tool program

• drum and rotor resurfacing

• custom hydraulic hoses

• professional paint shop mixing and related materials

• machine shops

See "Risk Factors" beginning on page 14 for a description of certain risks relevant to our business. These risk factors include, among

others, deteriorating economic conditions, the performance of acquired stores, increased debt levels, our acquisition strategies,

competition in the automotive aftermarket business, our dependence upon key and other personnel, future growth assurance, our

sensitivity to regional economic and weather conditions, the effect of sales of shares of our common stock eligible for future sale,

unanticipated fluctuations in our quarterly results, the volatility of the market price of our common stock, our relationships with key

vendors and availability of key products, a downgrade in our credit ratings, complications in our distribution centers (“DC”s), and

environmental legislation and other regulations.

OUR BUSINESS

Our goal is to continue to achieve growth in sales and profitability by capitalizing on our competitive advantages and executing our

growth strategy. We remain confident in our ability to continue to gain market share in our existing markets and grow our business in

new markets by focusing on our dual market strategy and the core O’Reilly values of customer service and expense control. Our

intent is to be the dominant auto parts provider in all the markets we serve, by providing superior customer service and significant

value to both DIY and professional service provider customers.

Competitive Advantages

We believe our effective dual market strategy, superior customer service, strategic distribution systems and experienced management

team make up our key competitive advantages that cannot be easily duplicated.

Proven Ability to Execute a Dual Market Strategy:

Over the past 30 years, we have established a track record of effectively serving, at a high level, both DIY and professional service

provider customers. We believe our proven ability to effectively execute a dual market strategy is a unique competitive advantage.

The execution of this strategy enables us to better compete by targeting a larger base of consumers of automotive aftermarket parts,

capitalizing on our existing retail and distribution infrastructure, operating profitably in both large markets and less densely populated

geographic areas that typically attract fewer competitors, and enhancing service levels offered to DIY customers through the offering

of a broad inventory and the extensive product knowledge required by professional service providers.

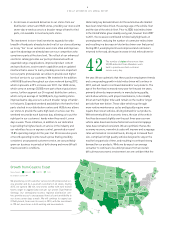

In 2012, we derived approximately 59% of our sales from our DIY customers and approximately 41% of our sales from our

professional service provider customers. Prior to the acquisition of CSK, we derived approximately 50% of our sales from both our

DIY and professional service provider customers. As we continue to grow our commercial business in the acquired CSK markets, we

expect that over time our DIY and professional service provider sales mix to approximate historical averages. As a result of our

historical success of executing our dual market strategy and our over 470 full-time sales staff dedicated solely to calling upon and

servicing the professional service provider customer, we believe we will continue to increase our sales to professional service provider

customers and will continue to have a competitive advantage over our retail competitors who continue to derive a higher concentration

of their sales from the DIY market.

Superior Customer Service:

We seek to attract new DIY and professional service provider customers and to retain existing customers by offering superior

customer service, the key elements of which are identified below:

• superior in-store service through highly-motivated, technically-proficient store personnel (“Professional Parts People”) using an

advanced point-of-sale system

• an extensive selection and availability of products

• attractive stores in convenient locations

• competitive pricing, supported by a good, better, best product assortment designed to meet all of our customers’ quality and value

preferences

Technically Proficient Professional Parts People:

Our highly-motivated, technically-proficient Professional Parts People provide us with a significant competitive advantage,

particularly over less specialized retail operators. We require our Professional Parts People to undergo extensive and ongoing training

and to be technically knowledgeable, particularly with respect to hard parts, in order to better serve the technically-oriented

professional service provider customers with whom they interact on a daily basis. Such technical proficiency also enhances the

customer service we provide to our DIY customers who value the expert assistance provided by our Professional Parts People.